Once an investment is made, and assuming no new money is put to work, there are four levers to help an investor reach dividend income goals:

1) Attractive entry price

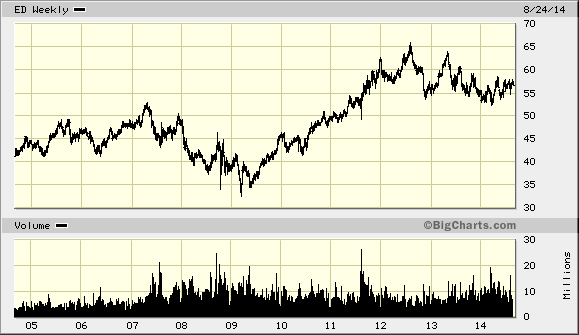

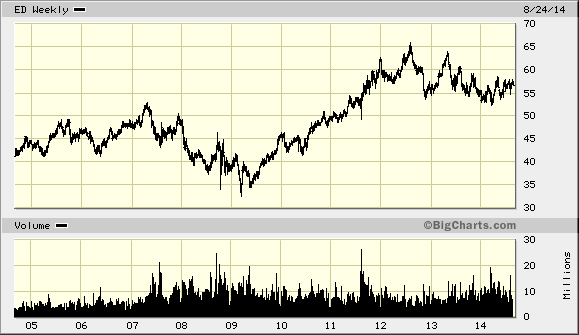

The importance of the entry price cannot be overstated. Even the best company in the world is not worth overpaying for. It matters a lot that you can acquire those shares at low valuations, which ensures better entry yields. For example, if you bought Coca-Cola (KO) in 1999 at $23.50/share, you would have paid over 30 times earnings and received an initial yield of about 1.30%. Despite the fact that earnings and dividends increased rapidly, your yield on cost did not go that much higher than 5.20% although you did earn some capital gains in the subsequent 15 years. You would have been better served putting that money in REITs, oil companies or tobacco shares, which were cheap at the time and had better starting yields. Therefore, when you buy shares, it pays to always pick the ones with the cheapest valuations. Quality should never be sacrificed, but if you make a purchase at a cheap enough price, you can earn a decent return even if growth projections turn out to be poor. For example, I bought ED in 2008 – 2009 at really low valuations and entry of 6%. In hindsight, this was a mistake since the dividend was growing slower that inflation. But I still earned a high return despite that, and once I realized the mistake I sold and redeployed capital elsewhere.

2) Dividend growth

Dividend growth is the second important component in turbocharging the dividend income. A company that is cheap, and manages to grow dividends is a must to invest. Even if you spend your dividend income each year, your dividend income still increases. For example in 2004 Coca-Cola sold for 20-21 times earnings and yielded close to 2.50%. Since then the dividend income would have more than doubled by now, rising from 50 cents/share in 2004 to $1.22/share by 2014. Historically, dividends per share on US stocks have grown by 5%- 6%/year. This has beaten inflation, and ensured that the purchasing power of your passive income is maintained.

3) Dividend reinvestment

Another important component to grow income is the power of dividend reinvestment. Let’s assume a scenario where you have a company that yields 3% today, which manages to grow dividends by 7%/year and you spend all your dividend income. In this case, using the rule of 72, you will end up with double the dividend income in a decade. However, if you decided to reinvest those dividends into more shares yielding 3% and growing dividends by 7%/year, your dividend income will double in approximately seven years. It is important to treat reinvestment carefully however, and be mindful of valuations when doing so. In some cases, it might only be cost effective to automatically reinvest dividends, particularly if the position is only a few hundred dollars for example. In other cases however, it might be preferable to accumulate cash dividends for a month, and then put that amount to work in your best ideas at the time. This would work if you generate $600 - $800/month in dividend income.

4) Tax advantaged growth

Two things in life are certain – death and taxes. Investors who receive dividend income and are in the 25% tax bracket have to pay 15% tax on qualified dividend income. This reduces the amount of money one can feed their dividend machine. In order to reduce the effects of this obstacle, many dividend investors place their stocks in tax-advantaged accounts like Roth IRA’s. As a result, their dividends grow tax free, and therefore they could reinvest the whole amount into more dividend paying shares. If you are in the 15% tax bracket however, this means your qualified dividend income is essentially tax free.

The four points discussed above could be best illustrated by a small investment I made in Kinder Morgan Energy Management LLC (KMR) in 2009. This was one of the smartest investments I ever did, and hit the four points perfectly. I was bullish on the Kinder Morgan Partnership (KMP), which was a dividend achiever that offered sustainable current yield, and high distributions growth. I liked the prospect for high distributions growth and high current yields. However, I noticed that KMR was selling at a discount to KMP. KMR was equivalent to KMP in every single economics way, with the only exception being that it paid distributions in additional shares, and not in cash. Some investors disliked this idea, which explained why KMR was always cheaper by 5%-10%. In addition, since the distributions were payable in additional shares of KMR, this meant that IRS saw them as stock splits and considered them tax-free as long as the investor held on to shares. I thought of buying up KMR since I am in the accumulation phase, and then if the gap narrowed to sell and buy the limited partnership units and live off those distributions. For each dollar invested in August 2009, with distributions being reinvested tax-free at KMR that was selling at a massive discount, I ended up with approximately $2.80. Thus, an investment of $1000 back then would have turned into approximately $2800 today. Once the acquisition by Kinder Morgan Inc (KMI) is performed, and each of my shares of KMR is exchanged for 2.4849 shares of Kinder Morgan Inc, this small investment will result in an yield on cost of over 13% at the current rate of $1.76/share. At the $2/share annual dividend that is expected by Kinder Morgan Inc in 2015, that $1,000 investment in 2009 will generate close to $150 or a 15% yield on the amount invested. Not too shabby if you ask me.

As we all know however, Kinder Morgan Management LLC (KMR) is about to stop trading, since its shares will be exchanged for shares in Kinder Morgan Inc (KMI).

A recent example was the purchase of shares in several companies in tax-advantaged accounts such as Roth IRA and Sep IRA. I plan on maxing out the Roth IRA in 2015, and the SEP IRA, along with the 401 (k) and a newly started Health Savings Account. When you get the powers of compounding withing a tax-deferred vehicle, the results are truly spectacular.

Full Disclosure: Long KMR, KMI, KO,

Relevant Articles:

- Kinder Morgan to Merge Partnerships into One Company

- Kinder Morgan Limited Partners Could Face Steep Tax Bills

- Kinder Morgan Partners – One Company three ways to invest in it

- How to buy Kinder Morgan at a discount

- Two and a half purchases I made this week

Monday, November 24, 2014

Friday, November 21, 2014

Franklin Resources (BEN) Dividend Stock Analysis

Franklin Resources Inc. (BEN) is a publicly owned asset management holding company. The firm provides its services to individuals, institutions, pension plans, trusts, and partnerships. This dividend champion has paid dividends since 1981 and managed to increase them for 34 years in a row.

The most recent dividend increase was in December 2013, when the Board of Directors approved a 20% increase in the quarterly dividend to 12 cents/share.

Over the past decade this dividend growth stock has delivered an annualized total return of 15% to its shareholders. Future returns will be dependent on growth in earnings and dividend yields obtained by shareholders.

The company has managed to deliver a 17.70% average increase in annual EPS over the past decade. Franklin Resources is expected to earn $3.73 per share in 2014 and $4.07 per share in 2015. In comparison, the company earned $3.37/share in 2013.

Between 2004 and 2014, the number of shares outstanding has decreased from 757 million to 628 million. The consistent decrease in shares outstanding adds an extra growth kick to earnings per share over time.

Overall I am bullish on asset managers, who have the odds stacked in their favor for future success. Essentially, the goal of the game is to get as much in assets under management, and then try to have low costs relative to competitors. As a large portion of customers stay with a manager, this generates fees for years to come.

Since asset prices tend to rise over time, asset managers who earn a fixed fee based on amount of money they manage are destined to earn more as well. This would not be a smooth ride up, but nevertheless the rising tide is destined to lift all boats up. Even if stock markets end going up by 6 - 7% in price annually for the next 2 - 3 decades, those asset managers are going to earn 6-7% more per year merely because they manage those assets. As long as the amount redeemed equal amount of new money invested, the asset manager will earn more money for shareholders simply for being there.

It is a pretty sweet model after all, where if you come up with a mutual fund idea and raise hundreds of millions from investors, you get to earn an annuity like income stream, as long as asset levels are at least maintained. There is no risk for the manager, and the risk is borne by investors in the funds.

Of course, if those asset managers also find ways to market their products and receive more in inflows from investors, their earnings per share could grow much faster than overall profits from other US sectors.

The main problem behind mutual fund companies and asset managers is the rise in passive investing approaches, which have been popularized by Vanguard. It is tough to compete against an organization which runs its passively managed funds at cost, thus minimizing expenses for shareholders in those funds. However, I do believe that not all assets will end up in index funds, although the competition will much tougher than before. However, even the passively managed index funds are not a panacea for the ordinary mom and pop investor, who needs some guidance for managing their retirement money. From my personal experience , ordinary investors tend to focus on their jobs and lives, and are not very focused on investing decisions. This is why it is quite possible that traditional asset managers who manage to reach to those individuals, and sell relevant investment products that generate recurring revenues to them, will benefit.

It is very easy to buy and sell an investment these days, which makes "asset stickiness" a potential problem. This is why I am actually more bullish on investment advisers such as Ameriprise Financial (NYSE:AMP) than mutual fund companies such as Franklin Resources . However, many individuals who buy an investment such as a mutual fund, tend to hold on to that investment for years. In addition, fewer individuals have company pensions, which means that they would have to manage their own money, or otherwise risk not retiring. This is why professionally managed money will still be around, and earn fees for decades to come. In addition, the products from Franklin Resources are sold through more than 130,000 advisers, which is a way to ensure stickiness of assets.

The annual dividend payment has increased by 15% per year over the past decade, which is lower than the growth in EPS. I expect dividends to grow in the low teens over the next decade. While Frankln Resources has a low dividend payout, and a low dividend yield, it has managed to distribute special dividend payments to shareholders on several occasions over the past decade as well.

A 15% growth in distributions translates into the dividend payment doubling every four and a half years on average. If we check the dividend history, going as far back as 1988, we could see that Franklin Resources has managed to double dividends almost every five years on average.

In the past decade, the dividend payout ratio has largely remained low around 11- 12%. The company has preferred share repurchases to paying dividends, although it has kept raising dividends at a very healthy clip. The nice potential for dividend investors is that there is room for plenty of dividend growth in the future. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

The return on equity increased from 15% in 2004 to 22.30% in 2013. While this indicator will closely follow stock market fluctuations over time, I am nevertheless impressed by the high amount. I generally like seeing a high return on equity, which is also relatively stable over time.

Currently, Franklin Resources is selling for times 15.20 times forward earnings and yields 0.90%. Many dividend investors overlook the company, because of the low yield. I believe that they are wrong to do so however, because the company offers an attractive valuation today, opportunity for high earnings and dividend growth over time, and the potential for further expansion of the dividend payout ratio. While I do have a minimum yield requirement, I am considering initiating a position in the stock sometime in late 2014 or early 2015, which of course would be subject to availability of cash and other ideas. I would of course start with a small position, but I do believe this company will bring wealth to shareholders in the future. I am hopeful for a stock market decline, which would result in temporary decreases in earnings and share prices. Accumulating the whole position after a five year bull market does not sound very tempting. This is why dollar cost averaging would really help in accumulating a position in asset managers like Franklin Resources.

Full Disclosure: None

Relevant Articles:

- Should I have a minimum yield requirement?

- Dividend Macro trends: The Baby Boomer Retirement Investment

- Dividend Aristocrats List

- Five Dividend Hikes In the News

- Top Dividend Growth Stocks of the past decade

The most recent dividend increase was in December 2013, when the Board of Directors approved a 20% increase in the quarterly dividend to 12 cents/share.

Over the past decade this dividend growth stock has delivered an annualized total return of 15% to its shareholders. Future returns will be dependent on growth in earnings and dividend yields obtained by shareholders.

The company has managed to deliver a 17.70% average increase in annual EPS over the past decade. Franklin Resources is expected to earn $3.73 per share in 2014 and $4.07 per share in 2015. In comparison, the company earned $3.37/share in 2013.

Between 2004 and 2014, the number of shares outstanding has decreased from 757 million to 628 million. The consistent decrease in shares outstanding adds an extra growth kick to earnings per share over time.

Overall I am bullish on asset managers, who have the odds stacked in their favor for future success. Essentially, the goal of the game is to get as much in assets under management, and then try to have low costs relative to competitors. As a large portion of customers stay with a manager, this generates fees for years to come.

Since asset prices tend to rise over time, asset managers who earn a fixed fee based on amount of money they manage are destined to earn more as well. This would not be a smooth ride up, but nevertheless the rising tide is destined to lift all boats up. Even if stock markets end going up by 6 - 7% in price annually for the next 2 - 3 decades, those asset managers are going to earn 6-7% more per year merely because they manage those assets. As long as the amount redeemed equal amount of new money invested, the asset manager will earn more money for shareholders simply for being there.

It is a pretty sweet model after all, where if you come up with a mutual fund idea and raise hundreds of millions from investors, you get to earn an annuity like income stream, as long as asset levels are at least maintained. There is no risk for the manager, and the risk is borne by investors in the funds.

Of course, if those asset managers also find ways to market their products and receive more in inflows from investors, their earnings per share could grow much faster than overall profits from other US sectors.

The main problem behind mutual fund companies and asset managers is the rise in passive investing approaches, which have been popularized by Vanguard. It is tough to compete against an organization which runs its passively managed funds at cost, thus minimizing expenses for shareholders in those funds. However, I do believe that not all assets will end up in index funds, although the competition will much tougher than before. However, even the passively managed index funds are not a panacea for the ordinary mom and pop investor, who needs some guidance for managing their retirement money. From my personal experience , ordinary investors tend to focus on their jobs and lives, and are not very focused on investing decisions. This is why it is quite possible that traditional asset managers who manage to reach to those individuals, and sell relevant investment products that generate recurring revenues to them, will benefit.

It is very easy to buy and sell an investment these days, which makes "asset stickiness" a potential problem. This is why I am actually more bullish on investment advisers such as Ameriprise Financial (NYSE:AMP) than mutual fund companies such as Franklin Resources . However, many individuals who buy an investment such as a mutual fund, tend to hold on to that investment for years. In addition, fewer individuals have company pensions, which means that they would have to manage their own money, or otherwise risk not retiring. This is why professionally managed money will still be around, and earn fees for decades to come. In addition, the products from Franklin Resources are sold through more than 130,000 advisers, which is a way to ensure stickiness of assets.

The annual dividend payment has increased by 15% per year over the past decade, which is lower than the growth in EPS. I expect dividends to grow in the low teens over the next decade. While Frankln Resources has a low dividend payout, and a low dividend yield, it has managed to distribute special dividend payments to shareholders on several occasions over the past decade as well.

A 15% growth in distributions translates into the dividend payment doubling every four and a half years on average. If we check the dividend history, going as far back as 1988, we could see that Franklin Resources has managed to double dividends almost every five years on average.

In the past decade, the dividend payout ratio has largely remained low around 11- 12%. The company has preferred share repurchases to paying dividends, although it has kept raising dividends at a very healthy clip. The nice potential for dividend investors is that there is room for plenty of dividend growth in the future. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

The return on equity increased from 15% in 2004 to 22.30% in 2013. While this indicator will closely follow stock market fluctuations over time, I am nevertheless impressed by the high amount. I generally like seeing a high return on equity, which is also relatively stable over time.

Currently, Franklin Resources is selling for times 15.20 times forward earnings and yields 0.90%. Many dividend investors overlook the company, because of the low yield. I believe that they are wrong to do so however, because the company offers an attractive valuation today, opportunity for high earnings and dividend growth over time, and the potential for further expansion of the dividend payout ratio. While I do have a minimum yield requirement, I am considering initiating a position in the stock sometime in late 2014 or early 2015, which of course would be subject to availability of cash and other ideas. I would of course start with a small position, but I do believe this company will bring wealth to shareholders in the future. I am hopeful for a stock market decline, which would result in temporary decreases in earnings and share prices. Accumulating the whole position after a five year bull market does not sound very tempting. This is why dollar cost averaging would really help in accumulating a position in asset managers like Franklin Resources.

Full Disclosure: None

Relevant Articles:

- Should I have a minimum yield requirement?

- Dividend Macro trends: The Baby Boomer Retirement Investment

- Dividend Aristocrats List

- Five Dividend Hikes In the News

- Top Dividend Growth Stocks of the past decade

Wednesday, November 19, 2014

Independent thinking for successful dividend investing

I enjoy dividend investing, because it is always challenging but it is also very rewarding. I have a set level of basic guidelines such as my entry criteria I apply on the list of dividend champions and achievers, in order to identify companies for further research. I then maintain a list of companies that I have analyzed, which I monitor very often for any weakness for a buying opportunity. In addition, I also monitor my existing positions in order to identify any laggards that are either cutting dividends or might not deliver as much as previously expected.

My investment analysis goes beyond reading annual reports and research. I also try to learn as much as possible about the stock market, investing and general business knowledge. In other words, I keep learning as much as possible in order to make myself a better and more rounded investor. Most of things I learn go through my filters, and are rejected as unsuitable for my strategy. Some investment gems are tested and a few are implemented in my tools of the trade. I do eat and breathe investing, and the knowledge I have accumulated in the process has allowed me to develop an independent view on the subject, which works for me. I invest my money based on my own analysis, and end up earning dividends and capital gains, although sometimes I generate capital losses in the process. Surprisingly, I have often found that I am usually right when most other investors are opposed to my ideas.

Sometimes, I also learn from the intelligent comments from my readers. A lot of the times however, I end up interacting with investors who clearly should not be putting their money in anything else than an FDIC insured bank account. Many times these investors are arguing with me, and end up informing me that my view is incorrect. After reviewing their objections, I typically find out that these investors are not performing objective analysis of investment situations either because they are blinded by high current yields or because they are not taking into account some other factors. A third scenario that could sometimes include bits and pieces of the items mentioned earlier is the situation where investors are simply following someone else, without doing their own due diligence.

Back at the end of 2012, I posted an analysis of Abbott Laboratories (ABT), right before the company split into Abbott and Abbvie (ABBV). At the same time I also mentioned that I had recently added to my position in the legacy Abbott Laboratories. While many investors had valid comments about this investment, there was one investor whose main concern was very flawed. If they had mentioned that Abbott was not the wisest decision, stemming from the fact that it was not possible to determine if the two new companies would continue the long streak of dividend increases or that synergies between the two companies would disappear after the split, that could have been a concern worth raising. However, the main argument from the investor with the flawed thinking however was that David van Knapp had recommended selling the stock.

I think that blindly following someone’s advice to be the worst sin of investing. If you follow someone’s ideas to purchase a stock, you are immediately at a disadvantage because you would not be the first one to learn about future investment moves. In fact, if the original “guru” ends up selling their position, without notifying the follower, the follower might end up losing money. In addition, if the “guru” buys a stock, which then promptly falls by 50% or more, as plenty of good quality stock prices did in 2008, an inexperienced investor might get scared, and sell at a loss. You might think that only inexperienced investors do this, but in reality everyone is influenced by authority a little bit. I sometimes find myself influenced by authority figures such as Warren Buffett, and thus justifying certain investments with the mere fact that Buffett has purchased them for Berkshire Hathaway (BRK.B). Following a guru however, is never a good reason to purchase or sell a stock. However, performing an analysis of a stock that a guru purchases, and then determining if it is a buy is perfectly fine.

Back in early 2010, I analyzed Realty Income (O), and found it to be a buy. However, many investors dismissed my analysis, because hedge fund manager Bill Ackman was short the stock. Yet, his thesis was flawed, and contained a lot of holes - and the investment has doubled since then. I held on to my stock during that time period, and added to it. Back in 2013, another investor was short Digital Realty Trust (DLR). I called our his manipulations and held on to my position. Someone on Seeking Alpha objected to my analysis, and their primary argument was that I was not a billionaire. Yet the conviction in my own analysis provided me the strength to hold on to my stock positions. If I had merely followed someone blindly into a stock, I would have bailed out at the first sign of trouble.

Another interesting factor about dividend investing is that some investors simply refuse to do their own independent research. One of the questions I always receive from investors is for the list of my current portfolio holdings. I first posted a snapshot of my portfolio four years ago, but since then the page has been out of date. I have since shared my dividend holdings with subscribers of my mailing list. There is a reason why I don't make this list easily available, unlike other sites dedicated to dividend investing. My thinking is that if I posted my holdings, I would actually be doing a disservice to novice investors. I would much rather have patient readers who review my thought process through my regular postings that describe somewhat recent events, from which they could hopefully learn something. If I posted my portfolio and made it easy for anyone to check it, I would usually risk someone seeing what I owned and then purchased it without giving much thought about it. Unfortunately, my portfolio has been built slowly over a timespan exceeding several years. Just because I found Family Dollar (FDO) to be attractively valued in 2008 and initiated a position at $24.99/share, might not mean that Family Dollar is a buy today at $77 - $78/share.

Full Disclosure: Long O, DLR, FDO, ABBV, ABT

Relevant Articles:

- Do not become a victim of fear in your dividend investing

- Why most dividend investors never succeed

- Should you follow Warren Buffett’s latest moves?

- How to monitor your dividend investments

- Never Stop Learning and Improving

My investment analysis goes beyond reading annual reports and research. I also try to learn as much as possible about the stock market, investing and general business knowledge. In other words, I keep learning as much as possible in order to make myself a better and more rounded investor. Most of things I learn go through my filters, and are rejected as unsuitable for my strategy. Some investment gems are tested and a few are implemented in my tools of the trade. I do eat and breathe investing, and the knowledge I have accumulated in the process has allowed me to develop an independent view on the subject, which works for me. I invest my money based on my own analysis, and end up earning dividends and capital gains, although sometimes I generate capital losses in the process. Surprisingly, I have often found that I am usually right when most other investors are opposed to my ideas.

Sometimes, I also learn from the intelligent comments from my readers. A lot of the times however, I end up interacting with investors who clearly should not be putting their money in anything else than an FDIC insured bank account. Many times these investors are arguing with me, and end up informing me that my view is incorrect. After reviewing their objections, I typically find out that these investors are not performing objective analysis of investment situations either because they are blinded by high current yields or because they are not taking into account some other factors. A third scenario that could sometimes include bits and pieces of the items mentioned earlier is the situation where investors are simply following someone else, without doing their own due diligence.

Back at the end of 2012, I posted an analysis of Abbott Laboratories (ABT), right before the company split into Abbott and Abbvie (ABBV). At the same time I also mentioned that I had recently added to my position in the legacy Abbott Laboratories. While many investors had valid comments about this investment, there was one investor whose main concern was very flawed. If they had mentioned that Abbott was not the wisest decision, stemming from the fact that it was not possible to determine if the two new companies would continue the long streak of dividend increases or that synergies between the two companies would disappear after the split, that could have been a concern worth raising. However, the main argument from the investor with the flawed thinking however was that David van Knapp had recommended selling the stock.

I think that blindly following someone’s advice to be the worst sin of investing. If you follow someone’s ideas to purchase a stock, you are immediately at a disadvantage because you would not be the first one to learn about future investment moves. In fact, if the original “guru” ends up selling their position, without notifying the follower, the follower might end up losing money. In addition, if the “guru” buys a stock, which then promptly falls by 50% or more, as plenty of good quality stock prices did in 2008, an inexperienced investor might get scared, and sell at a loss. You might think that only inexperienced investors do this, but in reality everyone is influenced by authority a little bit. I sometimes find myself influenced by authority figures such as Warren Buffett, and thus justifying certain investments with the mere fact that Buffett has purchased them for Berkshire Hathaway (BRK.B). Following a guru however, is never a good reason to purchase or sell a stock. However, performing an analysis of a stock that a guru purchases, and then determining if it is a buy is perfectly fine.

Back in early 2010, I analyzed Realty Income (O), and found it to be a buy. However, many investors dismissed my analysis, because hedge fund manager Bill Ackman was short the stock. Yet, his thesis was flawed, and contained a lot of holes - and the investment has doubled since then. I held on to my stock during that time period, and added to it. Back in 2013, another investor was short Digital Realty Trust (DLR). I called our his manipulations and held on to my position. Someone on Seeking Alpha objected to my analysis, and their primary argument was that I was not a billionaire. Yet the conviction in my own analysis provided me the strength to hold on to my stock positions. If I had merely followed someone blindly into a stock, I would have bailed out at the first sign of trouble.

Another interesting factor about dividend investing is that some investors simply refuse to do their own independent research. One of the questions I always receive from investors is for the list of my current portfolio holdings. I first posted a snapshot of my portfolio four years ago, but since then the page has been out of date. I have since shared my dividend holdings with subscribers of my mailing list. There is a reason why I don't make this list easily available, unlike other sites dedicated to dividend investing. My thinking is that if I posted my holdings, I would actually be doing a disservice to novice investors. I would much rather have patient readers who review my thought process through my regular postings that describe somewhat recent events, from which they could hopefully learn something. If I posted my portfolio and made it easy for anyone to check it, I would usually risk someone seeing what I owned and then purchased it without giving much thought about it. Unfortunately, my portfolio has been built slowly over a timespan exceeding several years. Just because I found Family Dollar (FDO) to be attractively valued in 2008 and initiated a position at $24.99/share, might not mean that Family Dollar is a buy today at $77 - $78/share.

Full Disclosure: Long O, DLR, FDO, ABBV, ABT

Relevant Articles:

- Do not become a victim of fear in your dividend investing

- Why most dividend investors never succeed

- Should you follow Warren Buffett’s latest moves?

- How to monitor your dividend investments

- Never Stop Learning and Improving

Tuesday, November 18, 2014

What should I do about those non-dividend paying stocks I received in a spin-off?

In a previous article, I discussed the idea of dividend investors holding non – dividend paying stocks. After I wrote the article a few weeks ago, I realized that I have received/am about to receive shares in two companies, after them being spun-off from their parents.

I receive one share in CDK Global (CDK) share for every 3 shares of Automatic Data Processing (ADP). Based on reading the dividend policy of this company, it is unclear whether they will be paying a dividend in the foreseeable future. Based on expected earnings of $1.37 - $1.39/share, the stock is selling for 26.30 - 26.70 times forward earnings, which is pricey. If we get high single digit earnings growth however over the next decade, it could be worth to hold on to this business.

I receive one share of Halyard Health (HYH) for every 8 shares of Kimberly-Clark (KMB). The company has stated that no dividends are expected to be paid. The company earned $154.6 million in 2013, and has approximately 46.5 million shares outstanding, which equates to approximately to an EPS of $3.30/share. Thus, the company is selling for approximately 11.50 times earnings, which is pretty cheap. While revenues have been stagnant for the past 3 years, net income has grown slightly. If they manage to streamline operations, repurchase stock or start growing income organically, shareholders could do pretty well by holding on. If they initiate a dividend and start growing it, I would have less reasons to not hold on to the company.

So I am trying to decide what to do. I basically have two options:

1) Sell

This sounds like a logical option for someone who calls themselves a dividend growth investor. If my goal is to earn more in dividend income from my portfolio, it would seem a waste of capital to hold shares in companies that do not pay dividends. I could essentially sell the shares, pay the capital gains taxes, and reinvest the proceeds in something that pays dividends. Since my goal is to earn more dividend income from my capital, I should not hold on to shares in companies which have mentioned that they won’t continue the legacy of regular dividend growth of their parent companies.

For some investors, having two extra companies in their portfolio would probably trigger a sale, because it would exceed a self-imposed number of companies they want to own. In addition, many index funds that held Automatic Data Processing (ADP) in their portfolios, were selling shares of CDK Global (CDK) merely because CDK was not a member of S&P 500, without questioning whether CDK is a good business to own.

2) Hold

I could also just sit tight and hold on to those shares. This is because stock spin-offs usually do really well, as the new company gets management whose sole focus is on managing it, rather than a division whose goals and needs are lost in a larger company. In addition, I have found through an analysis of the sales I have made that selling a company and buying another one usually results in poor results. This is because I pay capital gains taxes on the gains, which leaves me with less money to reinvest. In addition, I have reinvestment risk if I sold and bought something that doesn’t perform as well. The more time I spend reviewing investments, the more I realize that the biggest risk is not that a company goes to zero, but that I miss out on a potential for large gains.

Conclusion

I believe that I will simply hold on to those shares for the time being. In addition, despite the spin-offs of shares, my total dividend income will be unchanged since Automatic Data Processing (ADP) and Kimberly-Clark (KMB) are holding their dividends per share steady. Update: Actually ADP just increased their dividend by 2% to 49 cents/share, citing the high payout ratio as a reason for the slow increase. This dividend champion has grown dividends for 40 years in a row, and is targeting a dividend payout ratio of 55 - 60%.

The position in Halyard Health (HYH) is really small, since I received 1 share for every 8 shares of Kimberly-Clark (KMB). So the amount I received is roughly equivalent to the dividend from Kimberly-Clark (KMB) for 1 - 1.5 years. Based on my study of historical Kimberly-Clark spin-offs, it might pay off to sit tight, rather than lose capital to taxes and reinvestment risk.

There was a spin-off from Kimberly-Clark in 2005, called Neenah Paper (NP). The company was paying a quarterly dividend of 10 cents/share that was unchanged for about 6 years, until it started raising it to about 27 cents/share in 2014. Thus, if you held for 10 years, your dividend income would have increased by 170%, which is not bad at all. Either way, the investor in the company earned a total return of 7.50%/year since the spin-off. The investor in S&P 500 earned approximately 7.70%/year.

There was another spin-off from Kimberly-Clark in 1995, called Schweitzer-Mauduit International Inc (SWM), which made cigarette paper and related tobacco products. That company didn’t pay a dividend for the first 6 months after spin-off, and started at 7.50 cents/share every quarter in 1996. The dividend was held steady until 2012, after which it has been increasing to 36 cents/share every quarter. This goes to show that the most in profits is made by the patient investor, who holds on to their ownership through thick and thin, and doesn’t get scared away easily. Of course, waiting for a dividend increase for 16 years is a tough proposition. Either way, the investor in the company earned a total return of 10%/year the spin-off. The investor in S&P 500 earned approximately 8.40%/year.

The position in CDK Global is slightly larger, but not by much. A previous spin-off from ADP called Broadridge Financial Solutions (BR) has done pretty well, and has paid and increased dividends to shareholders since 2007. It paid a quarterly dividend of 6 cents/share in 2007, which increased to 27 cents/share by 2014. The company has done much better than an investment in S&P 500 since 2007, by providing a total return of 172% versus 67% for the stock index.

The more important thing is for those companies to be able to grow earnings per share. In addition, it is possible that they pay a dividend at some point in the future. After looking at the sales and earnings trends for the two companies over the past few years, I believe that those would be decent investments. I will wait for one or two years’ worth of performance as separate businesses, and see how promising they are as investments. At that stage I will decide whether it is worth holding on to those companies, based upon their business performance.

Update 11/20/2014: CDK (Name: CDK GLOBAL INC) announced a cash dividend with ex-dividend date of 2014-11-26 and payable date of 2014-12-29. The declared cash rate is USD 0.12.

Full Disclosure: Long KMB, ADP, CDK, HYH

Relevant Articles:

- What is Dividend Growth Investing?

- Stock Spin-Offs – What Should Dividend Investors do?

- Warren Buffett is now working for me

- Types of dividend growth stocks

- Do not focus only on income for retirement planning

I receive one share in CDK Global (CDK) share for every 3 shares of Automatic Data Processing (ADP). Based on reading the dividend policy of this company, it is unclear whether they will be paying a dividend in the foreseeable future. Based on expected earnings of $1.37 - $1.39/share, the stock is selling for 26.30 - 26.70 times forward earnings, which is pricey. If we get high single digit earnings growth however over the next decade, it could be worth to hold on to this business.

I receive one share of Halyard Health (HYH) for every 8 shares of Kimberly-Clark (KMB). The company has stated that no dividends are expected to be paid. The company earned $154.6 million in 2013, and has approximately 46.5 million shares outstanding, which equates to approximately to an EPS of $3.30/share. Thus, the company is selling for approximately 11.50 times earnings, which is pretty cheap. While revenues have been stagnant for the past 3 years, net income has grown slightly. If they manage to streamline operations, repurchase stock or start growing income organically, shareholders could do pretty well by holding on. If they initiate a dividend and start growing it, I would have less reasons to not hold on to the company.

So I am trying to decide what to do. I basically have two options:

1) Sell

This sounds like a logical option for someone who calls themselves a dividend growth investor. If my goal is to earn more in dividend income from my portfolio, it would seem a waste of capital to hold shares in companies that do not pay dividends. I could essentially sell the shares, pay the capital gains taxes, and reinvest the proceeds in something that pays dividends. Since my goal is to earn more dividend income from my capital, I should not hold on to shares in companies which have mentioned that they won’t continue the legacy of regular dividend growth of their parent companies.

For some investors, having two extra companies in their portfolio would probably trigger a sale, because it would exceed a self-imposed number of companies they want to own. In addition, many index funds that held Automatic Data Processing (ADP) in their portfolios, were selling shares of CDK Global (CDK) merely because CDK was not a member of S&P 500, without questioning whether CDK is a good business to own.

2) Hold

I could also just sit tight and hold on to those shares. This is because stock spin-offs usually do really well, as the new company gets management whose sole focus is on managing it, rather than a division whose goals and needs are lost in a larger company. In addition, I have found through an analysis of the sales I have made that selling a company and buying another one usually results in poor results. This is because I pay capital gains taxes on the gains, which leaves me with less money to reinvest. In addition, I have reinvestment risk if I sold and bought something that doesn’t perform as well. The more time I spend reviewing investments, the more I realize that the biggest risk is not that a company goes to zero, but that I miss out on a potential for large gains.

Conclusion

I believe that I will simply hold on to those shares for the time being. In addition, despite the spin-offs of shares, my total dividend income will be unchanged since Automatic Data Processing (ADP) and Kimberly-Clark (KMB) are holding their dividends per share steady. Update: Actually ADP just increased their dividend by 2% to 49 cents/share, citing the high payout ratio as a reason for the slow increase. This dividend champion has grown dividends for 40 years in a row, and is targeting a dividend payout ratio of 55 - 60%.

The position in Halyard Health (HYH) is really small, since I received 1 share for every 8 shares of Kimberly-Clark (KMB). So the amount I received is roughly equivalent to the dividend from Kimberly-Clark (KMB) for 1 - 1.5 years. Based on my study of historical Kimberly-Clark spin-offs, it might pay off to sit tight, rather than lose capital to taxes and reinvestment risk.

There was a spin-off from Kimberly-Clark in 2005, called Neenah Paper (NP). The company was paying a quarterly dividend of 10 cents/share that was unchanged for about 6 years, until it started raising it to about 27 cents/share in 2014. Thus, if you held for 10 years, your dividend income would have increased by 170%, which is not bad at all. Either way, the investor in the company earned a total return of 7.50%/year since the spin-off. The investor in S&P 500 earned approximately 7.70%/year.

There was another spin-off from Kimberly-Clark in 1995, called Schweitzer-Mauduit International Inc (SWM), which made cigarette paper and related tobacco products. That company didn’t pay a dividend for the first 6 months after spin-off, and started at 7.50 cents/share every quarter in 1996. The dividend was held steady until 2012, after which it has been increasing to 36 cents/share every quarter. This goes to show that the most in profits is made by the patient investor, who holds on to their ownership through thick and thin, and doesn’t get scared away easily. Of course, waiting for a dividend increase for 16 years is a tough proposition. Either way, the investor in the company earned a total return of 10%/year the spin-off. The investor in S&P 500 earned approximately 8.40%/year.

The position in CDK Global is slightly larger, but not by much. A previous spin-off from ADP called Broadridge Financial Solutions (BR) has done pretty well, and has paid and increased dividends to shareholders since 2007. It paid a quarterly dividend of 6 cents/share in 2007, which increased to 27 cents/share by 2014. The company has done much better than an investment in S&P 500 since 2007, by providing a total return of 172% versus 67% for the stock index.

The more important thing is for those companies to be able to grow earnings per share. In addition, it is possible that they pay a dividend at some point in the future. After looking at the sales and earnings trends for the two companies over the past few years, I believe that those would be decent investments. I will wait for one or two years’ worth of performance as separate businesses, and see how promising they are as investments. At that stage I will decide whether it is worth holding on to those companies, based upon their business performance.

Update 11/20/2014: CDK (Name: CDK GLOBAL INC) announced a cash dividend with ex-dividend date of 2014-11-26 and payable date of 2014-12-29. The declared cash rate is USD 0.12.

Full Disclosure: Long KMB, ADP, CDK, HYH

Relevant Articles:

- What is Dividend Growth Investing?

- Stock Spin-Offs – What Should Dividend Investors do?

- Warren Buffett is now working for me

- Types of dividend growth stocks

- Do not focus only on income for retirement planning

Monday, November 17, 2014

Should Dividend Investors own Non-Dividend Paying Stocks?

Dividend growth investing is the strategy I have been using for several years in order to reach my retirement goals. In order to be successful with a strategy and stick to it through thick and thin, investors need to understand its positives and limitations. One of the disadvantages of investing purely for dividends is missing out on spectacular price gains of hot new technology stocks. On the other hand, everyone can pick the best hot stock only after the fact. Most investors who look for the best growth stock are very often very wrong at the end. This is why I stick to the tried and true dividend champions and dividend achievers.

Apple (AAPL) is one of the best performing stocks over the past decade. The stock rose from a low of about $4/share in November 2004 to a high of about $100/share in 2012. If you look at any of the top performing stocks from ten years ago, one could notice that few of them even paid dividends, let alone maintained a streak of dividend increases. Opponents of dividend investing often use this fact as an argument against the merits of dividend investing. While as a dividend investor I am going to miss out on the next Apple, I also know that I am going to miss out on the next technology bubble, the next MCI Worldcom or the next company that will try to be the next Apple (or Google, Microsoft etc) but fail in the process. Most companies that are touted to be the "next something" end up failing, losing money for their investors and their worthless shares get delisted. Since those losers are not in the plain sight of ordinary investors, the lessons from their failures are soon forgotten by investors.

The world of technology changes very fast, which is why it is so difficult to maintain an economic moat that lasts for several decades. The companies that try to become the “next” Google, Apple or Microsoft often end up being nothing more than pipe dreams, which end up costing investors many dollars. In addition, the chances of selecting the best growth company over the next five years are really slim, unless you are a seasoned and well-connected Silicon Valley venture capitalist.

Looking at the best performing stocks over the past decade and then invalidating dividend investment altogether is not a very smart way of looking into things. This is because one is not comparing apples to apples. If instead we compared the results of dividend paying stocks to the results of non-dividend paying stocks, we could notice a stark contrast. Over the past years, dividend stock have consistently outperformed non dividend paying stocks.

The reasons behind this out-performance are somewhat counter-intuitive:

1) Dividend paying stocks are typically mature companies, which generate excess cash flows that they do not know what to do with. As a result, these companies return this excess cashflows to shareholders in the form of dividends. Some, like Procter & Gamble or Coca-Cola have increased dividends for over 50 years in a row each.

2) The boards of these dividend paying companies realize that companies cannot reinvest new money at the same rates of return. Investing new funds is important to maintain and grow the business, but unfortunately there are physical limitations to expanding business indefinitely and forever. Due to laws of diminishing returns, once you add in an extra dollar of investment that does not result in much profit, you should be better off doing something else with the money. In other words, if you are Starbucks (SBUX) and you already have four coffeehouses on a busy intersection, chances are the adding a fifth one is not going to result in a 20 – 25% automatic increase in total sales.

3) Because dividend companies are mature enterprises, their growth prospects are not going to be very high. As a result, these stocks are often trading at low price-earnings multiples. This allows investors to purchase these quality companies at a discount, and thus enjoy better compounding of capital. The companies which have very high earnings growth projections often sell at a premium price, which has high earnings growth already baked in to the stock price. The reason why Altria (MO) (which was called Phillip Morris back then) was the best performing stock between 1957 - 2003, was because it grew earnings and dividends while shares were always cheap, and thus shareholders were able to consistently reinvest dividends at low valuations. This turbocharges dividend income and capital growth.

4) While the growth prospects for mature dividend paying stocks are not as high as the prospects for a hot new IPO, they are more dependable. Many of these mature companies tend to deliver a small but consistent growth, which makes them clear winners over time. Many of these stodgy dividend champions tend to sell a similar type of a branded product or service that your parents or grandparents have used and which you and your children would likely use for decades to come. The consistent growth translates into consistent profitability, which coupled with the relative undervaluation when compared to the stock market makes investment a very good idea.

5) The dividends that these companies pay to shareholders represent a return on investment which is always positive. A company can see its stock price rise quickly to new highs or fall precipitously to all-time-lows, leaving investors with rapidly fluctuating capital gains or losses. At the same time however, income investors receiving a dividend would be essentially paid to hold on to the stock of their choice, and would be less likely to panic and sell at the worst time possible. The dividend payment, if sustainable, would thus be a factor that could keep the stock price from losing too much, since value oriented investors would step up and provide support behind the stock by purchasing it at attractive valuations.

6) The dividend payment provides a regular stream of income, which investors could use to either spend or invest in stocks that fit their entry criteria. Dividend reinvestment allows investors to compound their capital over time, through the systematic accumulation of undervalued assets over time using dividend income. This strategy has helped famous value investor Warren Buffett to accumulate a fortune worth over $60 billion. By focusing Berkshire Hathaway’s capital on income producing investments, and then reinvesting excess capital into other income producing assets, Buffett has transformed the sleepy textile company into a diversified conglomerate with a market capitalization of over $200 billion.

The article discusses dividend paying stocks and non-dividend paying stocks in general. While there could be dividend paying stocks which have failed, as well as non-dividend paying stocks which have been wildly successful, this does not change the overall conclusion that dividend paying stocks have historically done better than non-paying ones. The probability that your average blue chip dividend stock provides better returns is much higher than the probability of good returns by your average non-dividend paying stock. In order to further increase your chances of achieving your goals, one also needs to further screen out investments and evaluate the final list of candidates for inclusion one by one.

Full Disclosure: Long KO, PG, MO, PM,

Relevant Articles:

- Another reason for companies to pay dividends

- Why Dividend Growth Stocks Rock?

- What is Dividend Growth Investing?

- Should dividend investors hold non-dividend paying stocks?

- The predictive value of rising dividends

Apple (AAPL) is one of the best performing stocks over the past decade. The stock rose from a low of about $4/share in November 2004 to a high of about $100/share in 2012. If you look at any of the top performing stocks from ten years ago, one could notice that few of them even paid dividends, let alone maintained a streak of dividend increases. Opponents of dividend investing often use this fact as an argument against the merits of dividend investing. While as a dividend investor I am going to miss out on the next Apple, I also know that I am going to miss out on the next technology bubble, the next MCI Worldcom or the next company that will try to be the next Apple (or Google, Microsoft etc) but fail in the process. Most companies that are touted to be the "next something" end up failing, losing money for their investors and their worthless shares get delisted. Since those losers are not in the plain sight of ordinary investors, the lessons from their failures are soon forgotten by investors.

The world of technology changes very fast, which is why it is so difficult to maintain an economic moat that lasts for several decades. The companies that try to become the “next” Google, Apple or Microsoft often end up being nothing more than pipe dreams, which end up costing investors many dollars. In addition, the chances of selecting the best growth company over the next five years are really slim, unless you are a seasoned and well-connected Silicon Valley venture capitalist.

Looking at the best performing stocks over the past decade and then invalidating dividend investment altogether is not a very smart way of looking into things. This is because one is not comparing apples to apples. If instead we compared the results of dividend paying stocks to the results of non-dividend paying stocks, we could notice a stark contrast. Over the past years, dividend stock have consistently outperformed non dividend paying stocks.

The reasons behind this out-performance are somewhat counter-intuitive:

1) Dividend paying stocks are typically mature companies, which generate excess cash flows that they do not know what to do with. As a result, these companies return this excess cashflows to shareholders in the form of dividends. Some, like Procter & Gamble or Coca-Cola have increased dividends for over 50 years in a row each.

2) The boards of these dividend paying companies realize that companies cannot reinvest new money at the same rates of return. Investing new funds is important to maintain and grow the business, but unfortunately there are physical limitations to expanding business indefinitely and forever. Due to laws of diminishing returns, once you add in an extra dollar of investment that does not result in much profit, you should be better off doing something else with the money. In other words, if you are Starbucks (SBUX) and you already have four coffeehouses on a busy intersection, chances are the adding a fifth one is not going to result in a 20 – 25% automatic increase in total sales.

3) Because dividend companies are mature enterprises, their growth prospects are not going to be very high. As a result, these stocks are often trading at low price-earnings multiples. This allows investors to purchase these quality companies at a discount, and thus enjoy better compounding of capital. The companies which have very high earnings growth projections often sell at a premium price, which has high earnings growth already baked in to the stock price. The reason why Altria (MO) (which was called Phillip Morris back then) was the best performing stock between 1957 - 2003, was because it grew earnings and dividends while shares were always cheap, and thus shareholders were able to consistently reinvest dividends at low valuations. This turbocharges dividend income and capital growth.

4) While the growth prospects for mature dividend paying stocks are not as high as the prospects for a hot new IPO, they are more dependable. Many of these mature companies tend to deliver a small but consistent growth, which makes them clear winners over time. Many of these stodgy dividend champions tend to sell a similar type of a branded product or service that your parents or grandparents have used and which you and your children would likely use for decades to come. The consistent growth translates into consistent profitability, which coupled with the relative undervaluation when compared to the stock market makes investment a very good idea.

5) The dividends that these companies pay to shareholders represent a return on investment which is always positive. A company can see its stock price rise quickly to new highs or fall precipitously to all-time-lows, leaving investors with rapidly fluctuating capital gains or losses. At the same time however, income investors receiving a dividend would be essentially paid to hold on to the stock of their choice, and would be less likely to panic and sell at the worst time possible. The dividend payment, if sustainable, would thus be a factor that could keep the stock price from losing too much, since value oriented investors would step up and provide support behind the stock by purchasing it at attractive valuations.

6) The dividend payment provides a regular stream of income, which investors could use to either spend or invest in stocks that fit their entry criteria. Dividend reinvestment allows investors to compound their capital over time, through the systematic accumulation of undervalued assets over time using dividend income. This strategy has helped famous value investor Warren Buffett to accumulate a fortune worth over $60 billion. By focusing Berkshire Hathaway’s capital on income producing investments, and then reinvesting excess capital into other income producing assets, Buffett has transformed the sleepy textile company into a diversified conglomerate with a market capitalization of over $200 billion.

The article discusses dividend paying stocks and non-dividend paying stocks in general. While there could be dividend paying stocks which have failed, as well as non-dividend paying stocks which have been wildly successful, this does not change the overall conclusion that dividend paying stocks have historically done better than non-paying ones. The probability that your average blue chip dividend stock provides better returns is much higher than the probability of good returns by your average non-dividend paying stock. In order to further increase your chances of achieving your goals, one also needs to further screen out investments and evaluate the final list of candidates for inclusion one by one.

Full Disclosure: Long KO, PG, MO, PM,

Relevant Articles:

- Another reason for companies to pay dividends

- Why Dividend Growth Stocks Rock?

- What is Dividend Growth Investing?

- Should dividend investors hold non-dividend paying stocks?

- The predictive value of rising dividends

Friday, November 14, 2014

Con Edison (ED) Dividend Growth Analysis

Consolidated Edison, Inc. (ED) is engaged in regulated electric, gas, and steam delivery businesses in the United States. The company, through its subsidiary, Consolidated Edison Company of New York, Inc., provides electric services to approximately 3.4 million customers in New York City and Westchester County; gas to approximately 1.1 million customers in Manhattan, the Bronx, and parts of Queens and Westchester County; and steam to approximately 1,703 customers in parts of Manhattan This dividend champion has paid dividends since 1885 and managed to increase them for 40 years in a row.

The most recent dividend increase was in January 2014, when the Board of Directors approved a 2.40% increase in the quarterly dividend to 63 cents/share.

Over the past decade, this dividend growth stock has delivered an annualized total return of 8.20% to its shareholders. Future returns will be dependent on growth in earnings and dividend yields obtained by shareholders.

The most recent dividend increase was in January 2014, when the Board of Directors approved a 2.40% increase in the quarterly dividend to 63 cents/share.

Over the past decade, this dividend growth stock has delivered an annualized total return of 8.20% to its shareholders. Future returns will be dependent on growth in earnings and dividend yields obtained by shareholders.

Wednesday, November 12, 2014

Successful Dividend Investing Requires Patience

We live in a fast paced world, where we are constantly bombarded by information on something that makes us want to act quickly. Unfortunately, that is not the successful set of skills that you need as a dividend investor. The best dividend investors are those who buy a stock, and then let it quietly compound their income and capital over time. I know that many think they can do it, but in reality, few have the stamina to sit through extended periods of “temporary punishment”. Very often, investors give up on a company after an extended period of below average performance. After that happens, the things revert to the mean and the truly patient shareholders with a long-term vision are rewarded.

Those who got scared easily ended up with emotional scars for life and most probably failed to learn the lesson of what successful dividend investing is all about. The secret sauce is that one needs to select a company that fits their entry criteria, research it both qualitatively and quantitatively, and then let it compound their capital without really worrying too much about quarterly noise and even annual noise. You have to be patient, and not be scared by temporary periods of weak performance. Sometimes things look bleakest right after the tide turns positive. If you try to jump in and out of companies, you are very likely to incur so much in investment expenses, tax expenses and lost opportunity costs, that will result in a very poor investment record. The truly successful dividend investor knows they will have some losers, but that their winners will do so much better on average, that they would still generate an adequate portfolio return over a 20 – 30 year period. It is difficult to say whether a problem that everyone is talking about is a temporary or a long-term one that will result in the demise of the company. This is why I ignore most opinions out there, and keep holding and investing. It is tough to say if a weakness is a random item, or a beginning of a pattern until it is too late. I believe that no one can predict the future, which is why I try to ignore speculation which might or might not turn true. The dividend investor will have nerves of steel in their conviction, and hold on through thick and thin, despite the loud noise out there. The dividends they receive will be used to acquire more shares in the best values at the moment, or spent if they are in the distribution phase of their dividend investor lifecycle. Now, if the dividends are cut or eliminated, that itself signals that the reason the company was able to have a dividend growth streak is probably not valid after all. This is the situation when I sell right away, and ask questions later. Until then, I hold on.

We often hear the story of how someone could have put $1,000 in Johnson& Johnson (JNJ) in 1972, then let dividends compound for decades and ended up with a stake worth approximate $97,500. The reality is that in order to earn that handsome return, the investor would have had to sit through difficult periods that would have tested their conviction time and again. For example, it would have been difficult holding a stock through the 1972 – 1974 correction. It would have also been difficult to hold on to Johnson & Johnson through 1983, when the stock price finally exceeded the all-time-highs. It would have also been difficult to hold on to the stock during the Tylenol recalls in 1982, when you are bombarded by terrible news all the time. For me, it was difficult to hold on to shares of Johnson & Johnson in 2010, when I got bad news about recalls. It is difficult for most investors to hold on to a company where prices have gone nowhere for a decade. I got this response a lot when I first started my site and analyzed companies . As a dividend investor, it is rewarding to get paid for waiting, and receive a higher dividend check every year.

Nowadays, it is tough to hold on to shares of McDonald’s (MCD), as the popular opinion discussed how unhealthy the food is, how the minimum wage will rise to $15/hour, how the millennials are not going there etc. The reality is that same store sales have stagnated, and earnings per share growth has slowed down in the past couple of years. It is yet to be seen whether this is a real trend or just a temporary situation. In addition, McDonald’s is often compared to other chains that are relatively new and therefore have a lower base to grow from. And according to the WSJ, most millennials are still eating there, although the amount going to eat elsewhere is increasing from a smaller base slightly quicker. If you stop by your local McDonald’s, you see people waiting in line, going through the drive through, and eating their lunch in. The company is still unmatched in its scale of operations, and still manages to sell its products to millions of customers around the world. The globally recognizable brand name is still there, the premier locations are still there, and the innovation that resulted in the earnings growth that made 38 years of record dividends possible is still there. It is a given that blue chips stumble from time to time. This was true with McDonald’s in 2002 – 2004. It is true again with it in 2014. If you sold then ( in 2002 - 2004), you missed out on capital gains and dividends that were roughly several times more than the amount you had at risk. I like the fact that I am essentially paid for holding on to my McDonald’s shares, which are attractively valued today. I can and have used those dividends to acquire stakes in other dividend paying companies. This means that if I hold for 20 years, and the dividend increases by just 3% per year, I will likely receive as much money in dividends as I paid for the stock today. Plus, I would still have ownership of McDonald’s (MCD), the results of which can be pretty satisfactory without even considering the dividends. Of course, a 3% annual dividend growth in dividends sounds very low, and I only used it to illustrate the point that shares are offering a good return opportunity today. The lower the shares go, the better the opportunity in my opinion.

It might sound counterintuitive, but companies can provide very good returns to long-term shareholders even if their revenues stagnate. For example, investors in Sears in 1993 did slightly better than the S&P 500 benchmark over the next 20 years. This was due to unlocking value through spin-offs, regular dividend payments, share buybacks, cost cutting and asset sales. McDonald’s (MCD) has a lot of real estate, and a lot of restaurants it can refranchise, thus further increasing the amount of cash it could send the way of shareholders. Imagine how much more dividend income you can receive if McDonald’s spins off its real estate and converts it into a REIT? Even today, if an investor manages to buy the shares at close to a 3.50% - 4% yield, and then earnings and dividends only grow by 4.5% - 5%/year, they should earn a 9% total return. To give you some perspective, the lowest annual dividend growth by McDonald’s was by 4.50% - 5%/year in the late 1990s and early 2000’s. So I am describing again a very conservative scenario from a historical perspective. If that investor reinvests dividends automatically every quarter, their return will be further enhanced if the share price is depressed and thus they earn a higher yield on reinvestment than the above stated one.

Either way, I plan to hold on to my investment in McDonald’s, until management proves me wrong and cuts the dividend. If they freeze the dividend, I would no longer add money to the position (except for my IRA, where it makes sense to automatically reinvest them due to cost/benefit). Furthermore, my downside is protected because McDonald’s has a 2% weight in my diversified dividend portfolio. My largest 40 positions account for 90% of my dividend portfolio value. This helps me sleep well at night even in the highly unlikely scenario that I am wrong. The outcome of this investment will be visible in 2024-2034. Let’s circle back on this article then.

In conclusion, the important thing for investors is to have a strategy for stock selection, and stick to it through thick and thin, while ignoring noise. Investors should also have the patience to hold on to their position as part of a diversified portfolio, in order to let the power of compounding do its magic. Not all dividend investments will work out, but it is tough to say which ones will provide the blockbuster returns in the future. This is why it is a mistake to cut the opportunity for capital gains and dividends too quickly, and disposing of investments.

Full Disclosure: Long MCD, JNJ

Relevant Articles:

- How to define risk in dividend paying stocks?

- Why would I not sell dividend stocks even after a 1000% gain?

- Dividends Offer an Instant Rebate on Your Purchase Price

- Dividend Investing Is Not As Risky As It Is Portrayed Out to Be

- How to become a successful dividend investor

Those who got scared easily ended up with emotional scars for life and most probably failed to learn the lesson of what successful dividend investing is all about. The secret sauce is that one needs to select a company that fits their entry criteria, research it both qualitatively and quantitatively, and then let it compound their capital without really worrying too much about quarterly noise and even annual noise. You have to be patient, and not be scared by temporary periods of weak performance. Sometimes things look bleakest right after the tide turns positive. If you try to jump in and out of companies, you are very likely to incur so much in investment expenses, tax expenses and lost opportunity costs, that will result in a very poor investment record. The truly successful dividend investor knows they will have some losers, but that their winners will do so much better on average, that they would still generate an adequate portfolio return over a 20 – 30 year period. It is difficult to say whether a problem that everyone is talking about is a temporary or a long-term one that will result in the demise of the company. This is why I ignore most opinions out there, and keep holding and investing. It is tough to say if a weakness is a random item, or a beginning of a pattern until it is too late. I believe that no one can predict the future, which is why I try to ignore speculation which might or might not turn true. The dividend investor will have nerves of steel in their conviction, and hold on through thick and thin, despite the loud noise out there. The dividends they receive will be used to acquire more shares in the best values at the moment, or spent if they are in the distribution phase of their dividend investor lifecycle. Now, if the dividends are cut or eliminated, that itself signals that the reason the company was able to have a dividend growth streak is probably not valid after all. This is the situation when I sell right away, and ask questions later. Until then, I hold on.

We often hear the story of how someone could have put $1,000 in Johnson& Johnson (JNJ) in 1972, then let dividends compound for decades and ended up with a stake worth approximate $97,500. The reality is that in order to earn that handsome return, the investor would have had to sit through difficult periods that would have tested their conviction time and again. For example, it would have been difficult holding a stock through the 1972 – 1974 correction. It would have also been difficult to hold on to Johnson & Johnson through 1983, when the stock price finally exceeded the all-time-highs. It would have also been difficult to hold on to the stock during the Tylenol recalls in 1982, when you are bombarded by terrible news all the time. For me, it was difficult to hold on to shares of Johnson & Johnson in 2010, when I got bad news about recalls. It is difficult for most investors to hold on to a company where prices have gone nowhere for a decade. I got this response a lot when I first started my site and analyzed companies . As a dividend investor, it is rewarding to get paid for waiting, and receive a higher dividend check every year.

Nowadays, it is tough to hold on to shares of McDonald’s (MCD), as the popular opinion discussed how unhealthy the food is, how the minimum wage will rise to $15/hour, how the millennials are not going there etc. The reality is that same store sales have stagnated, and earnings per share growth has slowed down in the past couple of years. It is yet to be seen whether this is a real trend or just a temporary situation. In addition, McDonald’s is often compared to other chains that are relatively new and therefore have a lower base to grow from. And according to the WSJ, most millennials are still eating there, although the amount going to eat elsewhere is increasing from a smaller base slightly quicker. If you stop by your local McDonald’s, you see people waiting in line, going through the drive through, and eating their lunch in. The company is still unmatched in its scale of operations, and still manages to sell its products to millions of customers around the world. The globally recognizable brand name is still there, the premier locations are still there, and the innovation that resulted in the earnings growth that made 38 years of record dividends possible is still there. It is a given that blue chips stumble from time to time. This was true with McDonald’s in 2002 – 2004. It is true again with it in 2014. If you sold then ( in 2002 - 2004), you missed out on capital gains and dividends that were roughly several times more than the amount you had at risk. I like the fact that I am essentially paid for holding on to my McDonald’s shares, which are attractively valued today. I can and have used those dividends to acquire stakes in other dividend paying companies. This means that if I hold for 20 years, and the dividend increases by just 3% per year, I will likely receive as much money in dividends as I paid for the stock today. Plus, I would still have ownership of McDonald’s (MCD), the results of which can be pretty satisfactory without even considering the dividends. Of course, a 3% annual dividend growth in dividends sounds very low, and I only used it to illustrate the point that shares are offering a good return opportunity today. The lower the shares go, the better the opportunity in my opinion.

It might sound counterintuitive, but companies can provide very good returns to long-term shareholders even if their revenues stagnate. For example, investors in Sears in 1993 did slightly better than the S&P 500 benchmark over the next 20 years. This was due to unlocking value through spin-offs, regular dividend payments, share buybacks, cost cutting and asset sales. McDonald’s (MCD) has a lot of real estate, and a lot of restaurants it can refranchise, thus further increasing the amount of cash it could send the way of shareholders. Imagine how much more dividend income you can receive if McDonald’s spins off its real estate and converts it into a REIT? Even today, if an investor manages to buy the shares at close to a 3.50% - 4% yield, and then earnings and dividends only grow by 4.5% - 5%/year, they should earn a 9% total return. To give you some perspective, the lowest annual dividend growth by McDonald’s was by 4.50% - 5%/year in the late 1990s and early 2000’s. So I am describing again a very conservative scenario from a historical perspective. If that investor reinvests dividends automatically every quarter, their return will be further enhanced if the share price is depressed and thus they earn a higher yield on reinvestment than the above stated one.