I review the list of dividend increases each week as part of my monitoring process. This exercise helps me check out new companies for further research. It also helps me to monitor existing positions.

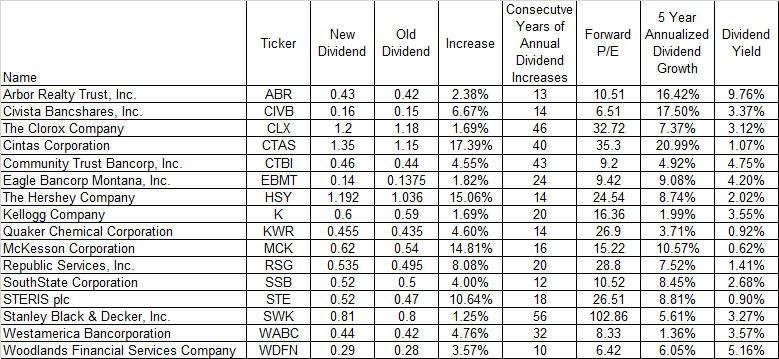

There were over 42 companies increasing dividends last week. I narrowed the list down to 16 by only focusing on the companies that have managed to raise dividends for at least ten years in a row. I have found that to be a very helpful requirement that weeds out cyclical companies.

I included the new dividend increase and calculated the rate of change relative to the last one. I also included the track record of consistent annual dividend increases.

I have also included valuation metrics such as forward P/E ratio, 5 year dividend growth rate and dividend yield.

You can view the full table below:

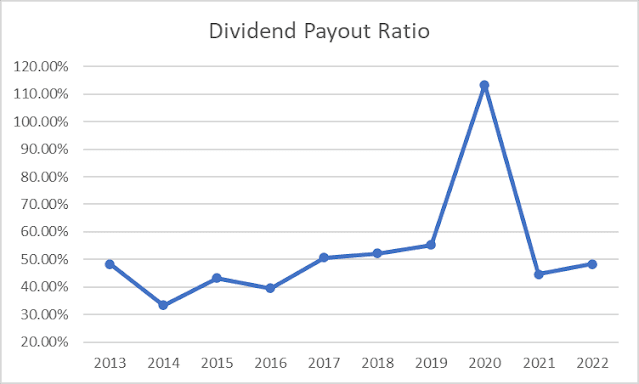

The next step in the process would be to review trends in earnings per share, in order to determine if the dividend growth is on strong ground. Rising earnings per share provide the fuel behind future dividend increases.

This should be followed by reviewing the trends in dividend payout ratios, in order to check the health of dividend payments. A rising payout ratio over time shows that future dividend growth may be in jeopardy. There is a natural limit to dividends increasing if earnings are stagnant or if dividends grow faster than earnings.

Obtaining an understanding behind the company’s business is helpful, in order to determine how defensible the dividend will be during the next recession. Certain companies are more immune to any downside, while others follow very closely the rise and fall in the economic cycle.

Of course, valuation is important, but it is more art than science. P/E ratios are not created equal. A stock with a P/E of 10 may turn out to be more expensive than a stock with a P/E of 30, if the latter is growing earnings and the former isn’t. Plus, the low P/E stock may be in a cyclical industry whose earnings will decline during the next recession, increasing the odds of a dividend cut. The high P/E company may be in an industry where earnings are somewhat recession resistant, which means that the likelihood of dividend cuts during the next recession is lower.

- Seven Companies Rewarding Shareholders With a Raise

- Five Dividend Growth Companies Raising Dividends Last Week

- Seven Dividend Growth Stocks Rewarding Shareholders with Raises

- 48 Dividend Champions For Further Research