Royal Dutch Shell Plc (RDS.A)(RDS.B) operates as an oil and gas company worldwide. The company explores for, and extracts crude oil and natural gas. The company is not on any dividend indices, despite its long history of consistent dividend increases.

Over the past decade this dividend stock has delivered an annual average total return of 5.10% to its shareholders.

There are two classes of shares – A and B(RDS.A and RDS.B). For US investors it is a much better option to invest in the B shares, since those do not come with a 15% withholding tax from the Dutch government. You could here about the difference between A and B shares. In addition to that, each Royal Dutch Shell American Depository Receipt (ADR) is equal to two shares, traded on London or Amsterdam.

At the same time the company has managed to deliver a 1.10% average annual increase in its EPS since 2000. The increase in prices of crude oil and natural gas definitely helped with earnings. The rapid fall of energy prices in late 2008 and early 2009 and weak global demand led to a 52% decrease in earnings per share in 2009 to $4.09. For fiscal year 2010 analysts expect earnings to increase by 41% to $5.75/share. Analysts also expect earnings per share to rise 25% from there to $7.16/share by FY 2011. The company is in the process of selling or closing unprofitable refineries it owns, which weigh in on its margins. It has also cut 10% of its global workforce, which added to other cost savings initiatives led to $1 billion in savings. The company is increasing its Canadian Oil Sands production, and doubling its Liquified Natural Gas capacity in Russia and Qatar.

Any analysis of earnings trends for an oil and gas producer such as Royal Dutch Shell would definitely depend on the future prices of energy commodities over the next few years. Nevertheless the dividend is sustainable at current levels and there definitely is some room for dividend growth in 2011 and beyond.

Returns on Equity decreased to 9.50% in 2009, after a few years of consistently being above 15%. Year over year this indicator will fluctuate, due to the changes in the value of oil and natural gas. The company should be able to generate sufficient average returns on equity in excess of 15% in the long run.

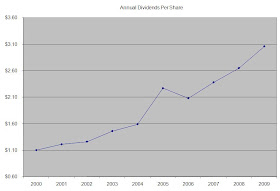

Annual dividend payments have increased by an average of 12% annually in US dollar terms since 2000, which is higher than the growth in EPS. The reason for this is that earnings have a much higher volatility than dividend payments.

A 12% growth in dividends translates into the dividend payment doubling every six years. Since 1988 Royal Dutch Shell has actually managed to double its dividend payment almost every eleven years on average. The company last raised its quarterly dividend by 5 % to 84 cents/share in 2009.

The reason why the company has not been included on any dividend indices is because it was a result of the merger of Royal Dutch with Shell in 2005. It switched from paying dividends in pounds and euro to paying dividends in US dollars. This probably ended the continuity in many stock databases as it required a manual input from analysts. Per the table below, Royal Dutch Shell has managed to boost distributions at least since 1993.

The dividend payout ratio has followed the trend in earnings and returns on equity. It largely remained below 50%, until it rose to 75% on a temporary dip in earnings in 2009.. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

The fact that Royal Dutch isn’t on any of the international dividend growth indices shows you that enterprising dividend investors should keep their eyes open at all times while searching for opportunities everywhere. Overly relying on mechanical rules, just like relying solely on your judgment, might be a recipe for disaster. While many successful dividend investors have some mechanical aspects to their trading, they also utilize their judgment in order to select the best dividend stocks in the world.

Currently the company is trading at a P/E of 11 and yields 6.70%. In contrast shares of British Petroleum (BP) trade at a P/E of 6 and yield 9.20%, while Chevron (CVX) and Exxon Mobil (XOM) trade at P/E ratios of 11 and 14 respectively and yield 3.90% and 2.90%.

Full Disclosure: Long BP,CVX,RDS-B and XOM

Relevant Articles:- Chevron Corporation (CVX) Dividend Stock Analysis

- Exxon Mobil (XOM) Dividend Stock Analysis

- 3M Company (MMM) Dividend Stock Analysis

- Chevron (CVX) Raises Dividends; MLPs follow suit