Atmos Energy Corporation (ATO) engages in the regulated natural gas distribution, and pipeline and storage businesses in the United States. It operates in two segments, Distribution, and Pipeline and Storage.

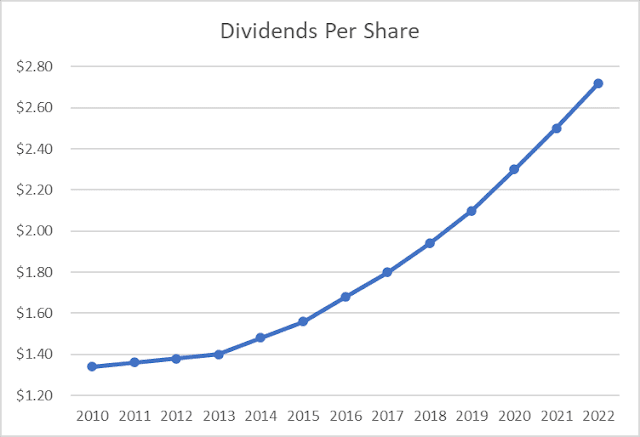

The company is a dividend aristocrat with a 39-year track

record of annual dividend increases. The last dividend increase occurred in

November 2022, when Atmos raised its quarterly dividend by 8.80% to 74

cents/share.

During the past decade, Atmos has managed to grow dividends

to shareholders at an annualized rate of 7.20%. The five-year annualized

dividend growth is at 8.70%.

At the same time, the company has managed to boost earnings from $2.37/share in 2012 to $5.61/share in 2022. Atmos Energy is expected to earn $6.03/share in 2023 and $6.42/share in 2024.

Growth will be generated through continued capital

investment in the business. The company believes that most of that capex would

be immediately accretive within half a year or so. Most of the capex is on

increased safety and reliability.

The company’s earnings are generated through regulated gas

distribution and natural gas transmission and storage.

Growth in rates over time should compensate for investments.

The risk is that states may not be as accommodative to utilities. This risk is

somewhat mitigated by the fact that Atmos operates in several states in the US

– Texas, Louisiana, Colorado/Kansas, Mississippi, Kentucky.

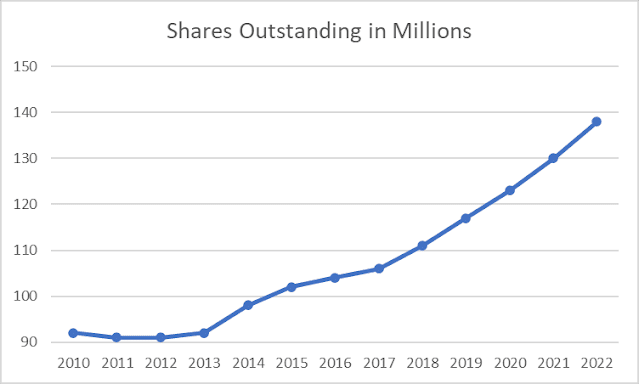

The company obtains capital by selling shares, in order to

fund its growth Capex initiatives. As a result, the number of shares

outstanding increased from 91 million in 2012 to 138 million in 2022.

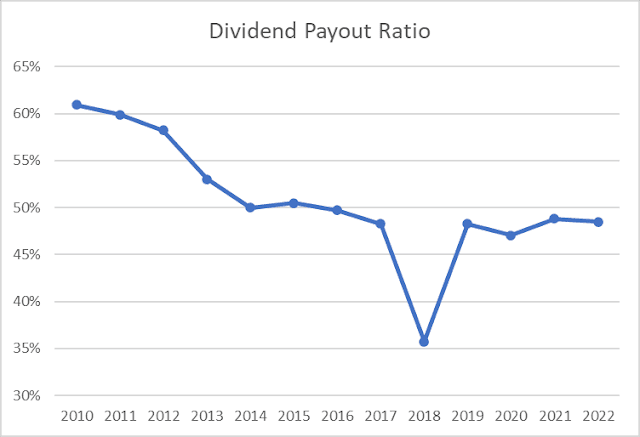

The dividend payout ratio has decreased from 58% in 2012 to

48% in 2022. The lower dividend payout ratio can result in a dividend growth

that is higher than earnings growth over the next decade.

I believe that the stock is fairly valued today at 19.30

times forward earnings. The yield is low for a utility at 2.55%, but the

dividend payout ratio is lower too.

- Nine Companies Rewarding Shareholders With Raises