As part of my review process, I monitor dividend increases every week. I compile the list each week, but focus my attention on companies with a ten year track record of annual dividend increases or longer. I am looking for companies that have managed to grow dividends through a typical full length economic cycle of a boom and bust. A ten year requirement for dividend increases weeds out a lot of cyclical companies. It helps me focus on those who have a higher likelihood of future increases.

The fun doesn't stop there however. I review the recent increase relative to the historical record - meaning the past 5 or 10 years. Next, I review the trend in earnings per share, in order to determine if dividend growth is sitting on a stable foundation. I want a business that can grow earnings per share and grow dividends per share from there. I do not want a business that grows dividends by increasing the dividend payout ratio, as that is unsustainable for dividend increases and the business as a whole. I also want a dividend payout ratio that is sustainable, and generally staying within a tight range over time.

Next, I am going to review valuation. Even the best company in the world is not worth overpaying for. In my case, valuation means looking at P/E ratios and dividend growth rates. I try to account for how defensible the business is, whether I already have a position (and its size), and compare different options out there by yield/growth when I am ready to pull the trigger.

Over the past week, there were four companies that raised dividends to shareholders. All have managed to increase dividends for at least ten years in a row:

Aon plc (AON) is a professional services firm, provides advice and solutions to clients focused on risk, retirement, and health worldwide.

Aon increased quarterly dividends by 9.80% to $0.615/share. This is the 12th consecutive annual dividend increase for this dividend achiever.

Over the past decade, the company has managed to increase dividends at an annualized rate of 13.40%. The five year annualized dividend growth is at 9.20%.

Between 2013 and 2022, the company has managed to grow earnings from $3.57/share to $12.23/share.

The company is expected to earn $14.63/share in 2023.

The stock sells for 22.18 times forward earnings and yields 0.76%.

Agree Realty Corporation (ADC) is a publicly traded real estate investment trust primarily engaged in the acquisition and development of properties net leased to industry-leading retail tenants.

Agree Realty raised quarterly dividends by 1.20% to $0.243/share. This is also a 3.84% raise over the dividend paid during the same time last year. This is the eleventh consecutive annual dividend increase for this dividend achiever.

Over the past decade, the company has managed to increase dividends at an annualized rate of 5.70%. The five year annualized dividend growth is at 6.70%.

Between 2013 and 2022, the company has managed to grow FFO from $2.12/share to $3.47/share.

The company is expected to generate $3.95/share in FFO in 2023.

The stock sells for 16.72 times forward FFO and yields 4.40%.

The Procter & Gamble Company (PG) provides branded consumer packaged goods worldwide. It operates through five segments: Beauty; Grooming; Health Care; Fabric & Home Care; and Baby, Feminine & Family Care.

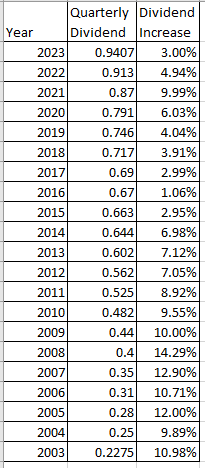

Procter & Gamble raised quarterly dividends by 3% to $0.9407/share. This dividend increase will mark the 67th consecutive year that P&G has increased its dividend and the 133rd consecutive year that P&G has paid a dividend since its incorporation in 1890. The company is a member of the elite dividend kings list.

Over the past decade, the company has managed to increase dividends at an annualized rate of 5%. The five year annualized dividend growth is at 5.70%.

Earnings per share have increased from $3.66 in 2012 to $5.81 in 2022. The company is expected to generate $5.86/share in earnings in 2023.

The stock sells for 25.77 times forward earnings and yields 2.50%. Check my review of Procter & Gamble here.

Star Group, L.P. (SGU) sells home heating and air conditioning products and services to residential and commercial home heating oil and propane customers in the United States

Star Group raised dividend by 6.60% to $0.1625/share. This is the eleventh consecutive annual dividend increase for this dividend achiever.

Over the past decade, the company has managed to increase dividends at an annualized rate of 6.80%. The five year annualized dividend growth is at 6.80%.

The stock sells for 15.37 times forward earnings and yields 5.05%.

Relevant Articles:

- Four Notable Dividend Increases From Last Week