The company's last dividend increase was in March 2014 when the Board of Directors approved an 8.50% increase to 77 cents/share. The company's largest competitors include Airgas (ARG), Praxair (PX) and Air Liquide (AIQUY).

Over the past decade this dividend growth stock has delivered an annualized total return of 12.20% to its shareholders.

The company has managed to deliver 5.70% in annual EPS growth since 2004. Analysts expect Air Products and Chemicals to earn $6.47 per share in 2015 and $7.26 per share in 2016. In comparison Air Products and Chemicals earned $4.59/share in 2014. Earnings per share does look a little lower than usual, due to one-time items.

While European divisions have been operating in a tough environment, Air Products and Chemicals is attempting to streamline operations and manage costs strategically. The company has been shedding unprofitable operations, and focusing on cost cutting initiatives, in order to boost the bottom line.

In order to grow, the company should focus on increasing volumes in the merchant segment, plus executing new projects on time and budged in the tonnage segment, while focusing on plan efficiency improvements. In addition, focusing on major customers in the electronics and performance materials segment, while also introducing new offerings that could increase margins and returns. Other important opportunities include focusing on the pricing and the right mix of productivity and cost reductions, in order to hit profitability and margin goals set for itself.

The company operates under long-term customer supply contracts, particularly in the gases on-site business. These contracts principally have initial contract terms of 15 to 20 years. There are also long-term customer supply contracts associated with the tonnage gases business within the Electronics and Performance Materials segment. These contracts principally have initial terms of 10 to 15 years. Additionally, they company has several customer supply contracts within the Equipment and Energy segment with contract terms that are primarily 5 to 10 years. Under those contracts, the Company has built a facility on land owned by the customer, and is essentially a de-facto monopoly in the specific geographic area for that customer.

Activist investor Bill Ackman has built a 10% stake in the firm, with his goal likely to push management to improve performance. This could be achieved either by passing on cost increases to customers, cutting costs or a combination of both.

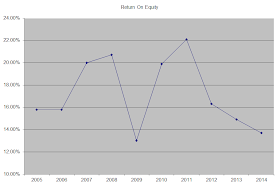

The return on equity has decreased slightly from 15.80% in 2005 to 13.70% in 2014. Rather than focus on absolute values for this indicator, I generally want to see at least a stable return on equity over time.

The annual dividend payment has increased by 11.20% per year over the past decade, which is higher than to the growth in EPS. Given the fact that earnings per share have been largely flat for the past five years, dividend growth has been running on fumes, mostly through the expansion of the dividend payout ratio. Without earnings growth, there is a limit to where dividends can rise. However, without certain one-time items, earnings per share are actually better off. Therefore, I am not worried in the case of Air Products & Chemicals.

An 11% growth in distributions translates into the dividend payment doubling every six and a half years. If we look at historical data, going as far back as 1985 we see that Air Products and Chemicals has managed to double its dividend every seven and a quarter years on average.

The dividend payout ratio increased from 40% in 2005 to 65.80%. This is a direct result of dividend growth exceeding earnings growth. Normally, I do not like seeing dividend payout ratios above 60%. In Air Products & Chemicals case however, I think that the payout is sustainable based on expected earnings in 2015. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

Currently, Air Products and Chemicals is overvalued at 23.60 times earnings, yields 2% and has an adequately covered dividend. I would find the shares more appealing on dips below $123/share, equivalent to an entry yield of 2.50%. I do not plan on adding to this position however, since this is one of the largest holdings in my portfolio. However, I do expect to hold on to this stock.

Full Disclosure: Long APD

Relevant Articles:

- Three Attractive Dividend Paying Companies to Consider

- Twenty Dividend Stocks I Recently Purchased for my 401 (k) Rollover

- Lower Entry Prices Mean Locking Higher Yields Today

- Looking for dividend bargains in an overheated market

- Dividend Investing – Science versus Intuition