Buffett had sold securities prior to that, managed his own portfolio and participated in numerous business ventures, including placing pinball machines in barber shops. Between 1950 and 1955, his net worth increased from $9,800 to $127,000.

This was his dream job. Buffett had been rejected by Harvard, and went to school in Columbia, where Ben Graham taught a course on value investing. Buffett wanted to go work for Graham after graduating. He even offered to work for free, but Graham rejected him at the time as “overvalued”.

After selling securities for his father’s firm between 1951 and 1954, Buffett received an offer from Ben Graham, which he accepted on the spot. This was his dream job to work for his mentor.

In 1955, Buffett learned that Ben Graham was going to retire and close his investing company.

Warren declined the opportunity to become a partner in Graham-Newman. Instead, he chose to retire. He shares this story in this great article.

He was 25 at the time, married with a kid. However, he was not worried at all. These are his words, as discussed in a Forbes article from a few years ago:

The thing is, when I got out of college, I had $9,800, but by the end of 1955, I was up to $127,000. I thought, I’ll go back to Omaha, take some college classes, and read a lot—I was going to retire! I figured we could live on $12,000 a year, and off my $127,000 asset base, I could easily make that. I told my wife, “Compound interest guarantees I’m going to get rich.”

Warren Buffett decided to become a private investor in 1955, and live off his capital base. He retired at the age of 25. He expected that his investment skill would be sufficient to generate as much money as his old day job at Graham-Newman.

Retiring early to pursue your passions is a concept that many Financial Independence Retire Early (FIRE) Blogs focus on. Living on your capital, rather than employment is the goal for many of these folks. We do get inspired by folks like Mr Money Mustache who retired at the age of 30 after a decade of investing or Derek Foster, who retired at the age of 34.

Here we have Warren Buffett, who retired at the age of 25 however. He retired to live life on his own terms, and do what made him excited to get out of bed every morning and "tap dance to "work"". Similar to every early retiree, he focused his attention on pursuing his passions and focus on what's important for him in life. And he succeeded beyond his wildest dreams most probably.

To put things in perspective, the average salary for a full-time employee in the 1950s was roughly $5,500/year. So Buffett was earning above average income, and he was expecting to earn an above average income from his investing.

It looks like he expected to generate 10%/year and live off these proceeds. That’s a pretty high annual return needed, but this is the Oracle of Omaha we are talking about. He has been able to compound money at Berkshire Hathaway and the Berkshire Partnerships at 20%/year for decades. Which means that even if he remained a private investor, he would have likely continued to compound his money at more than 10%/year, even after paying for his living expenses.

The most fascinating thought process for me is that if he had managed to compound his capital, net of living and investment expenses, at 10%/year between 1955 and 2019, he would have a net worth of $56.6 million today. That would have been an impressive track record, and he would have been wealthier than most investors today. But it is very likely that we would have never heard about him. It is very likely that if he really retired to do his own thing in the 1950s, there wouldn’t have been several books about him, the annual shareholder meetings, and the fame.

In 1955, it would have been quite easy to construct a portfolio of blue-chip companies that yielded 5%. Security prices had just exceeded their pre-Depression highs from 1929, even as earnings and dividend payments had increased substantially.

His lifestyle does not seem very frugal however. Each dollar in 1955 has the same purchasing power as $9.60 in 2019. In other words, an item that used to cost $1 in 1955 can be purchased at $9.60 today. This means that spending $12,000/year was equivalent to spending $115,200/year today. That’s a pretty nice lifestyle to have in Omaha, Nebraska.

For reference, his net worth was quite impressive for a 25-year-old, since his $127,000 in 1955 is equivalent to having $1.20 million today.

It is fascinating to read his opinion on housing from that time.

In Omaha, I rented a house at 5202 Underwood for $175 a month. I told my wife, “I’d be glad to buy a house, but that’s like a carpenter selling his toolkit.” I didn’t want to use up my capital.

However, three years later he did buy a house for a reported $31,500 in 1958. Although I do not know his networth in 1958, I do know that he became a millionaire in 1960, at the tender age of 30.

The nice thing is that he was able to focus his attention to investing full time. The really nice thing is that he had wealthy relatives and friends, who put up money to start his investment partnership in 1956. Later on, money came pouring in through word of mouth. Several of Graham-Newman’s clients invested with Warren Buffett. You can read more about the Buffett Partnership and read his 1956 - 1969 letters here.

He managed to compound that money at high rates of return, beating his benchmarks in the process. As a result, the assets under management for the Buffett partnership compounded to $100 million by 1969. Warren Buffett was worth $20 million by 1969.

This is when he decided to retire for a second time. This time he retired at the age of 39. By 1970, his sole occupation was being a CEO of Berkshire Hathaway.

If he had really just managed to earn 10%/year off that $20 million by retiring and focusing on charity work for example, Buffett would have been worth roughly $2.3 billion. It would still be very impressive, but nowhere close to being one of the ten richest people in the world. Very few would even bother studying his investment record. Just as few are studying the investment records of other investors on the Forbes list worth less than $10 billion today.

It is fascinating that Buffett retired at the age of 25, and decided to live off investment income. He has been fascinated with the power of compound interest since he read the book “1000 ways to earn $1000” as an impressionable teenager. He knew that even a modest rate of return, compounded over long periods of time could lead to impressive results. For example, a dollar you waste in your 20s, could have grown to $117 in 50 years, provided that you invested it at a 10% annualized total return.

While you may not be alive in 50 years, there is a very high chance that a family member or a charitable cause could be there in 50 years, and benefiting from your foresight.

It is also fascinating to think about opportunity costs. If Buffett had decided to just work an ordinary job, and not focus on investments full time, he would still end up rich but not rich enough to have biographies written about him, and world leaders reaching out to him on the phone in times of crisis. He retired twice, at the ages of 25 and 39. However, he retired to do something better than before.

It is even more fascinating to look at mistakes made, opportunities missed and calculate their impact, decades down the road. Doing so really makes you understand how a simple decision can have a type of butterfly effect that reverberates over the decades.

For example, back in 1951, Buffett lost 20% of his networth on a Sinclair station that he tried to manage. That was approximately $2,000, as he was worth $10,000 at the time. In a 1998 speech he mentioned that the opportunity cost of those $2,000 was something like $6 billion. It is triple that amount now.

I am pretty sure that he would have been wealthier if he had not bought his house in 1958. But at some point, you need to use the money to create the sort of life you need, not be a slave to the power of compounding either.

He made a smart decision at the age of 25 to retire early, and create a life that is true to his values. The money was merely a scorecard, a byproduct of his passion for investing. Investing is something he did when he was a teenager worth a few hundred dollars and it is something he still does, by managing a corporation worth hundreds of billions of dollars.

"Although I had no idea, age 25 was a turning point. I was changing my life, setting up something that would turn into a fairly good-size partnership called Berkshire Hathaway. I wasn’t scared. I was doing something I liked, and I’m still doing it."

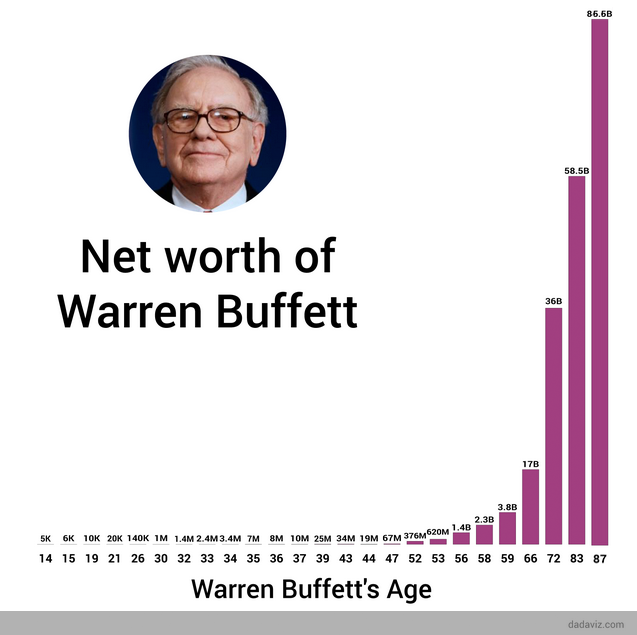

You can see his networth by age in the chart below:

Relevant Articles:

- Buffett Partnership Letters

- The one lesson about Warren Buffett's success that no one wants to hear

- What would happen to Berkshire Hathaway after Warren Buffett is gone?

- The Pareto Principle In Dividend Investing

- Warren Buffett Investing Resource Page

- Warren Buffett’s Dividend Stock Strategy