The S&P Dividend Aristocrats index tracks companies in the S&P 500 that have increased dividends every year for at least 25 years in a row. The index is equally weighted, and rebalanced every quarter.

To qualify for membership in the S&P 500 Dividend Aristocrats index, a stock must satisfy the following criteria:

1. Be a member of the S&P 500

2. Have increased dividends every year for at least 25 consecutive years

3. Meet minimum float-adjusted market capitalization and liquidity requirements defined in the index inclusion and index exclusion rules below.

The group of companies in the Dividend Aristocrats index tend to generate reliable dividend income, and provide the potential for strong total returns. The list is well diversified across sectors.

There are a record 67 companies in the Dividend Aristocrats index for 2023.

The 2023 Dividend Aristocrats are listed below:

|

Symbol |

Name |

Sector |

Years of Annual

Dividend Increases |

10 year Dividend

Growth |

Dividend Yield |

|

ABBV |

AbbVie Inc. |

Health Care |

51 |

13.98% |

4.00% |

|

ABT |

Abbott Laboratories |

Health Care |

51 |

13.80% |

2.00% |

|

ADM |

Archer-Daniels-Midland

Co |

Consumer Staples |

48 |

9.00% |

2.49% |

|

ADP |

Automatic Data

Processing |

Information Technology |

48 |

12.64% |

2.40% |

|

AFL |

AFLAC Inc |

Financials |

42 |

8.99% |

2.42% |

|

ALB |

Albemarle Corp. |

Materials |

29 |

5.21% |

1.11% |

|

AMCR |

Amcor |

Materials |

28 |

#N/A |

5.28% |

|

AOS |

Smith A.O. Corp |

Industrials |

30 |

18.16% |

1.55% |

|

APD |

Air Products &

Chemicals Inc |

Materials |

41 |

9.51% |

2.56% |

|

ATO |

Atmos Energy |

Utilities |

40 |

7.86% |

2.78% |

|

BDX |

Becton Dickinson &

Co |

Health Care |

52 |

6.13% |

1.56% |

|

BEN |

Franklin Resources Inc |

Financials |

44 |

11.99% |

4.16% |

|

BF.B |

Brown-Forman Corp B |

Consumer Staples |

39 |

6.89% |

1.58% |

|

BRO |

Brown & Brown |

Financials |

30 |

9.89% |

0.73% |

|

CAH |

Cardinal Health Inc |

Health Care |

27 |

5.60% |

1.99% |

|

CAT |

Caterpillar Inc |

Industrials |

30 |

7.89% |

1.76% |

|

CB |

Chubb Ltd |

Financials |

30 |

5.39% |

1.52% |

|

CHD |

Church & Dwight |

Consumer Staples |

27 |

6.89% |

1.15% |

|

CHRW |

C.H. Robinson

Worldwide |

Industrials |

26 |

5.71% |

2.82% |

|

CINF |

Cincinnati Financial

Corp |

Financials |

63 |

5.99% |

2.90% |

|

CL |

Colgate-Palmolive Co |

Consumer Staples |

60 |

3.69% |

2.41% |

|

CLX |

Clorox Co |

Consumer Staples |

46 |

5.83% |

3.37% |

|

CTAS |

Cintas Corp |

Industrials |

41 |

20.57% |

0.90% |

|

CVX |

Chevron Corp |

Energy |

36 |

4.47% |

4.05% |

|

DOV |

Dover Corp |

Industrials |

68 |

5.30% |

1.33% |

|

ECL |

Ecolab Inc |

Materials |

32 |

8.71% |

1.15% |

|

ED |

Consolidated Edison

Inc |

Utilities |

49 |

2.79% |

3.56% |

|

EMR |

Emerson Electric Co |

Industrials |

67 |

2.31% |

2.16% |

|

ESS |

Essex Property Trust |

Real Estate |

29 |

6.80% |

3.73% |

|

EXPD |

Expeditors

International |

Industrials |

29 |

8.69% |

1.08% |

|

FAST |

Fastenal |

Industrials |

25 |

13.35% |

2.16% |

|

FRT |

Federal Realty Invt

Trust |

Real Estate |

56 |

3.84% |

4.23% |

|

GD |

General Dynamics |

Industrials |

32 |

9.07% |

2.03% |

|

GPC |

Genuine Parts Co |

Consumer Discretionary |

67 |

5.71% |

2.74% |

|

GWW |

Grainger W.W. Inc |

Industrials |

52 |

7.36% |

0.90% |

|

HRL |

Hormel Foods Corp |

Consumer Staples |

58 |

12.46% |

3.52% |

|

IBM |

Intl Business Machines |

Information Technology |

28 |

6.01% |

4.06% |

|

ITW |

Illinois Tool Works

Inc |

Industrials |

49 |

13.07% |

2.14% |

|

JNJ |

Johnson & Johnson |

Health Care |

61 |

6.14% |

3.04% |

|

KMB |

Kimberly-Clark |

Consumer Staples |

51 |

4.46% |

3.88% |

|

KO |

Coca-Cola Co |

Consumer Staples |

61 |

5.09% |

3.12% |

|

KVUE |

Kenvue |

|

61 |

#N/A |

1.91% |

|

LIN |

Linde plc |

Materials |

30 |

7.83% |

1.24% |

|

LOW |

Lowe's Cos Inc |

Consumer Discretionary |

61 |

20.25% |

1.98% |

|

MCD |

McDonald's Corp |

Consumer Discretionary |

48 |

7.16% |

2.25% |

|

MDT |

Medtronic plc |

Health Care |

46 |

9.76% |

3.35% |

|

MKC |

McCormick & Co |

Consumer Staples |

37 |

8.66% |

2.46% |

|

MMM |

3M Co |

Industrials |

65 |

8.98% |

5.49% |

|

NEE |

NextEra Energy |

Utilities |

29 |

10.98% |

3.08% |

|

NDSN |

Nordson Corp |

Industrials |

60 |

15.36% |

1.03% |

|

NUE |

Nucor Corp |

Materials |

51 |

3.33% |

1.24% |

|

O |

Realty Income Corp. |

Real Estate |

31 |

3.57% |

5.36% |

|

PEP |

PepsiCo Inc |

Consumer Staples |

51 |

8.13% |

2.98% |

|

PG |

Procter & Gamble |

Consumer Staples |

67 |

4.67% |

2.57% |

|

PNR |

Pentair PLC |

Industrials |

48 |

3.16% |

1.27% |

|

PPG |

PPG Industries Inc |

Materials |

52 |

7.70% |

1.74% |

|

ROP |

Roper Technologies,

Inc |

Industrials |

31 |

15.26% |

0.55% |

|

SHW |

Sherwin-Williams Co |

Materials |

45 |

13.76% |

0.78% |

|

SJM |

J.M. Smucker |

Consumer Staples |

26 |

6.58% |

3.35% |

|

SPGI |

S&P Global |

Financials |

50 |

12.39% |

0.82% |

|

SWK |

Stanley Black &

Decker |

Industrials |

56 |

4.98% |

3.30% |

|

SYY |

Sysco Corp |

Consumer Staples |

53 |

5.86% |

2.73% |

|

TGT |

Target Corp |

Consumer Discretionary |

56 |

10.68% |

3.09% |

|

TROW |

T Rowe Price Group Inc |

Financials |

37 |

12.37% |

4.53% |

|

WMT |

Wal-Mart |

Consumer Staples |

50 |

2.30% |

1.45% |

|

WST |

West Pharmaceutical

Services |

Health Care |

31 |

7.18% |

0.23% |

|

XOM |

Exxon Mobil Corp |

Energy |

41 |

4.11% |

3.80% |

|

Note: Data as of

12/31/2023 |

|||||

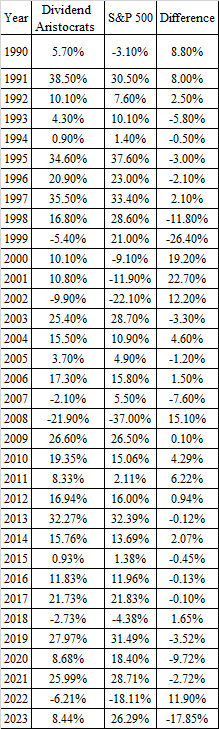

The dividend aristocrats index tends to shine during bear markets and low return environments. However, it also pulls its weight when we are in a bull market too. It is the best of both worlds really.

These are the returns since the launch of the Dividend Aristocrats Index in 1989:

As I gained more experience however, I have gravitated more towards the Dividend Champions list, which was created by Dave Fish. The Dividend Champions list is more complete, as it doesn’t exclude companies due to low liquidity, or due to market capitalization below a certain threshold. In addition, I find that historically, the list of Dividend Champions has followed a more consistent approach than the list of Dividend Aristocrats. Sadly, Dave passed away last year. Luckily, another person has agreed to update it for the time being. You can view the 2024 Dividend Champions List here.

When I review the list of historical changes in the Dividend Aristocrats index, I see some inconsistencies in the way portfolio components are added or removed.

For example, the Dividend Aristocrats index removed Altria in 2007, after it spun-off Kraft Foods and as a result its dividend decreased. It could be argued that the dividend income for the investor was not decreased, because they kept getting a dividend from Altria as well as dividends from Kraft Foods.

The S&P committee seems to have rectified this issue, and have kept both Abbott and Abbvie after legacy Abbott Laboratories split in two companies in early 2013.

Ironically, Dave Fish had Altria listed as a Dividend Champion. However, he didn’t have Abbott nor Abbvie listed as a dividend champion ( they are listed as Dividend Aristocrats however).

This is why you need to perform your own checks as an investor.

In addition, I wanted to let you know that I would not purchase all companies from either lists blindly. I run my entry criteria screen to come up with a list of companies for further research. Before investing in any individual stock, I research it enough to gain some understanding of the business and its trends in fundamentals.

Relevant Articles:

- Dividend Champions, Contenders & Challengers: The most complete list of US dividend growth stocks available

- Dividend Aristocrats List for 2017

- Dividend Aristocrats for Dividend Growth and Total Returns

- Where are the original Dividend Aristocrats now?

- Historical changes of the S&P Dividend Aristocrats

- Why do I like the Dividend Aristocrats?

- Dividend Aristocrats List for 2016