I review the list of dividend increases every week, as part of my monitoring process. This exercise helps me monitor existing holdings, and review the dividend growth investing universe for potential new ideas.

There were 49 dividend increases in the past week. I reviewed each one. I loved reading through the press releases, in order to gauge what management is saying about their dividend policies. The paragraph below includes a few snippets from companies about their dividend policies.

An increase in regular cash dividends demonstrates the strength of a company's balance sheet and its ongoing commitment to creating value for our shareholders. It reflects confidence that companies will again deliver on their promises. Companies treasure track record of dividend growth and remain committed to extending it, supported by the strength of capital and cash flows.

We also had Meta (META), whose former name was Facebook, initiating dividends for the first time. I view that as a positive factor. That's because a dividend focuses managements attention to projects with high return on investment. Any cashflow that does not meet minimum hurdle rates should be sent back to shareholders on a consistent basis. Otherwise, that money could be wasted on unprofitable projects or be deployed at sub-par returns, which sap management attention and company resources.

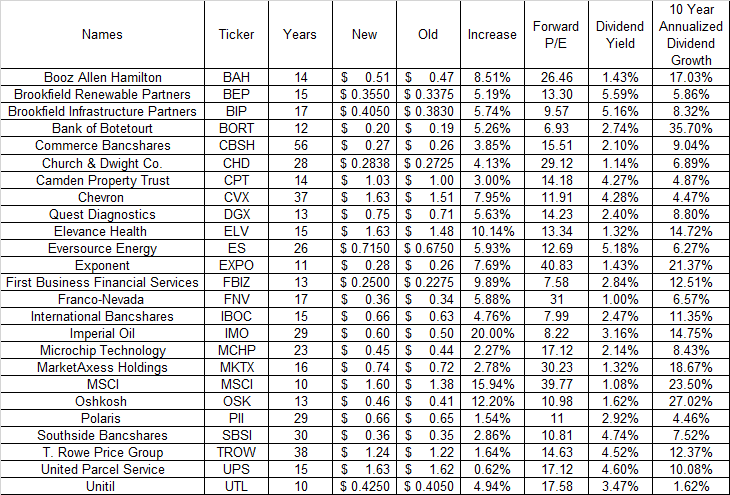

Of the companies raising dividends, I narrowed it down to those companies that have managed to boost dividends for at least ten years in a row. This leaves us with 25 companies that increased dividends last week and have a ten year track record of annual dividend increases:

This list is not a recommendation to buy or sell anything. Just a listing of companies that raised dividends last week.

I did go ahead and sort through it for companies I own. I was disappointed in the small dividend increase from Church & Dwight (CHD). I typically expect higher dividend growth from lower yielding companies that are also overvalued for example. This means that I would refrain from adding to this position for the time being.

This list also put a few companies on my list for research, or continued monitoring. I would love to invest in MSCI if it is ever available at a more attractive valuation.

When I review companies, in general I look for:

1) Track record annual dividend increases

2) Earnings per share growth over the past decade, as well as forward estimates

3) Dividend growth over the past decade, as well as recent dividend increase

4) A defensible dividend payout ratio

5) Qualitative assessments

6) Attractive valuation

I can get a pretty decent picture of whether I like a company or not, by looking at all of those together.

Relevant Articles:

- Five Dividend Growth Companies Raising Dividends Last Week

- Four Dividend Growth Companies Rewarding Shareholders With a Raise