Here is the simple answer: live off dividends

Here is the longer answer –when you live off the income that your portfolio produces, the chance that you will ever run out of money is greatly reduced. If you have to sell portions of your portfolio and thus rely on finding someone else to sell at higher prices than you bought, then you have a higher chance of outliving your money.

It is very easy to monetize a pile of cash, and convert it into a neat dividend machine, which will deposit cold hard cash into your brokerage account regularly. You can then use that cash to either spend or to reinvest into more dividend paying stocks, paying even more cash.

As I discussed earlier, there are largely two types of dividend growth investor investors. The first group are those who have been putting money mostly in dividend growth stocks regularly, reinvested dividends, and maintained their portfolios. The second group include those who are trying to convert a nest egg accumulated over a lifetime of hard work, or an inheritance or another pile of cash received recently as a lump-sum. Those are the ones who want to learn how to pensionize their assets, and live off that pile, while also minimizing the risk of loss to the minimum.

I am a long term buy and hold investor who focuses on dividend growth stocks

Dividend Growth Investor Newsletter

▼

Pages

▼

Thursday, August 31, 2017

Monday, August 28, 2017

Altria Delivers Dependable Dividend Growth and High Total Returns

Altria Group, Inc.(MO), through its subsidiaries, manufactures and sells cigarettes, smokeless products, and wine in the United States.

The company recently raised its quarterly dividend by 8.20% to 66 cents/share. Altria has delivered dependable dividend increases for 48 years in a row. Over the past decade, this dividend champion has managed to boost distributions at a rate of over 8%/year.

This dividend growth stock has delivered dependable dividend growth, and exceptional total returns to shareholders for decades. In fact, the company managed to become the best performing stock in the S&P 500 between 1957 and 2003.

Since then, the company spun-off Kraft foods in 2007 and Phillip Morris International in 2008. Kraft foods was further split into two companies in 2013 – Mondelez and Kraft. The latter merged with Heinz to form Kraft Heinz (KHC). An investor who bought Altria in 2003, and held on to all spin-offs, while reinvesting dividends, still managed to do much better than the S&P 500.

The company recently raised its quarterly dividend by 8.20% to 66 cents/share. Altria has delivered dependable dividend increases for 48 years in a row. Over the past decade, this dividend champion has managed to boost distributions at a rate of over 8%/year.

This dividend growth stock has delivered dependable dividend growth, and exceptional total returns to shareholders for decades. In fact, the company managed to become the best performing stock in the S&P 500 between 1957 and 2003.

Since then, the company spun-off Kraft foods in 2007 and Phillip Morris International in 2008. Kraft foods was further split into two companies in 2013 – Mondelez and Kraft. The latter merged with Heinz to form Kraft Heinz (KHC). An investor who bought Altria in 2003, and held on to all spin-offs, while reinvesting dividends, still managed to do much better than the S&P 500.

Thursday, August 24, 2017

Sequence of returns matters in retirement planning

One of the important truths about investing for retirement is that the sequence of returns matters greatly. In order to be successful in retirement, you want your money to outlive you. In order to achieve that, you do not need to identify the best performing investment over the next 20 years.

Rather, your goal should be to identify the investments which can generate reliable and consistent returns on live off. This is why I focus my attention to investments that pay me a reliable dividend which also grow over time. Dividends are always positive, they tend to be more stable than capital gains, and they are more reliable than capital gains. This is why we focus on the reliable dividend income in retirement planning. Share prices and corresponding capital gains or losses on the other hand are almost impossible to forecast. With dividend stocks, the randomness of total returns are smoothed out by dividends.

This is why we focus on living off dividends in retirement. Dividends are more stable and dependable as source of returns than capital gains. The industries that tend to produce the best dividend payers in the world also tend to be more mature and dependable.

I will illustrate the importance of consistent returns with an example.

Imagine that it is the year 1999, and you have $1 million to invest. You want to retire immediately, and enjoy the fruits of your labor. You require $40,000/year in annual expenses for your modest lifestyle. You can only choose between two companies – Amazon.com (AMZN) or Realty Income (O). The only other piece of information you are given is that a $1 million investment in Amazon will be worth $16,698,870 in 2017, while the same investment in Realty Income will be worth $14,455,380. Not a bad return for either investment.

Which investment would you choose, given those constraints?

Rather, your goal should be to identify the investments which can generate reliable and consistent returns on live off. This is why I focus my attention to investments that pay me a reliable dividend which also grow over time. Dividends are always positive, they tend to be more stable than capital gains, and they are more reliable than capital gains. This is why we focus on the reliable dividend income in retirement planning. Share prices and corresponding capital gains or losses on the other hand are almost impossible to forecast. With dividend stocks, the randomness of total returns are smoothed out by dividends.

This is why we focus on living off dividends in retirement. Dividends are more stable and dependable as source of returns than capital gains. The industries that tend to produce the best dividend payers in the world also tend to be more mature and dependable.

I will illustrate the importance of consistent returns with an example.

Imagine that it is the year 1999, and you have $1 million to invest. You want to retire immediately, and enjoy the fruits of your labor. You require $40,000/year in annual expenses for your modest lifestyle. You can only choose between two companies – Amazon.com (AMZN) or Realty Income (O). The only other piece of information you are given is that a $1 million investment in Amazon will be worth $16,698,870 in 2017, while the same investment in Realty Income will be worth $14,455,380. Not a bad return for either investment.

Which investment would you choose, given those constraints?

Monday, August 21, 2017

Five Tips to Avoid Dividend Cuts

This

is a guest post by Brian Bollinger from Simply Safe Dividends.

Brian is a CPA and was an equity research analyst at a multibillion-dollar

investment firm prior to founding Simply Safe Dividends. Simply Safe Dividends is

a one-stop shop for dividend investors, providing online tools, research, and

data designed to help generate safe retirement income from dividend stocks,

while saving you the high fees associated with other financial products and

advisors.

Have you ever held a stock

that eventually cut its dividend?

Or do you worry that a

company you own might have to reduce its dividend in the future?

If so, you aren’t alone.

Most of the dividend

investors I know are focused on building a safe income stream (typically for

retirement) and want to preserve their capital.

Avoiding dividend cuts can

help with both objectives, and in this article I will explore five techniques that

can help identify companies with the best potential of delivering safe, growing

dividends over time.

But first, I want to thank

Dividend Growth Investor for letting me share with you.

His blog has been an

inspiration and a wealth of quality information for dividend investors for

nearly a decade, and it’s an honor to be part of it today.

Let’s take a look at five

of the most important factors you can use to understand the safety of a company’s

dividend and make better informed investment decisions.

Friday, August 18, 2017

An update on my fixed income exposure

A couple of years ago, I shared with you that I am increasing my fixed income allocation by buying individual bonds, CD’s and bond funds. I made some calls stating that I am increasing my fixed income exposure. Well, after an year and a half, I ended up selling most of these fixed income instruments. I got out of them over the past three months or so.

I purchased fixed income, in order to have an allocation to an asset class that would zag when stocks zig. I wanted to be protected in the event of a deflation, which would torpedo economies and business profits. The super low expected returns were the price to pay for that protection. I take diversification seriously.

When I purchased these fixed income instruments, I also had a vague idea that I may be needing that money within the next five years or so. Conventional wisdom is to place money that you will need within five years or so in fixed income. On the other hand, I also wanted to get some diversification away from equities. The results from the past two years show that I achieved diworsification in this portion of my assets.

As I reviewed what I was doing, I realized that these instruments were not generating good expected returns. While diversification is great in theory, I was essentially diversifying my future expected returns away instead. As someone in their early 30s, who will likely end up generating income for most their lives, I have decades ahead of me. So having a 15% - 20% allocation to fixed income is probably too much for me, based on future expected returns. In addition, as I now have ten years of good earnings under my Social Security history, I also can expect to see a decent retirement check several decades from now. That future stream of social security checks is an asset that is part of my long term fixed income exposure.

I purchased fixed income, in order to have an allocation to an asset class that would zag when stocks zig. I wanted to be protected in the event of a deflation, which would torpedo economies and business profits. The super low expected returns were the price to pay for that protection. I take diversification seriously.

When I purchased these fixed income instruments, I also had a vague idea that I may be needing that money within the next five years or so. Conventional wisdom is to place money that you will need within five years or so in fixed income. On the other hand, I also wanted to get some diversification away from equities. The results from the past two years show that I achieved diworsification in this portion of my assets.

As I reviewed what I was doing, I realized that these instruments were not generating good expected returns. While diversification is great in theory, I was essentially diversifying my future expected returns away instead. As someone in their early 30s, who will likely end up generating income for most their lives, I have decades ahead of me. So having a 15% - 20% allocation to fixed income is probably too much for me, based on future expected returns. In addition, as I now have ten years of good earnings under my Social Security history, I also can expect to see a decent retirement check several decades from now. That future stream of social security checks is an asset that is part of my long term fixed income exposure.

Wednesday, August 16, 2017

The Blueprint for Successful Dividend Investing

This is a guest post by Nick McCullum from Sure Dividend. Sure Dividend uses The 8 Rules of Dividend Investing to systematically identify and rank high-quality dividend growth stocks suitable for long-term investment.

Dividend growth investing is one of the most straightforward and powerful ways to build long-

term wealth. It can also seem highly complicated to those without experience in this investment strategy.

Fortunately, one of the best things about dividend growth investing is its ease of implementation. This makes it well-suited for a wide variety of investors.

Additionally, dividend growth investing stands the test of time. This investment strategy has been studied/written about since at least 1934, when Security Analysis (arguably the most famous book on investing) was published:

“The prime purpose of a business corporation is to pay dividends regularly and, presumably, to increase the rate as time goes on.”

– Benjamin Graham in Security Analysis

– Benjamin Graham in Security Analysis

Clearly, something is special about dividend growth investing.

With that in mind, this article will describe four easy-to-understand principles that form the blueprint for successful dividend growth investing.

Invest in Consistent Dividend Growers

Monday, August 14, 2017

Tanger Factory Outlets (SKT) Dividend Stock Analysis

Tanger Factory Outlet Centers, Inc. (SKT) is an owner and operator of outlet centers in the United States and Canada. This REIT which focuses on developing, acquiring, owning, operating and managing outlet shopping centers. As of December 31, 2016, its portfolio consisted of 36 outlet centers, which contained over 2,600 stores representing approximately 400 store brands. Tanger Factory Outlet Centers is a dividend achiever, which has rewarded shareholders with a raise for 24 years in a row.

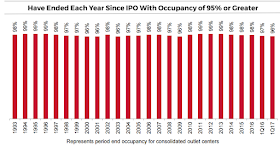

Tanger has maintained a high occupancy rate over the past 20 years. The rate usually dips to 96% during a recession, and then bounces back to 98% - 99%, before going down during the next recession. Currently, Tanger has a low occupancy rate, as if we are in a recession.

You can see Tanger's largest tenants listed below. Most of those are branded companies, which sell merchandise such as apparel (clothes) to the masses. I do believe that these tenants could face more pressure than those for Realty Income and National Retail Properties. This is where I could conclude that perhaps Tanger is slightly riskier than Realty Income and National Retail Properties. That being said, I believe that each of those retailers has a chance of implementing a dual online/brick and mortar strategy for accommodating customers. Having some brand equity associated with specialty merchandise and exceptional quality, can also be a plus. Another plus is having a type of merchandise that is unique to the customer. For example, purchasing shoes or clothes requires the need for some physical trial and error, until you find the one that fits right. Buying certain items like shoes online could be trickier, because it may create extra hassle of mailing things back if they are not as advertised. The other nice thing to consider is that the properties are easy to reconfigure in order to accommodate new tenants.

Tanger has maintained a high occupancy rate over the past 20 years. The rate usually dips to 96% during a recession, and then bounces back to 98% - 99%, before going down during the next recession. Currently, Tanger has a low occupancy rate, as if we are in a recession.

You can see Tanger's largest tenants listed below. Most of those are branded companies, which sell merchandise such as apparel (clothes) to the masses. I do believe that these tenants could face more pressure than those for Realty Income and National Retail Properties. This is where I could conclude that perhaps Tanger is slightly riskier than Realty Income and National Retail Properties. That being said, I believe that each of those retailers has a chance of implementing a dual online/brick and mortar strategy for accommodating customers. Having some brand equity associated with specialty merchandise and exceptional quality, can also be a plus. Another plus is having a type of merchandise that is unique to the customer. For example, purchasing shoes or clothes requires the need for some physical trial and error, until you find the one that fits right. Buying certain items like shoes online could be trickier, because it may create extra hassle of mailing things back if they are not as advertised. The other nice thing to consider is that the properties are easy to reconfigure in order to accommodate new tenants.

Thursday, August 10, 2017

Dividend Growth Investing Promotes Long-Term Thinking

Dividend growth investing encourages long term buy and hold investing. With dividend growth investing you buy a company with a rising dividend at the right price, and you then hold on to it for as long as the dividend is at least maintained. You ignore all the noise out there, and keep holding.

If you keep your emotions in check, you may find yourself holding companies for decades to come, while enjoying rising dividend income. This passive approach keeps investment costs low, which means that you get to keep your fair share of investment returns. It is easier to practice dividend investing through the difficult times, because you are getting paid to hold the worlds best quality companies.

With dividend growth investing, all we do is buy future income streams. With every $1,000 that I invest, I end up generating $30 - $40 in annual dividend income. This income can be used to pay for my expenses in retirement. If I earned $20/hour, I am essentially buying back 1.5 - 2 hours of freedom with every $1,000 invested. The goal is after several years of saving and investing, to replace your paycheck with the dividend income from your portfolio.

For example, if you invest $1,000 in Altria (MO) today, you will earn an annual dividend of $37/year. This sounds like a small amount of money that many will laugh at you for. But you should not despise the days of small beginnings. As the company earns more, it will pay more dividends. If earnings per share double over the next decade, and dividends follow along, your stake will be earning $74/year ( without factoring in dividend reinvestment). As you save more money, you can buy more shares in other companies. Perhaps you will add $1,000 in Tanger Factory Outlets (SKT), which will add $52 to your annual dividend income. You may also keep adding stakes in more promising dividend growth companies at attractive valuations that you stumble upon on your journey. They will generate more dividend income for you over time.

If you keep your emotions in check, you may find yourself holding companies for decades to come, while enjoying rising dividend income. This passive approach keeps investment costs low, which means that you get to keep your fair share of investment returns. It is easier to practice dividend investing through the difficult times, because you are getting paid to hold the worlds best quality companies.

With dividend growth investing, all we do is buy future income streams. With every $1,000 that I invest, I end up generating $30 - $40 in annual dividend income. This income can be used to pay for my expenses in retirement. If I earned $20/hour, I am essentially buying back 1.5 - 2 hours of freedom with every $1,000 invested. The goal is after several years of saving and investing, to replace your paycheck with the dividend income from your portfolio.

For example, if you invest $1,000 in Altria (MO) today, you will earn an annual dividend of $37/year. This sounds like a small amount of money that many will laugh at you for. But you should not despise the days of small beginnings. As the company earns more, it will pay more dividends. If earnings per share double over the next decade, and dividends follow along, your stake will be earning $74/year ( without factoring in dividend reinvestment). As you save more money, you can buy more shares in other companies. Perhaps you will add $1,000 in Tanger Factory Outlets (SKT), which will add $52 to your annual dividend income. You may also keep adding stakes in more promising dividend growth companies at attractive valuations that you stumble upon on your journey. They will generate more dividend income for you over time.

Monday, August 7, 2017

Ten Companies Rewarding Shareholders With Regular Dividend Increases

As part of my monitoring process, I review the list of dividend increases regularly. This helps me to monitor the performance of companies I own. It also helps me to identify promising companies for further research.

I typically focus on companies that have raised dividends for at least a decade. I rarely violate this principle, but when I do, I have found out to have mixed success.

I also evaluate trends in earnings, dividends and look at valuations in order to determine whether a company is worth researching further today. In general, dividend growth investors want to acquire shares in a quality company with a long record of annual dividend growth, which also sells at an attractive valuation. The goal is to invest in such a company that can grow earnings over time. This provides the fuel behind future dividend increases, which pay for expenses in retirement.

Over the past couple of weeks, there were several notable companies raising dividends to shareholders. The companies include:

I typically focus on companies that have raised dividends for at least a decade. I rarely violate this principle, but when I do, I have found out to have mixed success.

I also evaluate trends in earnings, dividends and look at valuations in order to determine whether a company is worth researching further today. In general, dividend growth investors want to acquire shares in a quality company with a long record of annual dividend growth, which also sells at an attractive valuation. The goal is to invest in such a company that can grow earnings over time. This provides the fuel behind future dividend increases, which pay for expenses in retirement.

Over the past couple of weeks, there were several notable companies raising dividends to shareholders. The companies include:

Thursday, August 3, 2017

Why I Use Dividend Growth Investing to Get Wealthy

Mark Seed is passionate about personal finance and investing and is the blogger behind My Own Advisor. Mark is currently investing in dividend paying stocks on his journey to financial freedom. He is almost halfway to his goal of earning $30,000 per year in tax-free and tax-efficient dividend income for an early retirement. You can follow Mark on his path to financial freedom here.

I wasn’t always a dividend growth investor. In fact, for a good part of my 20s, I wasn’t much of an investor at all. As a young Canadian kid fresh out of university having secured my first full-time (real) job at a major pharmaceutical company, I didn’t think very much about my financial future. Sure, I knew enough to “pay myself first” (and I did) to the tune of about $50 per month in my registered investment account, similar to a 401(k), but I was focused on living for today. And who isn’t for the most part in their 20s – you only live once right?

I wasn’t always a dividend growth investor. In fact, for a good part of my 20s, I wasn’t much of an investor at all. As a young Canadian kid fresh out of university having secured my first full-time (real) job at a major pharmaceutical company, I didn’t think very much about my financial future. Sure, I knew enough to “pay myself first” (and I did) to the tune of about $50 per month in my registered investment account, similar to a 401(k), but I was focused on living for today. And who isn’t for the most part in their 20s – you only live once right?

The reality check

As you get older in life, you realize more and more you don’t know what you don’t know. You also figure out when it comes to investing in particular, by owning some pricey mutual fund investments, you’re paying steep money management fees for products that have no chance to outperform the market over time. You also learn the fees paid in money management fees is money you’ll never see again. It’s a massive double-whammy that occurs in Canada, and the United States, and pretty much anywhere around the world. This is part of the reality check that led me to dividend growth investing.