I review dividend increases every week as part of my monitoring process. I usually focus on the companies with at least a ten year streak of annual dividend increases. This is then followed by a brief overview of each company, followed by a decision to do a more detailed research on the company or pass on it for whatever reason (valuation or fundamentals).

After reviewing the dividend increases over the past year, it looks like the past week had the most dividend increases so far in 2018. Those increased dividend incomes should definitely work well for dividend investors pocketbooks this Thanksgiving.

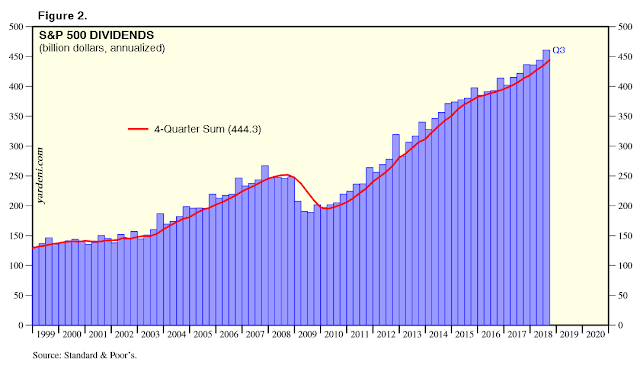

Overall, companies in the US are flush with cash and distributing record dividend amounts as well. This is evidenced by the record amounts of dividends paid by companies in the S&P 500:

The companies raising dividends over the past week include:

Brown-Forman Corporation (BF.B) manufactures, bottles, imports, exports, markets, and sells various alcoholic beverages worldwide. It provides spirits, wines, ready-to-drink cocktails, whiskeys, vodkas, tequilas, champagnes, brandy, and liqueurs. The company raised its quarterly dividend by 5.10% to 16.60 cents/share. This marked the 35th year of dividend increases for this dividend champion. Over the past decade, it has managed to boost dividends at an annual rate of 8.50%/year.

The company grew its earnings from $0.76/share in 2008 to $1.48/share in 2018. Analysts expect earnings of $1.71/share in 2019. The stock is overvalued at 28.40 times forward earnings and yields 1.40%. I would be interested in adding to my position in Brown-Forman on dips below $34/share.

Sysco Corporation (SYY), through its subsidiaries, markets and distributes a range of food and related products primarily to the foodservice or food-away-from-home industry. It operates through three segments: U.S. Foodservice Operations, International Foodservice Operations, and SYGMA. The company raised its quarterly dividend by 8.30% to 39 cents/share. This marked the 49th year of dividend increases for this dividend champion. Over the past decade, it has managed to boost dividends at an annual rate of 5.70%/year.

The company grew its earnings from $1.81/share in 2008 to $2.70/share in 2018. Analysts expect earnings of $3.40/share in 2019.

The stock looks fairly valued at 19.50 times forward earnings and yields 2.30%. I may have to add the stock to my list for further research.

MDU Resources Group, Inc. (MDU) engages in regulated energy delivery, and construction materials and services businesses in the United States. The company operates through five segments: Electric, Natural Gas Distribution, Pipeline and Midstream, Construction Materials and Contracting, and Construction Services. The company raised its quarterly dividend by 2.50% to 20.25 cents/share. This marked the 28h year of dividend increases for this dividend champion. MDU Resources Group has managed to boost dividends at an annual rate of 3.40%/year during the past decade.

MDU Resources earnings declined from $2.36/share in 2007 to $1.43/share in 2017. Analysts expect earnings of $1.39/share in 2019.

The stock yields 18.90 times forward earnings and yields 3.10%. Given the lack of earnings growth, I will take a pass on the stock today.

Matthews International Corporation (MATW) provides brand solutions, memorialization products, and industrial products in the United States, Central and South America, Canada, Europe, Australia, and Asia. It operates through three segments: SGK Brand Solutions, Memorialization, and Industrial Technologies.

The company raised its quarterly dividend by 5.30% to 20 cents/share. This marked the 24h year of dividend increases for this dividend achiever. Matthews International has managed to boost dividends at an annual rate of 12%/year during the past decade.

The company grew its earnings from $2.07/share in 2007 to $3.37/share in 2018. Analysts expect earnings of $4.18/share in 2019. The stock is cheap at 10.40 times forward earnings and yields 1.80%. I would add it to my list for further research.

National Bankshares, Inc. (NKSH) operates as the bank holding company for the National Bank of Blacksburg that provides retail and commercial banking services to individuals, businesses, non-profits, and local governments. The bank raised its semi-annual dividend to 63 cents/share. This was a 3.30% increase over the semi-annual dividend paid in the second half of 2017. National Bankshares is a dividend achiever with a 19 year history of annual dividend hikes. Over the past decade, this dividend achiever has managed to boost distributions at an annual rate of 4.40%/year. The company grew its earnings from $1.82/share in 2007 to $2.03/share in 2017. Analysts expect earnings of $2.55/share in 2018. The stock is selling at 17.30 times forward earnings and yields 2.70%. Given the slow rate of earnings growth over the past decade, as well as the decrease in earnings in every single year over the past decade, I will give the company a pass at this time.

NIKE, Inc. (NKE), together with its subsidiaries, designs, develops, markets, and sells athletic footwear, apparel, equipment, and accessories worldwide. The company offers NIKE brand products in six categories: running, NIKE basketball, the Jordan brand, football, training, and sportswear. Nike raised its quarterly dividend by 10% to 22 cents/share. This marked the 17th consecutive annual dividend increase for this dividend achiever. Nike has managed to boost its dividend at an annual rate of 13.90%/year over the past decade.

The company grew its earnings from $0.94/share in 2008 to an estimated $2.65/share in 2019. Nike earned $2.42/share in 2018 (this amount was adjusted by the $1.25 one-time impact to earnings from the new tax laws signed at the end of 2017).

Nike is overvalued at 28.20 times forward earnings and yields 1.20%. It may be worth a second look on dips below $53/share.

Spire Inc. (SR), through its subsidiaries, engages in the purchase, retail distribution, and sale of natural gas to residential, commercial, industrial, and other end-users of natural gas customers in the United States. It operates through two segments, Gas Utility and Gas Marketing. The company raised its quarterly dividends by 5.30% to 59.25 cents/share. This marked the 16th consecutive annual dividend increase for this dividend achiever. Over the past decade, Spire has managed to boost dividends at an annual rate of 3.70%/year.

The company grew its earnings from $2.31/share in 2007 to $4.33/share in 2017. Analysts expect earnings of $3.70/share in 2018.

The stock is overvalued at 21.30 times forward earnings and yields 3%. It may be worth researching on dips below $74/share.

American Equity Investment Life Holding Company (AEL), through its subsidiaries, provides life insurance products and services in the United States. The company issues fixed index and rate annuities; and single premium immediate annuities, as well as life insurance products. The company raised its quarterly dividends by 7.70% to 28 cents/share. Over the past decade, the stock has raised its dividends at an annual rate of 15.80%/year.

The company grew its earnings from $0.50/share in 2007 to $1.93/share in 2017. Analysts expect earnings of $4.58/share in 2018. The stock seems cheap at 7.50 times forward earnings and yields 3.30%.

Royal Gold, Inc. (RGLD), together with its subsidiaries, acquires and manages precious metal streams, royalties, and related interests. It focuses on acquiring stream and royalty interests or to finance projects that are in production or in development stage in exchange for stream or royalty interests, which primarily consists of gold, silver, copper, nickel, zinc, lead, cobalt, and molybdenum. The company raised its quarterly dividend by 6% to 26.60 cents/share. This marked the 18th year of annual dividend increases for Royal Gold. Over the past decade, it has managed to grow dividends at an annual rate of 14%. The company grew its earnings from $0.79/share in 2007 to an estimated $1.65/share in 2019.

The stock is overvalued at 46.10 times forward earnings and yields 1.40%. I would give the stock a pass at this time.

Lancaster Colony Corporation (LANC) manufactures and markets specialty food products for the retail and foodservice markets in the United States. The company operates through two segments, Retail and Foodservice. Lancaster Colony raised its quarterly dividend by 8.30% to 65 cents/share. This marked the 56th consecutive annual dividend increase for this dividend king. Over the past decade, it has managed to boost dividends at an annual rate of 7.50%/year.

The company grew its earnings from $1.28/share in 2008 to $4.92/share in 2018. Analysts expect earnings of $5.45/share in 2019.

The stock is overvalued at 33.50 times forward earnings and yields 1.40%. I do like the grow trajectory in earnings, but would need a better entry valuation before researching this company further. I will take another look at Lancaster Colony if it dips below $109/share.

Acme United Corporation (ACU), together with its subsidiaries, supplies cutting, measuring, first aid, and sharpening products to the school, home, office, hardware, sporting good, and industrial markets in the United States, Canada, Europe, and Asia. Acme United raised its quarterly dividend by 9.10% to 12 cents/share. This marked the 15th consecutive annual dividend increase for this dividend achiever. Over the past decade, this company has managed to grow its dividends at a rate of 10.80%/year.

The company grew its earnings from $1.09/share in 2007 to $1.42/share in 2017. Analysts expect earnings of $1.30 /share in 2018.

The stock is cheap at 11.80 times forward earning and it yields 3.10%. Given the slow rate of earnings growth however, the valuation multiple seems justified. I believe that future dividend growth through 2028 will probably be half of the dividend growth from the past decade.

Roper Technologies, Inc. (ROP) designs and develops software, and engineered products and solutions. It operates in four segments: RF Technology; Medical & Scientific Imaging; Industrial Technology; and Energy Systems & Controls. The company raised its quarterly dividend by 12.10% to 46.25 cents/share. This marked the 26th consecutive annual dividend increase for this dividend champion. Over the past decade, it has managed to boost dividends at an annual rate of 18.30%/year.

The company grew its earnings from $2.68/share in 2007 to $7.31/share in 2017. The 2017 results are adjusted to exclude a one-time net gain of $2.08/share resulting from the Tax Cuts and Jobs Act. Analysts expect earnings of $11.72 /share in 2018. The stock is overvalued at 25.80 times forward earnings. Roper Technologies yields a low 0.60% today as well. However, I do like the growth trajectory in earnings in the past. I would be interested in Roper Technologies on dips below $234/share.

Tennant Company (TNC) designs, manufactures, and markets floor cleaning equipment. The company raised its quarterly dividend by 4.80% to 22 cents/share. This marked the 47th consecutive annual dividend increase for this dividend champion. Over the past decade, Tennant has managed to boost dividends by 5.80%/year. If Tennant had not raised dividends this year, it would have lost its streak of dividend increases.

The company grew its earnings from $2.08/share in 2007 to an estimated $2.11/share in 2018. Given the lack of earnings growth over the past decade, and the valuation at 28.50 times forward earnings today, I will give the stock a pass today.

Assurant, Inc. (AIZ), through its subsidiaries, provides risk management solutions for housing and lifestyle markets in North America, Latin America, Europe, and the Asia Pacific. The company operates through three segments: Global Housing, Global Lifestyle, and Global Preneed. Assurant raised its quarterly dividend by 7.10% to 60 cents/share. This marked the 15th consecutive annual dividend increase for this dividend achiever. Over the past decade, this company has been able to increase dividends at an annual rate of 16.70%/year.

The company grew its earnings from $5.38/share in 2007 to $9.39/share in 2017. Analysts expect earnings of $6.08 /share in 2018. The stock looks attractively valued at 16.50 times forward earnings and yields 2.40%. I do not like the fact that earnings per share are volatile, although this is pretty normal for insurers. Rising interest rates are typically good for insurers however, because their fixed income investments can generate more yield and thus more profits.

DTE Energy Company (DTE), together with its subsidiaries, operates as an electric and natural gas utility company in Michigan. The company raised its quarterly dividend by 7.10% to 94.50 cents/share. This marked the 10th consecutive year of dividend increase for this newly minted dividend achiever. Over the past decade, this utility company has managed to compound dividends at an annual rate of 4.50%/year.

The company grew its earnings from $3.34/share in 2008 to $6.32/share in 2017. Analysts expect earnings of $6.29/share in 2018. DTE Energy sells at 18.90 times forward earnings and yields 3.20%. While I personally find 19 times forward earnings to be a high multiple for a utility company, I like the growth in earnings, which is why I will put this stock on my list for further research.

Relevant Articles:

- How to invest in dividend stocks

- How to select dividend stocks?

- The Future for Dividend Investors

- Ten Dividend Stocks Beating Inflation

Popular Posts

-

Realty Income (O) stock reached an all-time-high of $82.29/share in February 2020, or about five years ago. Today, the stock is selling at $...

-

I review the list of dividend increases every week as part of my monitoring process. Dividend increases provide signaling value to me in my ...

-

I review the list of dividend increases every week, as part of my monitoring process. This exercise helps me monitor existing positions. I a...

-

I am a big fan of diversification. That doesn't just mean owning a lot of companies however. It means spreading the risk. You need to un...

-

I review the list of dividend increases every week as part of my monitoring process. Dividend increases provide signaling value to me in my ...

-

I tend to focus my attention on companies that regularly increase dividends to shareholders . A long history of annual dividend increases is...

-

I came upon an interesting story about another dividend investor, this time a famous actor. This is Sean William Scott, who starred in such ...

-

I was reviewing my old files and re-visited an interesting paper from Standard & Poor's from a few years ago about the importance of...

-

The past few months have been difficult for many investors. Stocks are down from their all time highs, reached just a few months ago. It is ...

-

As a shareholder, there are two ways to make profits from a stock. The first way is when you sell your stock for a gain, after it has incre...