I wanted to share a nice collection of articles, written by Peter Lynch for Worth Magazine in the 1990's. Peter Lynch is probably one of the best-known stock pickers of our time and certainly among the most successful. He was portfolio manager of Fidelity Investments' Magellan Fund for 13 years, starting out in 1977 with $20 million in assets and winding up his tenure in 1990, with more than 1 million shareholders and assets in excess of $14 billion. During that period, Lynch delivered an average annual return of just over 29 percent.

Lynch has served as executive vice president and director of Fidelity Management & Research Company and managing director of FMR Corp. He has also written three bestselling books on investing: "One Up on Wall Street," "Beating the Street," and his latest, "Learn to Earn: A Beginner's Guide to the Basics of Investing and Business,"

I wanted to share these articles with you. I believe that most investors are not even aware that they exist. I believe these articles could be a good addition to your knowledge base, if you have read the author's books. The articles provide a more real-time view of his investing thought process, as he was doing it, and without the benefit of hindsight.

You can download the articles in a PDF format by clicking on this link here: Peter Lynch Articles For Worth Magazine

As I mentioned, I found them online, so I am linking to the source. However, that link may be taken down at any moment.

Relevant Articles:

- Buffett Partnership Letters

- These Books Shaped My Investing Strategy

- Dividend Achievers Offer Income Growth and Capital Appreciation

- Best Dividend Investing Articles for 2013

Sunday, May 31, 2020

Monday, May 25, 2020

Five Dividend Growth Stocks Raising Shareholder Distributions

I review the list of dividend increases every week, as part of my review process. I focus my attention on companies that raised dividends in the current week, and have at least a ten-year track record of annual dividend increases.

Only a company with a strong cash flow generating business can afford to grow dividends for a long period of time. Therefore, a business growing dividends for at least a decade is worth looking at for further research.

There were five companies that fit the criteria. You can view the five companies in the table below:

You can also read a little more about these companies in my summary below. I also included some information below on Ross Stores (ROST), which suspended dividends last week.

Flowers Foods, Inc. (FLO) produces and markets packaged bakery products in the United States.

The company raised its quarterly dividend by 5.30% to 20 cents/share. This marked the 19th consecutive annual dividend increase for this dividend achiever. During the past decade, the company has managed to increase dividends at an annualized rate of 9.60%.

The company is expected to earn $1.06/share in 2020. The company earned $0.66/share in 2010.

Right now the stock is selling for 21.60 times forward earnings and yields 3.50%.

The Clorox Company (CLX) manufactures and markets consumer and professional products worldwide. It operates through four segments: Cleaning, Household, Lifestyle, and International.

Clorox increased quarterly dividends by 4.70% to $1.11/share. This marked the 43rd consecutive year of annual dividend increased for this dividend champion. During the past decade, Clorox has managed to increase dividends at an annualized rate of 7.70%.

The company is expected to earn $6.60/share in 2020. The company earned $4.24/share in 2010.

Right now the stock sells for 30 times forward earnings and yields 2.25%.

Northrop Grumman Corporation (NOC) operates as a security company. The company operates through Aeronautics Systems, Defense Systems, Mission Systems, and Space Systems segments.

Northrop Grumman hiked its quarterly dividend by 9.85% to 1.45/share. This marked the 17th consecutive annual dividend increase for this dividend achiever. Over the past decade, the company has managed to increase dividends at an annualized rate of 13%.

Northrop Grumman is expected to earn $22.57/share in 2020. The company earned $6.82/share in 2010.

The stock sells for 14.45 times forward earnings and yields 1.80%.

Medtronic plc (MDT) develops, manufactures, distributes, and sells device-based medical therapies to hospitals, physicians, clinicians, and patients worldwide. It operates in four segments: Cardiac and Vascular Group, Minimally Invasive Therapies Group, Restorative Therapies Group, and Diabetes Group.

Medtronic increased its quarterly dividend by 7.40% to 58 cents/share, marking the 43rd consecutive annual dividend increase for this dividend champion. Medtronic has managed to increase dividends at an annualized rate of 10.20% during the past decade.

Medtronic is expected to earn $5.14/share in 2020. The company earned $2.79/share in 2010.

The stock sells for 18.40 times forward earnings and yields 2.45%.

Chubb Limited (CB) provides insurance and reinsurance products worldwide.

The company raised its quarterly dividend by 4% to 78 cents/share. This even marked the 27th consecutive annual dividend increase for this dividend champion. Chubb has managed to grow dividends at an annualized rate of 9.90% during the past decade.

The company is expected to earn $9.64/share in 2020. The company earned $9.11/share in 2010.

The stock sells for 12.15 times forward earnings and yields 2.70%.

Last week, I also had a dividend suspension from Ross Stores (ROST). The company followed the lead of TJX Companies (TJX) and is conserving cash in this environment. At least Ross Stores did a press release, and did not bury the dividend suspension in their quarterly report. Ross Stores just joined the dividend aristocrats index in early 2020, so this is a disappointment. They have to wait until 2046 before they will be eligible to join again.

Relevant Articles:

- Seven Dividend Growth Stocks Rewarding Shareholders With Raises

- Dividend Increases Outpace Dividend Cuts in 2020

- Four Dividend Growth Stocks Rewarding Shareholders With A Raise

- Disney's Dividend Suspension Increased My Dividend Income

- Two Dividend Growth Stocks Rewarding Shareholders With A Raise

Only a company with a strong cash flow generating business can afford to grow dividends for a long period of time. Therefore, a business growing dividends for at least a decade is worth looking at for further research.

There were five companies that fit the criteria. You can view the five companies in the table below:

You can also read a little more about these companies in my summary below. I also included some information below on Ross Stores (ROST), which suspended dividends last week.

Flowers Foods, Inc. (FLO) produces and markets packaged bakery products in the United States.

The company raised its quarterly dividend by 5.30% to 20 cents/share. This marked the 19th consecutive annual dividend increase for this dividend achiever. During the past decade, the company has managed to increase dividends at an annualized rate of 9.60%.

The company is expected to earn $1.06/share in 2020. The company earned $0.66/share in 2010.

Right now the stock is selling for 21.60 times forward earnings and yields 3.50%.

The Clorox Company (CLX) manufactures and markets consumer and professional products worldwide. It operates through four segments: Cleaning, Household, Lifestyle, and International.

Clorox increased quarterly dividends by 4.70% to $1.11/share. This marked the 43rd consecutive year of annual dividend increased for this dividend champion. During the past decade, Clorox has managed to increase dividends at an annualized rate of 7.70%.

The company is expected to earn $6.60/share in 2020. The company earned $4.24/share in 2010.

Right now the stock sells for 30 times forward earnings and yields 2.25%.

Northrop Grumman Corporation (NOC) operates as a security company. The company operates through Aeronautics Systems, Defense Systems, Mission Systems, and Space Systems segments.

Northrop Grumman hiked its quarterly dividend by 9.85% to 1.45/share. This marked the 17th consecutive annual dividend increase for this dividend achiever. Over the past decade, the company has managed to increase dividends at an annualized rate of 13%.

Northrop Grumman is expected to earn $22.57/share in 2020. The company earned $6.82/share in 2010.

The stock sells for 14.45 times forward earnings and yields 1.80%.

Medtronic plc (MDT) develops, manufactures, distributes, and sells device-based medical therapies to hospitals, physicians, clinicians, and patients worldwide. It operates in four segments: Cardiac and Vascular Group, Minimally Invasive Therapies Group, Restorative Therapies Group, and Diabetes Group.

Medtronic increased its quarterly dividend by 7.40% to 58 cents/share, marking the 43rd consecutive annual dividend increase for this dividend champion. Medtronic has managed to increase dividends at an annualized rate of 10.20% during the past decade.

Medtronic is expected to earn $5.14/share in 2020. The company earned $2.79/share in 2010.

The stock sells for 18.40 times forward earnings and yields 2.45%.

Chubb Limited (CB) provides insurance and reinsurance products worldwide.

The company raised its quarterly dividend by 4% to 78 cents/share. This even marked the 27th consecutive annual dividend increase for this dividend champion. Chubb has managed to grow dividends at an annualized rate of 9.90% during the past decade.

The company is expected to earn $9.64/share in 2020. The company earned $9.11/share in 2010.

The stock sells for 12.15 times forward earnings and yields 2.70%.

Last week, I also had a dividend suspension from Ross Stores (ROST). The company followed the lead of TJX Companies (TJX) and is conserving cash in this environment. At least Ross Stores did a press release, and did not bury the dividend suspension in their quarterly report. Ross Stores just joined the dividend aristocrats index in early 2020, so this is a disappointment. They have to wait until 2046 before they will be eligible to join again.

Relevant Articles:

- Seven Dividend Growth Stocks Rewarding Shareholders With Raises

- Dividend Increases Outpace Dividend Cuts in 2020

- Four Dividend Growth Stocks Rewarding Shareholders With A Raise

- Disney's Dividend Suspension Increased My Dividend Income

- Two Dividend Growth Stocks Rewarding Shareholders With A Raise

Wednesday, May 20, 2020

Disney's Dividend Suspension Increased My Dividend Income

Earlier this month, Walt Disney (DIS) suspended dividends for the first half of 2020. The company had just become a dividend achiever and had a ten year history of annual dividend increases under its belt. I viewed it as a great brand, with a strong moat and as a buy and hold forever type of a company.

However, I also have a strategy that helps me avoid big mistakes and manage risk. In order to avoid falling in love with a company whose best days may be behind it, I sell after a dividend cut or a suspension. I buy a stock with the intent of seeing it prosper, earning more income, growing to be more valuable and sharing a higher dividend with me over time. Only companies that have stood the test of time manage to even establish a lengthy track record of annual dividend increases through the ups and downs of several economic cycles. When management teams with a track record of dividend increases cut dividends, this tells me that something is different and I admit that I was wrong. I can always go back and initiate a position if a dividend is initiated and increased later.

After selling the stock, I realized that I am going to miss out on an annual income of $1.76 for each share that I owned.

All is not lost however. Just because a stock I own stopped paying dividends or reduced them, that doesn't mean I am not going to earn dividend income from that investment. I can always sell ( which I do after a dividend cut or a dividend suspension).

In my case, I managed to get a decent amount of money for my Disney stock, after I sold it.

I like to keep my money invested, because I believe that time in the market beats timing the market. I looked around and wanted to find a company that is in a similar part of the economy, in order to maintain sector allocations. I was able to redeploy the funds into Comcast. I informed the subscribers to my newsletter about this switch. I also added a sprinkle of Verizon and AT&T to juice things up a little.

For every share of Disney that I sold, I bought 2 shares of Comcast and 1/3 share of AT&T and 1/3 share of Verizon.

Let's do a few calculations to illustrate the point I am making.

Imagine that I owned 90 shares of Disney before the dividend cut.

By selling my shares of Disney, I lost annual future dividend income of $1.76/share for a total of $158.40. Well, I lost that future dividend income, because Disney suspended dividends. But in reality, I was expecting that much in annual dividend income from my Disney position, before the suspension.

By buying shares in Comcast, I added $0.92/share to my annual dividend income. 180 shares of Comcast generate a dividend income of $165.60/year.

Verizon pays $2.46/share in annual dividend income, while AT&T pays $2.08/share. Owning 30 shares of Verizon and 30 shares of AT&T results in an annual dividend income of $136.20/year.

If you add $165.60/year to $136.20/year you end up with $301.80/year.

In essence, I doubled my dividend income by selling Disney.

However, I do not like it when I grow my dividend income by selling a lower yielding stock, and replacing it with a higher yielding ones.

First, the risk is that the companies I bought end up not growing their dividend income, or even cutting it. Disney may turn out to have had a temporary issue, and comes roaring back. Or it turns out Disney ends up becoming the next Netflix. If I sold one stock to buy another, I may increase my income, but my total returns could be lower than simply staying put.

Second, the issue is that no two companies are the same. Therefore, getting into the habit of selling one company to buy another may turn the portfolio into a riskier and more concentrated one. We do not want to affect the risk profile of the portfolio, nor do we want to potentially end up overweighting or underweighting sectors ( if this were to happen). Speaking of risk and risk profile, we should not forget that there are largely 3 types of dividend growth stocks. One is low yield/high growth, those in the sweet spot of yield/growth and those with a higher yield and lower growth. We do not want to overweight one of these three types, because the portfolio profile and future growth will be affected. We want a nice balance, as each of those comes with its own sets of risks and opportunities.

Third, this strategy may teach investors that it is ok to just sell their lowest yielding stocks, in order to reach their dividend income goals faster. As we discussed in the paragraph above, this can affect your risk profile. Replacing lower yielding stocks to buy higher yielding ones could be a justification to chase yield. You may end up with a lot of higher yielding companies, which may be concentrated in a few sectors. Or they may be from different sectors, but have exposure to the same type of risks such as interest rates or regulation. These higher yielding companies may also have lower growth, which may result in inability to maintain purchasing power of your income in retirement. The higher yielding companies may have higher payout ratios, which may stifle growth in earnings and may expose those companies to a higher risk of a dividend cut during the next recession.

Basically, replacing dividend stocks can be a mistake if done without a good reason. And it can turn otherwise wise long-term investors into antsy active traders. I usually agree and stay put through any issues, for as long as the dividend is at least maintained. If a dividend is cut or eliminated however, I admit that I have been incorrect, and sell. After all, when I buy a stock, I expect it to keep growing earnings and dividends. If it stops growing those dividends and cuts them, then my initial expectations were wrong. If I am proven to be wrong, I see no reason to sit tight and hope for something that may or may not materialize. So I sell.

In my investing, I prefer to generate growth in dividend income organically. This occurs when a company earns more money over time, and decides to increase dividends from this source. This is a more sustainable strategy for future dividend increases. It is also preferable, because once you retire and stop contributing to your portfolio, you will need dividend income to grow above the rate of inflation. This is why organic dividend growth is so important.

The next preference goes to dividend reinvestment, which is the process where we deploy dividends received back into the portfolio. This step helps turbocharge dividend income and compound net worth in the accumulation process.

Relevant Articles:

- Should you sell after yield drops below minimum yield requirement?

- Replacing appreciated investments with higher yielding stocks

However, I also have a strategy that helps me avoid big mistakes and manage risk. In order to avoid falling in love with a company whose best days may be behind it, I sell after a dividend cut or a suspension. I buy a stock with the intent of seeing it prosper, earning more income, growing to be more valuable and sharing a higher dividend with me over time. Only companies that have stood the test of time manage to even establish a lengthy track record of annual dividend increases through the ups and downs of several economic cycles. When management teams with a track record of dividend increases cut dividends, this tells me that something is different and I admit that I was wrong. I can always go back and initiate a position if a dividend is initiated and increased later.

After selling the stock, I realized that I am going to miss out on an annual income of $1.76 for each share that I owned.

All is not lost however. Just because a stock I own stopped paying dividends or reduced them, that doesn't mean I am not going to earn dividend income from that investment. I can always sell ( which I do after a dividend cut or a dividend suspension).

In my case, I managed to get a decent amount of money for my Disney stock, after I sold it.

I like to keep my money invested, because I believe that time in the market beats timing the market. I looked around and wanted to find a company that is in a similar part of the economy, in order to maintain sector allocations. I was able to redeploy the funds into Comcast. I informed the subscribers to my newsletter about this switch. I also added a sprinkle of Verizon and AT&T to juice things up a little.

For every share of Disney that I sold, I bought 2 shares of Comcast and 1/3 share of AT&T and 1/3 share of Verizon.

Let's do a few calculations to illustrate the point I am making.

Imagine that I owned 90 shares of Disney before the dividend cut.

By selling my shares of Disney, I lost annual future dividend income of $1.76/share for a total of $158.40. Well, I lost that future dividend income, because Disney suspended dividends. But in reality, I was expecting that much in annual dividend income from my Disney position, before the suspension.

By buying shares in Comcast, I added $0.92/share to my annual dividend income. 180 shares of Comcast generate a dividend income of $165.60/year.

Verizon pays $2.46/share in annual dividend income, while AT&T pays $2.08/share. Owning 30 shares of Verizon and 30 shares of AT&T results in an annual dividend income of $136.20/year.

If you add $165.60/year to $136.20/year you end up with $301.80/year.

In essence, I doubled my dividend income by selling Disney.

However, I do not like it when I grow my dividend income by selling a lower yielding stock, and replacing it with a higher yielding ones.

First, the risk is that the companies I bought end up not growing their dividend income, or even cutting it. Disney may turn out to have had a temporary issue, and comes roaring back. Or it turns out Disney ends up becoming the next Netflix. If I sold one stock to buy another, I may increase my income, but my total returns could be lower than simply staying put.

Second, the issue is that no two companies are the same. Therefore, getting into the habit of selling one company to buy another may turn the portfolio into a riskier and more concentrated one. We do not want to affect the risk profile of the portfolio, nor do we want to potentially end up overweighting or underweighting sectors ( if this were to happen). Speaking of risk and risk profile, we should not forget that there are largely 3 types of dividend growth stocks. One is low yield/high growth, those in the sweet spot of yield/growth and those with a higher yield and lower growth. We do not want to overweight one of these three types, because the portfolio profile and future growth will be affected. We want a nice balance, as each of those comes with its own sets of risks and opportunities.

Third, this strategy may teach investors that it is ok to just sell their lowest yielding stocks, in order to reach their dividend income goals faster. As we discussed in the paragraph above, this can affect your risk profile. Replacing lower yielding stocks to buy higher yielding ones could be a justification to chase yield. You may end up with a lot of higher yielding companies, which may be concentrated in a few sectors. Or they may be from different sectors, but have exposure to the same type of risks such as interest rates or regulation. These higher yielding companies may also have lower growth, which may result in inability to maintain purchasing power of your income in retirement. The higher yielding companies may have higher payout ratios, which may stifle growth in earnings and may expose those companies to a higher risk of a dividend cut during the next recession.

Basically, replacing dividend stocks can be a mistake if done without a good reason. And it can turn otherwise wise long-term investors into antsy active traders. I usually agree and stay put through any issues, for as long as the dividend is at least maintained. If a dividend is cut or eliminated however, I admit that I have been incorrect, and sell. After all, when I buy a stock, I expect it to keep growing earnings and dividends. If it stops growing those dividends and cuts them, then my initial expectations were wrong. If I am proven to be wrong, I see no reason to sit tight and hope for something that may or may not materialize. So I sell.

In my investing, I prefer to generate growth in dividend income organically. This occurs when a company earns more money over time, and decides to increase dividends from this source. This is a more sustainable strategy for future dividend increases. It is also preferable, because once you retire and stop contributing to your portfolio, you will need dividend income to grow above the rate of inflation. This is why organic dividend growth is so important.

The next preference goes to dividend reinvestment, which is the process where we deploy dividends received back into the portfolio. This step helps turbocharge dividend income and compound net worth in the accumulation process.

Relevant Articles:

- Should you sell after yield drops below minimum yield requirement?

- Replacing appreciated investments with higher yielding stocks

Sunday, May 17, 2020

Seven Dividend Growth Stocks Rewarding Shareholders With Raises

As part of my review process, I monitor the list of dividend increases every week. I use several different resources to come up with a list of dividend increases for the week. I then narrow the list down to include only these companies that have a minimum streak of annual dividend increases. In this case, I focus on companies that raised dividends for at least a decade.

There were seven dividend growth stocks that raised dividends last week. One of them, MSA Safety is a newly minted dividend king.

The companies that increased dividends over the past week include:

This is not an automatic list to buy of course. I would review each company, and determine if it makes sense from a fundamentals point of view. This would include reviewing trends in earnings, dividends, payout ratios, revenues, and gaining an understand of the company's business model.

The job is not done just by reviewing fundamentals however. The investor also needs to come up with a conclusion whether the stock is fairly valued at the moment. If it is not, then the investor may come up with a price at which the security may be attractive.

The other thing to consider is that valuation is relative. When evaluating companies, we compare them to other companies with promising fundamental and valuation characteristics. Then, we strive to pick the company or companies with the best values in the investors opportunity set.

While this sounds like a lot of work on the surface, with practice, it becomes almost a second nature.

Relevant Articles:

- Dividend Increases Outpace Dividend Cuts in 2020

- Dividend Kings List for 2020

- Dividend Aristocrats Keep Performing Well in 2020

- How to read my weekly dividend increase reports

There were seven dividend growth stocks that raised dividends last week. One of them, MSA Safety is a newly minted dividend king.

The companies that increased dividends over the past week include:

|

Company

|

Symbol

|

Yield

|

New Rate

|

Increase

|

P/E

|

Years Annual Increases

|

10 year Dividend Growth

|

|

NACCO Industries

|

NC

|

2.87%

|

0.1925

|

1.32%

|

6.11

|

35

|

13.47%

|

|

MSA Safety

|

MSA

|

1.50%

|

0.4300

|

2.38%

|

26.40

|

50

|

5.50%

|

|

Chesapeake Utilities

|

CPK

|

2.11%

|

0.4400

|

8.64%

|

20.48

|

17

|

6.49%

|

|

Microchip Technology

|

MCHP

|

1.76%

|

0.3675

|

0.14%

|

15.19

|

20

|

0.75%

|

|

RLI Corp

|

RLI

|

1.39%

|

0.2400

|

4.35%

|

30.00

|

45

|

5.55%

|

|

Cardinal Health

|

CAH

|

3.97%

|

0.4859

|

1.00%

|

9.29

|

24

|

14.33%

|

|

Farmers & Merchants Bancorp

|

FMCB

|

2.04%

|

7.2500

|

1.40%

|

9.90

|

55

|

2.68%

|

This is not an automatic list to buy of course. I would review each company, and determine if it makes sense from a fundamentals point of view. This would include reviewing trends in earnings, dividends, payout ratios, revenues, and gaining an understand of the company's business model.

The job is not done just by reviewing fundamentals however. The investor also needs to come up with a conclusion whether the stock is fairly valued at the moment. If it is not, then the investor may come up with a price at which the security may be attractive.

The other thing to consider is that valuation is relative. When evaluating companies, we compare them to other companies with promising fundamental and valuation characteristics. Then, we strive to pick the company or companies with the best values in the investors opportunity set.

While this sounds like a lot of work on the surface, with practice, it becomes almost a second nature.

Relevant Articles:

- Dividend Increases Outpace Dividend Cuts in 2020

- Dividend Kings List for 2020

- Dividend Aristocrats Keep Performing Well in 2020

- How to read my weekly dividend increase reports

Saturday, May 16, 2020

Dividend Increases Outpace Dividend Cuts in 2020

It has been a turbulent five months since the beginning of the year. The Corona-virus has swept the world, leading to millions of infections, and tens of thousands of people dying from the virus. A large part of the developed world is on a government imposed lock-down, which has devastated economic output, and led to high unemployment in the US.

Last month, I shared my thoughts on the current health crisis in " My Take on Covid-19 Dividend Cuts". I wanted to provide you with an update, based on the updated data that I discussed in the article.

The number of dividend cuts has definitely increased this year, there is not doubt about it. The first companies to get impacted by the lock-downs were cyclical companies that usually get impacted during a recession. As a result, it was no surprise that companies like airlines, automakers and cruise ship companies cut or eliminated dividends. They did the same thing during the 2007 - 2009 financial crisis as well. There were a lot of dividend cuts in the REITs sector during the Global Financial Crisis, so this crisis is or won't be an exception either. So far, the financial companies like the major banks have largely held up. But their dividends could be in danger as homeowners cannot pay mortgages, or consumer increasingly start defaulting on consumer loans whose collateral value may be impacted in a recession.

Now, there are a few companies, whose cuts surprised me, but that's what makes investing such a challenging endeavor. These include Disney (DIS) and TJX Companies (TJX). I am surprised that most major oil and gas companies have managed to maintain their dividends for so long after the energy market collapsed in 2014 - 2016, and the only major cut was with Royal Dutch Shell last month.

The other problem is that when things are bad, the media tends to focus on the negative, and ignores the positive. I do not want to put my head in the sand, but I also think that by focusing on the negative, it is easier to confuse people that things are worse than they are. I am strictly speaking about dividends, I am not an expert epidemiologist.

So to summarize, it looks like dividend cuts are getting more coverage, and more dividend cuts are happening, because cyclical companies that usually cut dividends in a recession are facing their first recession in many years.

As dividend growth investors however, we are looking at quality companies, with long streaks of annual dividend increases. Only a certain type of company can afford to grow dividends annually for ten years in a row. We are looking for quality.

I dug a little, and found out the dividend declaration data for companies in the S&P 500. There are 500 companies included in this index. These are the largest and most successful US companies that are listed on a stock market. The index includes 11 industries, and is owned by millions of Americans in their retirement plans.

Based on the data so far, it looks like there had been 205 dividend actions on the S&P 500 so far this year through mid-May.

There were 151 companies on the S&P 500 that increased dividends so far this year.

There were 35 companies on the S&P 500 that suspended dividends, while 17 companies decreased dividends.

It looks like there were two companies that initiated a dividend this year.

If you look at the data, and crunch some numbers, you will see that the rate of dividend increases so far outpaced dividend cuts by a factor of 3:1.

You can view the data, organized by Sector and Type of action ( Decrease, Increase, Initial, Suspension). Source: Standard & Poor's

You can also view the detailed data per individual company in the spreadsheet you can download from here: File Data

As you may see, I am still optimistic about things. It is easy to be optimistic, when the data agree with your strategy. After all, for my dividend portfolio that I share with my premium newsletter, I have had 16 dividend increases so far in 2020 and two dividend cuts or suspension. Since the launch in July 2018 we've had just these two suspensions and 67 dividend increases.

That doesn't mean that things cannot and will not get worse, before they get better. It is possible that it takes the economy longer to recover than any of us anticipate. Stocks may go lower from here in price, as earnings are decimated, and unemployment soars. It is possible that dividends can get cut further from here.

As you can see, the pace of dividend increases on the S&P 500 has been slowing down since March, while the pace of dividend cuts and suspensions has been increasing.

Either way, I will keep sticking to my regular monthly investing plan. I will buy stock in companies I find to be attractively valued whenever I have money to invest. I will reinvest dividends received. If I have a dividend cut, I will most likely sell the stock, and replace it with another stock. This plan worked during the last recession. This plan also worked during the Great Depression.

The hard part is sticking to the plan, when the world around you seems to be collapsing. That's where many investors fail. But hopefully, we will stick to our plans, and ultimately prevail.

Relevant Articles:

- My Take On Covid-19 Dividend Cuts

- Dividend Aristocrats Keep Performing Well in 2020

- Dividend Investing and Covid-19 Disruptions

- Everybody ought to be rich

- Dividend Investors: Stay The Course

Last month, I shared my thoughts on the current health crisis in " My Take on Covid-19 Dividend Cuts". I wanted to provide you with an update, based on the updated data that I discussed in the article.

The number of dividend cuts has definitely increased this year, there is not doubt about it. The first companies to get impacted by the lock-downs were cyclical companies that usually get impacted during a recession. As a result, it was no surprise that companies like airlines, automakers and cruise ship companies cut or eliminated dividends. They did the same thing during the 2007 - 2009 financial crisis as well. There were a lot of dividend cuts in the REITs sector during the Global Financial Crisis, so this crisis is or won't be an exception either. So far, the financial companies like the major banks have largely held up. But their dividends could be in danger as homeowners cannot pay mortgages, or consumer increasingly start defaulting on consumer loans whose collateral value may be impacted in a recession.

Now, there are a few companies, whose cuts surprised me, but that's what makes investing such a challenging endeavor. These include Disney (DIS) and TJX Companies (TJX). I am surprised that most major oil and gas companies have managed to maintain their dividends for so long after the energy market collapsed in 2014 - 2016, and the only major cut was with Royal Dutch Shell last month.

The other problem is that when things are bad, the media tends to focus on the negative, and ignores the positive. I do not want to put my head in the sand, but I also think that by focusing on the negative, it is easier to confuse people that things are worse than they are. I am strictly speaking about dividends, I am not an expert epidemiologist.

So to summarize, it looks like dividend cuts are getting more coverage, and more dividend cuts are happening, because cyclical companies that usually cut dividends in a recession are facing their first recession in many years.

As dividend growth investors however, we are looking at quality companies, with long streaks of annual dividend increases. Only a certain type of company can afford to grow dividends annually for ten years in a row. We are looking for quality.

I dug a little, and found out the dividend declaration data for companies in the S&P 500. There are 500 companies included in this index. These are the largest and most successful US companies that are listed on a stock market. The index includes 11 industries, and is owned by millions of Americans in their retirement plans.

Based on the data so far, it looks like there had been 205 dividend actions on the S&P 500 so far this year through mid-May.

There were 151 companies on the S&P 500 that increased dividends so far this year.

There were 35 companies on the S&P 500 that suspended dividends, while 17 companies decreased dividends.

It looks like there were two companies that initiated a dividend this year.

If you look at the data, and crunch some numbers, you will see that the rate of dividend increases so far outpaced dividend cuts by a factor of 3:1.

You can view the data, organized by Sector and Type of action ( Decrease, Increase, Initial, Suspension). Source: Standard & Poor's

You can also view the detailed data per individual company in the spreadsheet you can download from here: File Data

As you may see, I am still optimistic about things. It is easy to be optimistic, when the data agree with your strategy. After all, for my dividend portfolio that I share with my premium newsletter, I have had 16 dividend increases so far in 2020 and two dividend cuts or suspension. Since the launch in July 2018 we've had just these two suspensions and 67 dividend increases.

That doesn't mean that things cannot and will not get worse, before they get better. It is possible that it takes the economy longer to recover than any of us anticipate. Stocks may go lower from here in price, as earnings are decimated, and unemployment soars. It is possible that dividends can get cut further from here.

As you can see, the pace of dividend increases on the S&P 500 has been slowing down since March, while the pace of dividend cuts and suspensions has been increasing.

Either way, I will keep sticking to my regular monthly investing plan. I will buy stock in companies I find to be attractively valued whenever I have money to invest. I will reinvest dividends received. If I have a dividend cut, I will most likely sell the stock, and replace it with another stock. This plan worked during the last recession. This plan also worked during the Great Depression.

The hard part is sticking to the plan, when the world around you seems to be collapsing. That's where many investors fail. But hopefully, we will stick to our plans, and ultimately prevail.

Relevant Articles:

- My Take On Covid-19 Dividend Cuts

- Dividend Aristocrats Keep Performing Well in 2020

- Dividend Investing and Covid-19 Disruptions

- Everybody ought to be rich

- Dividend Investors: Stay The Course

Thursday, May 14, 2020

What should I do about Raytheon and its spin-offs?

Just a few weeks ago, United Technologies (UTX) spun-off OTIS Elevator (CARR) and Carrier Global (CARR) to its shareholders.

Each shareholder of United Technologies received one share of Carrier for each share of United Technologies that they held.

Shareholders received a share of Otis Elevator for every two shares of United Technologies.

Following this event, United Technologies completed its acquisition of Raytheon. As a result, it changed its name to Raytheon Technologies (RTX).

I usually hold on to shares received in a spin-off, although I generally do not add to these positions. I even hold on to shares in a spin-off that hasn't declared dividends yet. I am more likely to be patient, and let the spin-offs find their dividend balance.

Before the spin-offs, and the acquisition, shareholders of United Technologies received a quarterly dividend of 73.50 cents/share.

I owned shares of United Technologies is several of my accounts. I reviewed the shares that were spun-off, and the allocation of cost basis. It seemed that the cost basis was allocated in the following basis:

55.1705% allocated to Raytheon Technologies (RTX)

26.1402% allocated to Otis Elevator (OTIS)

18.6893% allocated to Carrier (CARR)

If I allocate the dividend with the same percentages, as the ones used to split the cost basis, I come up with the following dividend amounts:

Raytheon Technologies (RTX) – 40.55 cents

Otis Elevator (OTIS) – 19.20 cents

Carrier (CARR) – 13.74 cents

As of June 11th, we have all three companies declare dividends after the spin-offs and mergers.

Raytheon Technologies (RTX) has declared a quarterly dividend of 47.50 cents/share. This amount seems like a dividend hike to me. Therefore, I still view this company as a dividend aristocrat or a dividend champion, since it inherited the dividend history of United Technologies. It looks like Standard & Poor's is treating this new dividend payment as a dividend cut, which doesn't make sense. If they remove Raytheon from their list simply because it had two spin-offs, that would make their list less credible.

Otis Elevator (OTIS) declared a quarterly dividend of 20 cents/share. This amount does not seem in line with the cost basis allocation. That's because we received half a share of Otis for every United Technologies share we owned. To maintain dividend income, Otis should have declared a dividend of 40 cents/share. Therefore, this looks like an effective dividend cut. I would be watching to see what they will be doing from here.

Carrier declared its first dividend on June 11th, 2020. It would pay 8 cents/share. This is lower than what I expected. It also looks like an effective dividend cut to me as well.

I expected that Carrier will declare their quarterly dividend right away, but they deferred that decision, due to the challenging macroeconomic environment. This decision seemed like a dividend suspension to me, but I am somewhat lenient towards dividend declarations with spin-offs (at least I was in the case of Yum Brands and Yum China). I am glad they declared that dividend. I would be watching to see if they actually grow it from here.

Since these companies were just spun-off however, I view them as a standalone companies with a standalone dividend records that was just established. I am not going to add to any of these companies, but will hold.

I will not be adding to either stock, but would evaluate it in the future.

Overall, shareholders of United Technologies experienced a dividend cut.

They received 73.50 cents/share prior to the split.

Now they are receiving:

47.50 cents/share from Raytheon Technologies (RTX)

8 cents/share from Carrier (CARR)

20 cents/share from Otis (OTIS). This should be divided by two, since we received half a share of Otis for each share of United Technologies.

Overall, we are receiving 65.50 cents/share versus 73.50 cents/share.

I will not be selling, but will be taking the dividends in cash, and deploying them elsewhere. If any of these standalone companies end up cutting or suspending dividends from these levels, I will sell them.

Relevant Articles:

- Dividend Aristocrats Keep Performing Well in 2020

- Stock Spin-Offs – What Should Dividend Investors do?

- What should I do about those non-dividend paying stocks I received in a spin-off?

- Should dividend investors hold on to Abbott (ABT) and Abbvie (ABBV) following the split?

Each shareholder of United Technologies received one share of Carrier for each share of United Technologies that they held.

Shareholders received a share of Otis Elevator for every two shares of United Technologies.

Following this event, United Technologies completed its acquisition of Raytheon. As a result, it changed its name to Raytheon Technologies (RTX).

I usually hold on to shares received in a spin-off, although I generally do not add to these positions. I even hold on to shares in a spin-off that hasn't declared dividends yet. I am more likely to be patient, and let the spin-offs find their dividend balance.

Before the spin-offs, and the acquisition, shareholders of United Technologies received a quarterly dividend of 73.50 cents/share.

I owned shares of United Technologies is several of my accounts. I reviewed the shares that were spun-off, and the allocation of cost basis. It seemed that the cost basis was allocated in the following basis:

55.1705% allocated to Raytheon Technologies (RTX)

26.1402% allocated to Otis Elevator (OTIS)

18.6893% allocated to Carrier (CARR)

If I allocate the dividend with the same percentages, as the ones used to split the cost basis, I come up with the following dividend amounts:

Raytheon Technologies (RTX) – 40.55 cents

Otis Elevator (OTIS) – 19.20 cents

Carrier (CARR) – 13.74 cents

As of June 11th, we have all three companies declare dividends after the spin-offs and mergers.

Raytheon Technologies (RTX) has declared a quarterly dividend of 47.50 cents/share. This amount seems like a dividend hike to me. Therefore, I still view this company as a dividend aristocrat or a dividend champion, since it inherited the dividend history of United Technologies. It looks like Standard & Poor's is treating this new dividend payment as a dividend cut, which doesn't make sense. If they remove Raytheon from their list simply because it had two spin-offs, that would make their list less credible.

Otis Elevator (OTIS) declared a quarterly dividend of 20 cents/share. This amount does not seem in line with the cost basis allocation. That's because we received half a share of Otis for every United Technologies share we owned. To maintain dividend income, Otis should have declared a dividend of 40 cents/share. Therefore, this looks like an effective dividend cut. I would be watching to see what they will be doing from here.

Carrier declared its first dividend on June 11th, 2020. It would pay 8 cents/share. This is lower than what I expected. It also looks like an effective dividend cut to me as well.

I expected that Carrier will declare their quarterly dividend right away, but they deferred that decision, due to the challenging macroeconomic environment. This decision seemed like a dividend suspension to me, but I am somewhat lenient towards dividend declarations with spin-offs (at least I was in the case of Yum Brands and Yum China). I am glad they declared that dividend. I would be watching to see if they actually grow it from here.

Since these companies were just spun-off however, I view them as a standalone companies with a standalone dividend records that was just established. I am not going to add to any of these companies, but will hold.

I will not be adding to either stock, but would evaluate it in the future.

Overall, shareholders of United Technologies experienced a dividend cut.

They received 73.50 cents/share prior to the split.

Now they are receiving:

47.50 cents/share from Raytheon Technologies (RTX)

8 cents/share from Carrier (CARR)

20 cents/share from Otis (OTIS). This should be divided by two, since we received half a share of Otis for each share of United Technologies.

Overall, we are receiving 65.50 cents/share versus 73.50 cents/share.

I will not be selling, but will be taking the dividends in cash, and deploying them elsewhere. If any of these standalone companies end up cutting or suspending dividends from these levels, I will sell them.

Relevant Articles:

- Dividend Aristocrats Keep Performing Well in 2020

- Stock Spin-Offs – What Should Dividend Investors do?

- What should I do about those non-dividend paying stocks I received in a spin-off?

- Should dividend investors hold on to Abbott (ABT) and Abbvie (ABBV) following the split?

Tuesday, May 12, 2020

Simon Property Groups (SPG) is Ambiguous on Dividends

I read the latest press release for Simon Property Group (SPG). I was expecting them to announce their dividend announcement as part of that release, given the fact that they are about 2 weeks late to their usual dividend declaration.

They did mention the word dividend in their latest press release, but I found it to be very ambiguous.

Simon's Board of Directors will declare a common stock dividend for the second quarter before the end of June. Simon intends to maintain a common stock dividend paid in cash and expects to distribute at least 100% of its REIT taxable income.

This is a very carefully crafted message that probably took their investor relations team 10 days to come up with. It gives the company some time to defer the difficult decision on cutting the dividend. They remind me of a teen-ager who procrastinates on a difficult assignment, because they do not want to do it, and face the consequences.

On one hand they are announcing that they will pay a dividend, in order to maintain REIT status. But they leave open the possibility that there will be a dividend cut. The way this was worded, implies a dividend cut in my opinion. Some investors have misread this statement to say that they will keep the dividend unchanged. This is incorrect - they are keeping a dividend payment, which mostly likely will be lower than the last quarterly payment.

I will stick to my strategy for now, and not sell. I am pretty certain that they are cutting the dividend with this ambiguous message, but I will not sell until they state it firmly. That being said, I am dissapointed by corporate double-speak. I am perhaps sticking to this stock for educational purposes only, because owning a stock forces me to keep up on it, as I am fed press releases, 10-k and 10-q reports on it.

In my opinion, Simon's management is not frank and upfront with their investors. I also do not like the fact that they have not shared the percentage rent collected from tenants, which is a statistic that is now commonly shared by many REITs. It sounds to me like they are trying to hide something, when we all know and expect to hear that things are not rosy.

It also seems to me that the Taubman Centers acquisition may have to be re-negotiated. Back in February, Simon (SPG) decided to acquire Taubman (TCO) for $53/share in cash. Subsequently, we had all the lock-downs, the economy going into a tailspin, but this deal is still going as if it is going to happen at the original terms. This deal needs to be renegotiated, because those assets are impaired as of today. It is basically lighting shareholder funds on fire, if they really were to acquire Taubman at the original terms from February. However, Simon management is refusing to say anything about it. Hopefully they are doing something behind the scenes to renegotiate the deal and its terms ( or walk out). Otherwise...

When I reviewed Simon Property Group (SPG) in December, I concluded that it is a high yield and a high-risk investment. It did remind me at the time of Tanger Factory Outlets in 2017 however. Both Simon in late 2019 and Tanger in early 2017 we yielding about 5%, had low valuations, and FFO/share growth was grinding to a halt. Yet, Tanger kept deteriorating over the next 2 - 3 years. It is possible that Simon is deteriorating at a faster pace over the course of the past 2 - 3 quarters.

If I were to sell Simon Property Group, and keep the money in REITs, I would probably replace it with W.P. Carey (WPC) or Realty Income (O). The first one received a 95% collection rate on rent, while the second company collected on 83% of rent in the most recent month. Sadly, National Retail Properties (NNN) collected only 52% of rent last month. I believe NNN is at a high risk of a dividend cut. I will turn off the DRIP for this stock too.

This is an interesting chart I found on Twitter, which shows April rent collection rates. If you want to think about which dividend is at risk, think about this chart and collection rates. A low collection rate in 12%, such as Tanger Factory Outlets is basically telling you that the dividend is toast ( it was suspended yesterday).

Simon Property Group is not on this list, and very likely will not appear on it for some time.

Relevant Articles:

- Simon Property Group (SPG): A High Yield and High Risk REIT

- Tanger Factory Outlets (SKT) Suspends Dividends

- Twelve Companies Raising Dividends To Their Investors

- Five Things to Look For in a Real Estate Investment Trust (REIT)

They did mention the word dividend in their latest press release, but I found it to be very ambiguous.

Simon's Board of Directors will declare a common stock dividend for the second quarter before the end of June. Simon intends to maintain a common stock dividend paid in cash and expects to distribute at least 100% of its REIT taxable income.

This is a very carefully crafted message that probably took their investor relations team 10 days to come up with. It gives the company some time to defer the difficult decision on cutting the dividend. They remind me of a teen-ager who procrastinates on a difficult assignment, because they do not want to do it, and face the consequences.

On one hand they are announcing that they will pay a dividend, in order to maintain REIT status. But they leave open the possibility that there will be a dividend cut. The way this was worded, implies a dividend cut in my opinion. Some investors have misread this statement to say that they will keep the dividend unchanged. This is incorrect - they are keeping a dividend payment, which mostly likely will be lower than the last quarterly payment.

I will stick to my strategy for now, and not sell. I am pretty certain that they are cutting the dividend with this ambiguous message, but I will not sell until they state it firmly. That being said, I am dissapointed by corporate double-speak. I am perhaps sticking to this stock for educational purposes only, because owning a stock forces me to keep up on it, as I am fed press releases, 10-k and 10-q reports on it.

In my opinion, Simon's management is not frank and upfront with their investors. I also do not like the fact that they have not shared the percentage rent collected from tenants, which is a statistic that is now commonly shared by many REITs. It sounds to me like they are trying to hide something, when we all know and expect to hear that things are not rosy.

It also seems to me that the Taubman Centers acquisition may have to be re-negotiated. Back in February, Simon (SPG) decided to acquire Taubman (TCO) for $53/share in cash. Subsequently, we had all the lock-downs, the economy going into a tailspin, but this deal is still going as if it is going to happen at the original terms. This deal needs to be renegotiated, because those assets are impaired as of today. It is basically lighting shareholder funds on fire, if they really were to acquire Taubman at the original terms from February. However, Simon management is refusing to say anything about it. Hopefully they are doing something behind the scenes to renegotiate the deal and its terms ( or walk out). Otherwise...

When I reviewed Simon Property Group (SPG) in December, I concluded that it is a high yield and a high-risk investment. It did remind me at the time of Tanger Factory Outlets in 2017 however. Both Simon in late 2019 and Tanger in early 2017 we yielding about 5%, had low valuations, and FFO/share growth was grinding to a halt. Yet, Tanger kept deteriorating over the next 2 - 3 years. It is possible that Simon is deteriorating at a faster pace over the course of the past 2 - 3 quarters.

If I were to sell Simon Property Group, and keep the money in REITs, I would probably replace it with W.P. Carey (WPC) or Realty Income (O). The first one received a 95% collection rate on rent, while the second company collected on 83% of rent in the most recent month. Sadly, National Retail Properties (NNN) collected only 52% of rent last month. I believe NNN is at a high risk of a dividend cut. I will turn off the DRIP for this stock too.

This is an interesting chart I found on Twitter, which shows April rent collection rates. If you want to think about which dividend is at risk, think about this chart and collection rates. A low collection rate in 12%, such as Tanger Factory Outlets is basically telling you that the dividend is toast ( it was suspended yesterday).

Simon Property Group is not on this list, and very likely will not appear on it for some time.

Relevant Articles:

- Simon Property Group (SPG): A High Yield and High Risk REIT

- Tanger Factory Outlets (SKT) Suspends Dividends

- Twelve Companies Raising Dividends To Their Investors

- Five Things to Look For in a Real Estate Investment Trust (REIT)

Monday, May 11, 2020

Tanger Factory Outlets (SKT) Suspends Dividends

I just read that Tanger Factory Outlets (SKT) is suspending dividends. That's after increasing the dividend in February 2020. This is what I obtained about the dividend from the company's press release:

Tanger intends to pay the dividend of $0.3575 per share declared in January 2020 as scheduled on May 15, 2020 to holders of record on April 30, 2020. Going forward, given the current uncertainty related to the pandemic's near and potential long-term impact, the Company's Board of Directors will temporarily suspend dividend distributions to conserve approximately $35 million in cash per quarter and preserve the Company's balance sheet strength and flexibility. The Board will continue to evaluate the potential for future dividend distributions on a quarterly basis. Tanger intends to remain in compliance with REIT taxable income distribution requirements for the 2020 tax year.

It makes sense to conserve cash, when you are able to collect on only 12% of rent that you billed to your tenants. As a result, the company's 27 year record of annual dividend increases is over, and it would be soon demoted from the list of dividend champions. The high-yield dividend aristocrats index already demoted the company in January 2020, because its market capitalization fell below a certain amount. While I held a small position in the the stock, I sold it an year later. I never bought it back, despite the fact that it was very cheap. If I held the stock today, I would have likely sold it at the open tomorrow.

It is an interesting exercise on how companies that are really cheap, and have a low valuation but no growth can turn out to be value traps. When I analyzed the stock in 2017, it looked cheap, and it seemed that just by maintaining the status quo, it could deliver 10% annualized returns through its high dividends and share repurchases. The dividend was also well supported.

Perhaps if we didn't have Covid-19, the company would have paid a dividend for a few more years. Over the past three years since I first analyzed the stock, it has paid $4.16/share in dividends. It is not a lot versus a share price of $26/share in May 2017, but it still represents a 16% rebate on the original purchase price, while also retaining an ownership interest of $6/share (or 23% of original cost). If held in a taxable account, an investor in a 30% tax bracket can generate a $6/share in tax benefits. It is nice to be reminded that dividends represent both a return of investment and a return on investment.

Since Tanger is a Real Estate Investment Trust, it would have to distribute a minimum amount of income to shareholders in 2020, in order to maintain its status and avoid paying taxes as a corporation. This may not be an issue this year after sending out two dividends in 2020. I just do not like that the company held off for so long, before cutting dividends. Investors would have been better off to be warned last year with a small dividend cut, and the company would have preserved liquidity along the way.

Going back to analyzing REITs, I do not look at rent collections as part of my analysis. I always looked at portfolio occupancy, and saw collections as a non-issue. But we grow and we learn. The next crisis will definitely look differently, and hit companies in a different way, which we probably never even imagined.

As an investor, I find it helpful to evaluate my investment decisions after the fact. It is helpful to read the reasons why I bought a stock, and determine where I went wrong, in order to try to improve and avoid the same mistake.

A lot of times, we do not know why an investment would do well or not do as well. Malls and traditional retail have been under siege over the past five years, but I could not have predicted that the economy would have been shut-down by a pandemic. The long-term trends were negative, but I had hopes that there is value left. Yet, other parts of the economy that were flourishing, such as online retail, are doing well as well. You can analyze all you want, but then there is always a chance you will be surprised. You can not research everything about a company.

There have been negative headwinds for the consumer packaged foods companies like Campbell Soup (CPB), General Mills (GIS), J.M. Smuckers (SJM) and Kellogg's (K). However, this pandemic and the pantry loading helped these companies, at least in the short-term this year.

Relevant Articles:

- What Dividend Investors Can Learn From Human Resource Departments?

- Tanger Factory Outlets (SKT) Dividend Stock Analysis

- Three REITs Approaching Value Territory

- Simon Property Group (SPG): A High Yield and High Risk REIT

Tanger intends to pay the dividend of $0.3575 per share declared in January 2020 as scheduled on May 15, 2020 to holders of record on April 30, 2020. Going forward, given the current uncertainty related to the pandemic's near and potential long-term impact, the Company's Board of Directors will temporarily suspend dividend distributions to conserve approximately $35 million in cash per quarter and preserve the Company's balance sheet strength and flexibility. The Board will continue to evaluate the potential for future dividend distributions on a quarterly basis. Tanger intends to remain in compliance with REIT taxable income distribution requirements for the 2020 tax year.

It makes sense to conserve cash, when you are able to collect on only 12% of rent that you billed to your tenants. As a result, the company's 27 year record of annual dividend increases is over, and it would be soon demoted from the list of dividend champions. The high-yield dividend aristocrats index already demoted the company in January 2020, because its market capitalization fell below a certain amount. While I held a small position in the the stock, I sold it an year later. I never bought it back, despite the fact that it was very cheap. If I held the stock today, I would have likely sold it at the open tomorrow.

It is an interesting exercise on how companies that are really cheap, and have a low valuation but no growth can turn out to be value traps. When I analyzed the stock in 2017, it looked cheap, and it seemed that just by maintaining the status quo, it could deliver 10% annualized returns through its high dividends and share repurchases. The dividend was also well supported.

Perhaps if we didn't have Covid-19, the company would have paid a dividend for a few more years. Over the past three years since I first analyzed the stock, it has paid $4.16/share in dividends. It is not a lot versus a share price of $26/share in May 2017, but it still represents a 16% rebate on the original purchase price, while also retaining an ownership interest of $6/share (or 23% of original cost). If held in a taxable account, an investor in a 30% tax bracket can generate a $6/share in tax benefits. It is nice to be reminded that dividends represent both a return of investment and a return on investment.

Since Tanger is a Real Estate Investment Trust, it would have to distribute a minimum amount of income to shareholders in 2020, in order to maintain its status and avoid paying taxes as a corporation. This may not be an issue this year after sending out two dividends in 2020. I just do not like that the company held off for so long, before cutting dividends. Investors would have been better off to be warned last year with a small dividend cut, and the company would have preserved liquidity along the way.

Going back to analyzing REITs, I do not look at rent collections as part of my analysis. I always looked at portfolio occupancy, and saw collections as a non-issue. But we grow and we learn. The next crisis will definitely look differently, and hit companies in a different way, which we probably never even imagined.

As an investor, I find it helpful to evaluate my investment decisions after the fact. It is helpful to read the reasons why I bought a stock, and determine where I went wrong, in order to try to improve and avoid the same mistake.

A lot of times, we do not know why an investment would do well or not do as well. Malls and traditional retail have been under siege over the past five years, but I could not have predicted that the economy would have been shut-down by a pandemic. The long-term trends were negative, but I had hopes that there is value left. Yet, other parts of the economy that were flourishing, such as online retail, are doing well as well. You can analyze all you want, but then there is always a chance you will be surprised. You can not research everything about a company.

There have been negative headwinds for the consumer packaged foods companies like Campbell Soup (CPB), General Mills (GIS), J.M. Smuckers (SJM) and Kellogg's (K). However, this pandemic and the pantry loading helped these companies, at least in the short-term this year.

Relevant Articles:

- What Dividend Investors Can Learn From Human Resource Departments?

- Tanger Factory Outlets (SKT) Dividend Stock Analysis

- Three REITs Approaching Value Territory

- Simon Property Group (SPG): A High Yield and High Risk REIT

Four Dividend Growth Stocks Rewarding Shareholders With A Raise

I review the list of dividend increases as part of my monitoring process. This is helpful in evaluating how my investments are doing. I review the dividend increase announcements, along with their corresponding press releases. The list of dividend increases is also helpful in identifying quality companies for further research. It is also helpful in observing companies act during a crisis. The companies with robust business models are able to weather the crisis relatively well, and are able to maintain and even increase dividends.

By the time this crisis is over, the list of dividend aristocrats and dividend champions will include bulletproof companies that managed to increase dividends during a global pandemic that caused a temporary global depression. These companies would have managed to increase dividends throughout the most difficult economic environment since the Great Depression. There is a very high chance that these companies are already on the lists of dividend aristocrats and dividend champions too.

Most of the companies cutting dividends today are companies in cyclical industries that usually cut dividends during a recession. However, I am also seeing companies that have been relatively recession resistant before to also start cutting dividends. There are some companies that are cutting dividends as a precautionary move, since they do not know how long, deep and severe this economic contraction is going to be. My review of dividend announcements used to focus mainly on dividend increases, since these typically account for most dividend actions.

The list nowadays includes dividend cuts as well. But those are only for companies I own or have owned. Hopefully that won't be too long and I won't do it for too long, but you never know.

Last week, I received several dividend cuts. One was Disney, which “temporarily” suspended dividends.

The other was Kontoor Brands (KTB), which also suspended dividends. This was spun-off from V.F. Corp (VFC) in 2019.

I sell after a dividend cut or suspension, and redeploy the funds elsewhere.

There were several companies that bucked the trend of dividend cuts, and actually raised dividends to shareholders. Just as usual, I focus my review only on those companies that raised dividends last week, which also have at least a ten-year history of annual dividend increases.

Ameriprise Financial, Inc. (AMP) provides various financial products and services to individual and institutional clients in the United States and internationally. It operates through five segments: Advice & Wealth Management, Asset Management, Annuities, Protection, and Corporate & Other.

The company raised its quarterly dividend by 7.20% to $1.04/share. This dividend achiever has managed to grow annual distributions in every year since it was spun-off in 2005. During the past decade, it managed to grow dividends at an annualized rate of 18.80%.

Between 2010 and 2019, Ameriprise managed to grow earnings from $4.18/share to $13.92/share

The company is expected to earn $15.01/share in 2020.

The stock sells for 8.40 times forward earnings and yields 3.30%.

Expeditors International of Washington, Inc. (EXPD) provides logistics services in the Americas, North Asia, South Asia, Europe, the Middle East, Africa, and India.

The company raised its quarterly dividend by 4% to 52 cents/share. This marked the 26th consecutive annual dividend increase for this dividend aristocrat. During the past decade, it has managed to grow dividends at an annualized rate of 10.20%.

Between 2010 and 2019, the company managed to grow earnings from $1.59/share to $3.39/share. The company is expected to earn $3.09/share in 2020.

The stock is richly valued at 24.20 times forward earnings and yields 2.80%.

PetMed Express, Inc. (PETS), doing business as 1-800-PetMeds, operates as a pet pharmacy in the United States.

The company increased its quarterly dividend by 3.70% to 28 cents/share. This marked the 11th consecutive annual dividend increase for this dividend achiever. PetMed Express has managed to hike dividends at an annualized rate of 18.40% over the past decade.

Between 2010 and 2019, the company grew earnings from $1.14/share to $1.84/share. The company is expected to earn $1.23/share in 2020.

The stock sells for 30.10 times forward earnings and yields 3%.

FactSet Research Systems Inc. (FDS) provides integrated financial information and analytical applications to the investment and corporate communities in the United States, Europe, and the Asia Pacific.

The company raised its quarterly dividend by 6.90% to 77 cents/share. This was the 21st year of annual dividend increases for this dividend achiever. During the past decade, it has managed to grow dividends at an annualized rate of 13.60%/year.

Between 2010 and 2019, the company grew earnings from $3.13/share to $9.08/share.

The company is expected to earn $10/share in 2020.

This is a great company, but unfortunately seems a little richly valued at the moment at 27.60 times forward earnings and a dividend yield of 1.10%.

One thing I noticed about FactSet Research is that the company’s press release mentioned that the company has managed to increase dividends for 15 years in a row. Source: Company Press Release

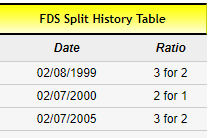

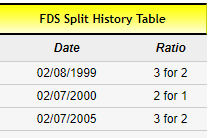

When I reviewed the company’s historical record of annual dividend increases however, it looked like it has managed to grow dividends annually since it initiated a dividend in February 1999. Source: Seeking Alpha

I believe that the disconnect stems from the three stocks splits on the stock between 1999 and 2005. I believe that the corporate team at FDS is not taking into account the splits on dividends paid in their press releases.

As a result, they are treating the dividends as cuts, when in fact they were increased. I sent a note to the company, so hopefully they will research and get back to me. They are selling themselves short if that’s the case, because their track record should be 21 years of dividend increases, not 15.

Relevant Articles:

- Dividend Achievers versus Dividend Contenders & Champions

- Replacing dividend stocks sold

- Dividend Aristocrats Keep Performing Well in 2020

- My Take On Covid-19 Dividend Cuts

By the time this crisis is over, the list of dividend aristocrats and dividend champions will include bulletproof companies that managed to increase dividends during a global pandemic that caused a temporary global depression. These companies would have managed to increase dividends throughout the most difficult economic environment since the Great Depression. There is a very high chance that these companies are already on the lists of dividend aristocrats and dividend champions too.

Most of the companies cutting dividends today are companies in cyclical industries that usually cut dividends during a recession. However, I am also seeing companies that have been relatively recession resistant before to also start cutting dividends. There are some companies that are cutting dividends as a precautionary move, since they do not know how long, deep and severe this economic contraction is going to be. My review of dividend announcements used to focus mainly on dividend increases, since these typically account for most dividend actions.

The list nowadays includes dividend cuts as well. But those are only for companies I own or have owned. Hopefully that won't be too long and I won't do it for too long, but you never know.

Last week, I received several dividend cuts. One was Disney, which “temporarily” suspended dividends.

The other was Kontoor Brands (KTB), which also suspended dividends. This was spun-off from V.F. Corp (VFC) in 2019.

I sell after a dividend cut or suspension, and redeploy the funds elsewhere.

There were several companies that bucked the trend of dividend cuts, and actually raised dividends to shareholders. Just as usual, I focus my review only on those companies that raised dividends last week, which also have at least a ten-year history of annual dividend increases.

Ameriprise Financial, Inc. (AMP) provides various financial products and services to individual and institutional clients in the United States and internationally. It operates through five segments: Advice & Wealth Management, Asset Management, Annuities, Protection, and Corporate & Other.

The company raised its quarterly dividend by 7.20% to $1.04/share. This dividend achiever has managed to grow annual distributions in every year since it was spun-off in 2005. During the past decade, it managed to grow dividends at an annualized rate of 18.80%.

Between 2010 and 2019, Ameriprise managed to grow earnings from $4.18/share to $13.92/share

The company is expected to earn $15.01/share in 2020.

The stock sells for 8.40 times forward earnings and yields 3.30%.

Expeditors International of Washington, Inc. (EXPD) provides logistics services in the Americas, North Asia, South Asia, Europe, the Middle East, Africa, and India.

The company raised its quarterly dividend by 4% to 52 cents/share. This marked the 26th consecutive annual dividend increase for this dividend aristocrat. During the past decade, it has managed to grow dividends at an annualized rate of 10.20%.

Between 2010 and 2019, the company managed to grow earnings from $1.59/share to $3.39/share. The company is expected to earn $3.09/share in 2020.

The stock is richly valued at 24.20 times forward earnings and yields 2.80%.

PetMed Express, Inc. (PETS), doing business as 1-800-PetMeds, operates as a pet pharmacy in the United States.

The company increased its quarterly dividend by 3.70% to 28 cents/share. This marked the 11th consecutive annual dividend increase for this dividend achiever. PetMed Express has managed to hike dividends at an annualized rate of 18.40% over the past decade.

Between 2010 and 2019, the company grew earnings from $1.14/share to $1.84/share. The company is expected to earn $1.23/share in 2020.

The stock sells for 30.10 times forward earnings and yields 3%.

FactSet Research Systems Inc. (FDS) provides integrated financial information and analytical applications to the investment and corporate communities in the United States, Europe, and the Asia Pacific.

The company raised its quarterly dividend by 6.90% to 77 cents/share. This was the 21st year of annual dividend increases for this dividend achiever. During the past decade, it has managed to grow dividends at an annualized rate of 13.60%/year.

Between 2010 and 2019, the company grew earnings from $3.13/share to $9.08/share.

The company is expected to earn $10/share in 2020.

This is a great company, but unfortunately seems a little richly valued at the moment at 27.60 times forward earnings and a dividend yield of 1.10%.

One thing I noticed about FactSet Research is that the company’s press release mentioned that the company has managed to increase dividends for 15 years in a row. Source: Company Press Release

When I reviewed the company’s historical record of annual dividend increases however, it looked like it has managed to grow dividends annually since it initiated a dividend in February 1999. Source: Seeking Alpha

I believe that the disconnect stems from the three stocks splits on the stock between 1999 and 2005. I believe that the corporate team at FDS is not taking into account the splits on dividends paid in their press releases.

Source: FDS Stock Split History

As a result, they are treating the dividends as cuts, when in fact they were increased. I sent a note to the company, so hopefully they will research and get back to me. They are selling themselves short if that’s the case, because their track record should be 21 years of dividend increases, not 15.

Relevant Articles:

- Dividend Achievers versus Dividend Contenders & Champions

- Replacing dividend stocks sold

- Dividend Aristocrats Keep Performing Well in 2020

- My Take On Covid-19 Dividend Cuts

Wednesday, May 6, 2020

Dividend Aristocrats Keep Performing Well in 2020

The dividend aristocrats list includes companies that have managed to increase dividends for 25 years in a row. The list has very stringent criteria for qualification, including being a member of the S&P 500 and having a certain market capitalization and liquidity.

There were 64 dividend aristocrats at the end of 2019. After the spin-off of Otis Elevator and Carrier from United Technologies, the list is up to 66 members as of April 30, 2020.