The company's latest dividend increase was announced in July 2014 when the Board of Directors approved a 10.30% increase in the quarterly dividend to 53.50 cents/share. The company's peer group includes Mondelez International (NASDAQ:MDLZ), Nestle (OTCPK:NSRGY) and Mars. Hershey is one of the five world class dividend companies I plan to buy during the next bear market.

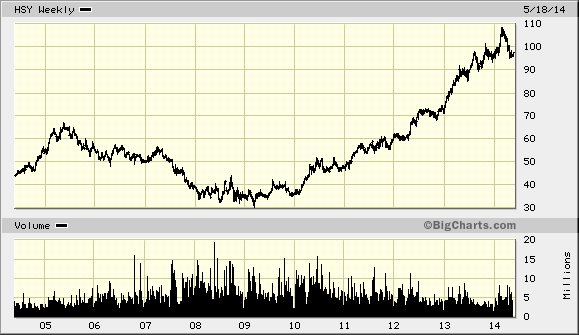

Over the past decade this dividend growth stock has delivered an annualized total return of 10.70% to its shareholders.

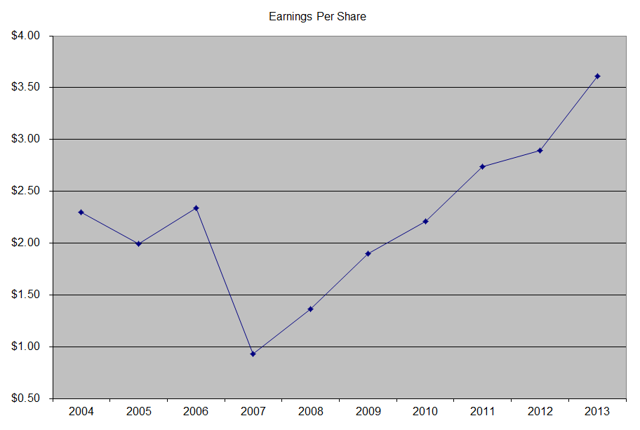

The company has managed to deliver a 7.40% average increase in annual EPS over the past decade. Hershey is expected to earn $4.11 per share in 2014 and $4.53 per share in 2015. In comparison, the company earned $3.61/share in 2013.

Hershey does not have a record of consistent share repurchases. Between 2004 and 2014, the number of shares declined from 257 million to 227 million. Almost all of the decrease occurred between 2004 and 2007.

Hershey is the quintessential wide-moat dividend growth stock. The company has strong brand recognition, and customer loyalty for it quality products, which results in pricing power. In the words of super investor Warren Buffett from a 1991 speech at the University of Notre Dame:

"If you walk into a drugstore, and you say 'I'd like a Hershey bar' and the man says 'I don't have any Hershey bars, but I've got this unmarked chocolate bar, and it's a nickel cheaper than a Hershey bar,' you just go across the street and buy a Hershey bar. That is a good business."

One notable fact about Hershey is that approximately one-third of the shares are held by the Milton Hershey School Trust, which has 80% of the voting power. The trust needs income every year that grows above the rate of inflation, which is a sufficient incentive for the company to keep growing the dividend over time. This is a powerful testament to the power of dividend growth over time, which makes it really easy for anyone to live off of for many decades.

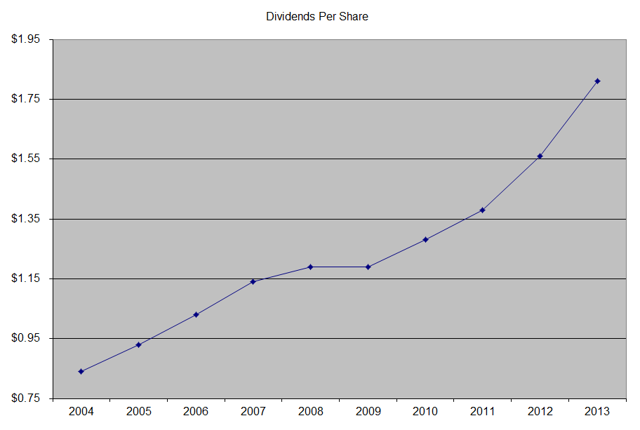

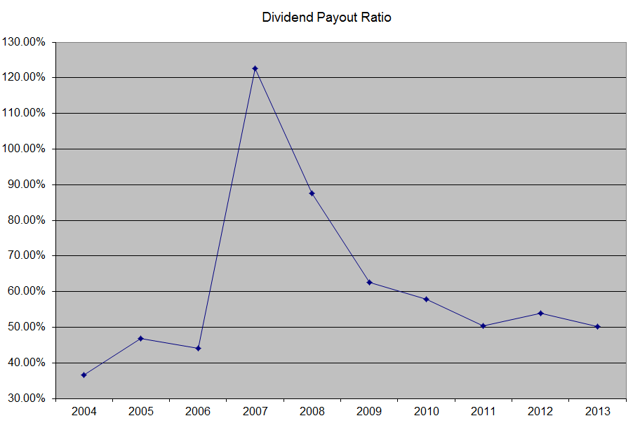

The annual dividend payment has increased by 9.60% per year over the past decade, which is higher than the growth in EPS. This was mostly possible due to the expansion in the dividend payout ratio over the past decade. The company did end a 35-year streak of consecutive dividend increases in 2009, by keeping distributions unchanged. However, it resumed dividend growth in the following year.

A 10% growth in distributions translates into the dividend payment doubling every seven years on average. If we check the dividend history going as far back as 1985, we could see that Hershey has actually managed to double dividends every seven years on average.

Over the past decade, the dividend payout ratio increased from 36.50% in 2004 to 50% in 2013. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

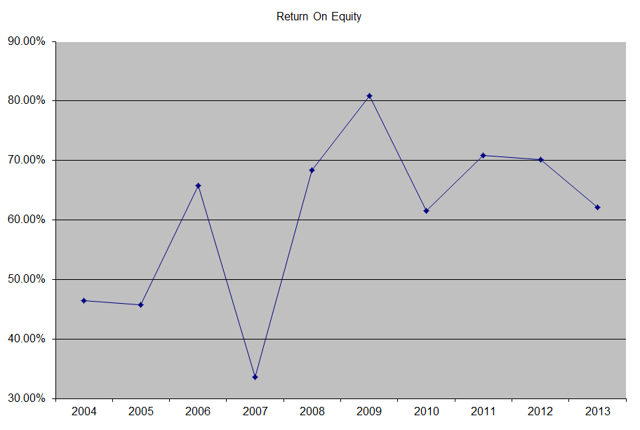

Hershey has a very high return on equity, which is a characteristic of companies with a wide moat. This indicator increased from 46% in 2004 to 62% in 2013. Rather than focus on absolute values for this indicator, I generally want to see at least a stable return on equity over time.

Currently, the stock is overvalued, as it trades at a forward P/E of 22.70 and a current yield of 2.30%. I would consider initiating a position in the stock on dips into the $81-$82 area. If stock drops further, that would be perfect. Another alternative I explored was selling a January 2016 put at a strike of $90. If exercised, the effective price would be somewhere around $83/share, which would be equivalent to a P/E below 20 and a yield above 2.50%. I ended up selling the put option, and reinvesting the premium proceeds into other dividend paying stocks.

Relevant Articles:

- Living off dividends in retirement

- Strong Brands Grow Dividends

- Your best ideas might already be in your circle of competence

- When to sell your dividend stocks?

- Five World Class Dividend Stocks to Buy During the Next Bear Market