Cummins Inc. (CMI) designs, manufactures, distributes, and services diesel and natural gas engines, electric and hybrid powertrains, and related components worldwide. It operates through five segments: Engine, Distribution, Components, Power Systems, and New Power.

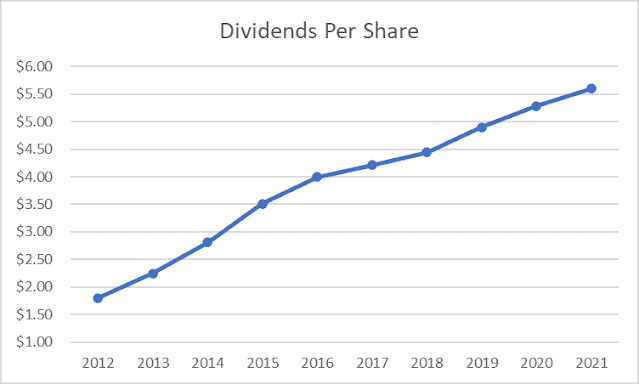

The company has managed to increase annual dividends for 17

years in a row. The last dividend increase was in July 2022, when the Board of

Directors hiked quarterly dividends by 8.30% to $1.57/share.

Over the past decade, this dividend achiever has managed to increase

dividends at an annualized rate of 15.50%. However, the five-year rate is a

more reasonable 7% annualized.

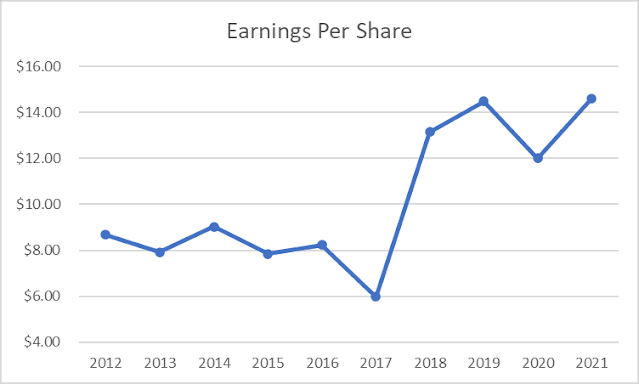

The company managed to grow earnings per share at a more

modest pace over the past decade. Earnings per share increased from $8.67 in

2012 to $14.61 in 2021. However, between 2012 and 2017, earnings per share were

largely flat.

The company is cyclical, so earnings per share would swing unfavorably when the economy gets soft. This should not be an issue, if the long-term trend in EPS is higher over time.

Cummins has five business segments.

The Engine segment (33% of sales) serves on-highway

and off-highway markets (such as construction equipment);

Distribution (29% of sales) provides

aftermarket support;

Components (24% of sales) manufactures filtration

products, fuel systems, and aftermarket services for commercial vehicle

applications;

Power Systems (14% of sales) is a global supplier of

power generation systems, components and services; and

New Power, the newest business segment, comprises

Cummins' electrified power and hydrogen portfolios.

There are a few positive things to state about Cummins. It

is one of the largest manufacturers of engines, and is known for quality. It

has a strong position in its markets, and strives to be the lowest cost

producers as well. It tries to expand into related markets and leverage

complementary businesses. The company has strong brands underpinned by its

high-performing and extremely durable engines. Customers also value Cummins’ ability

to enhance the value of their trucks, leading to product differentiation.

Cummins commands strong brand loyalty among customers, despite fierce

competition in the industry. The company's strong reputation is built on its

demonstrated history of consistently providing customers with durable and

fuel-efficient products. Cummins' strong product performance empowers customers

to lower the total cost of their operations.

Cummins has established relationships with large customers

like Paccar, Fiat Chrysler, Daimler, Navistar etc and a global presence. CMI

has more than 600 company-owned and independent distributor locations and about

9,000 dealer locations in over 190 countries and territories. CMI's key markets

are the on-highway, construction and general industrial markets. About 55% of

total revenue are typically from the U.S., with 45% coming from international

operations.

The company believes that decarbonization is an opportunity

for future growth. Stricter regulations can benefit the business going forward

as well. The company continues to innovate as well, through investments in technologies

to eliminate fossil fuels in trucking and power generators. As governments want

less carbon emissions, Cummins investments in the area should benefit the company

and yield dividends for shareholders.

Cummins tries to grow through strategic acquisitions as

well. For example, earlier this year Cummins acquired Meritor for $3.70

Billion. Meritor is a provider of drivetrain, mobility, braking, aftermarket,

and electric powertrain solutions for commercial and industrial vehicles.

Management expects this acquisition to be accretive to

earnings per share, and generate significant synergies in the process, while

also expanding product offerings in the powertrain components.

While demand for trucking is cyclical, there is the possibility for long-term increased demand for trucking as ecommerce increases transportation needs and as some emerging economies develop the need for more efficient trucks. Truck replacement cycles should be another boon for companies like Cummins.

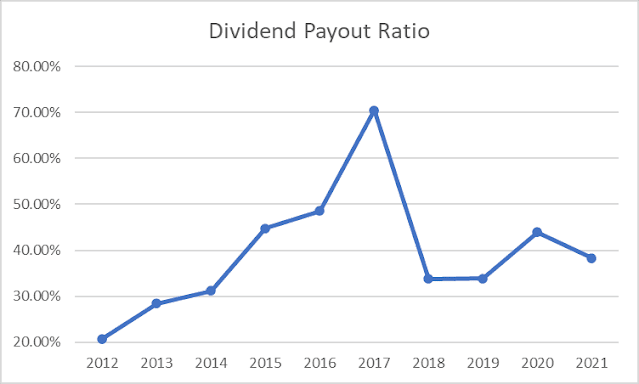

The company increases dividends at a faster rate between

2012 and 2017, which translated into the payout ratio increasing in the first

five years of the past decade. Over the past five years however, it seems like

dividend growth has closely followed earnings growth. This is evident by the small

range in the payout ratio between 2018 and 2021.

The company has managed to repurchase a quarter of shares

outstanding over the past decade.

The stock is attractively valued today at 12.20 times

forward earnings and yields 2.80%

Relevant Articles:

- Eight Dividend Growth Companies Rewarding Owners With a Raise Last Week