I review the list of dividend increases each week, as part of my monitoring process. This exercise helps me to review existing holdings and potentially uncover companies for further research.

This of course is just one aspect in my process. It does provide a helpful look at the way I would quickly evaluate companies, before determining if I want to place them on my list for further research.

Namely I look for:

1) Ten year streak of consecutive annual dividend increases

2) Rate of change in the most recent dividend increase, relative to the ten year historical average

3) Trends in earnings per share, in order to determine sustainability of that dividend income stream

4) Valuation, as well as dividend safety

My review of the weekly dividend increases follows the philosophy outlined in the checklist above.

Over the past week there were five companies that raised dividends and also have a ten year minimum streak of consecutive annual dividend increases. The companies include:

Chubb Limited (CB) provides insurance and reinsurance products worldwide.

Chubb increased quarterly dividends by 5.80% to $0.91/share. This marks the 31st consecutive annual dividend increase for this dividend aristocratdividend aristocrat. Over the past decade, the company has managed to boost dividends at an annualized rate of 5.40%.

The company has managed to grow earnings from $8.50/share in 2014 to $21.97/share in 2023. Chubb is expected to earn $21.67/share in 2024.

The stock sells for 12.65 times forward earnings and yields 1.33%.

Note, Warren Buffett recently initiated a large position Warren Buffett recently initiated a position in this insurer.

Northrop Grumman Corporation (NOC) operates as an aerospace and defense technology company in the United States, Asia/Pacific, Europe, and internationally.

The company increased quarterly dividends by 10.20% to $2.06/share. This is the 21st consecutive annual dividend increase for this dividend achiever. Over the past decade, the company has managed to boost dividends at an annualized rate of 11.90%.

Between 2014 and 2023, the company grew earnings from $9.91/share to $13.57/share.

The company is expected to earn $24.78/share in 2024.

The stock sells for 18.98 times forward earnings and yields 1.75%.

Realty Income (O) is a real estate investment trust which owns over 15,450 real estate properties.

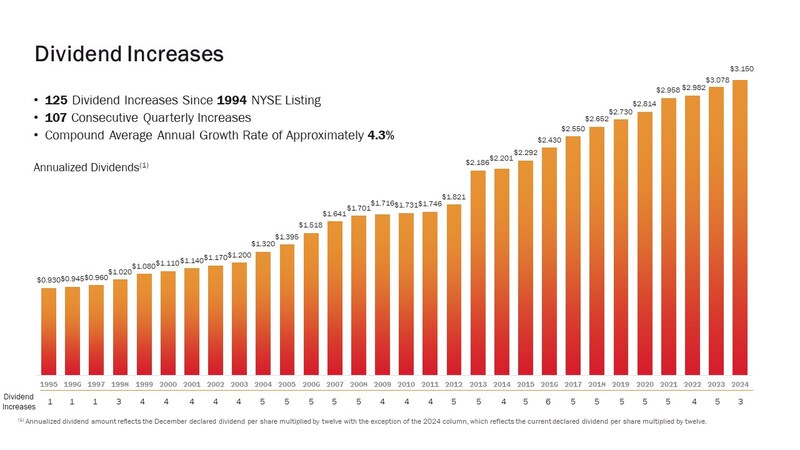

Realty Income increased its monthly dividend by 2.14% to $0.2625/share. The new dividend is 2.94% higher than the dividend paid during the same time last year. This dividend aristocrat dividend aristocrat has increased annual dividends several times per year since going public in 1994. Over the past decade, the company has managed to boost dividends at an annualized rate of 3.60%.

Advanced Drainage Systems, Inc. (WMS) designs, manufactures, and markets thermoplastic corrugated pipes and related water management products in North America and internationally. The company operates through Pipe, International, Infiltrator, and Allied Products & Other segments.

The company raised quarterly dividends by 14.30% to $0.16/share. This is the tenth consecutive annual dividend increase for this newly minted dividend achiever. Over the past 5 years, the company has managed to boost dividends at an annualized rate of 11.84%.

Between 2015 and 2024 the company managed to grow earnings per share from a loss of $0.38/share to a profit of $6.52/share. The company is expected to earn $6.79/share in 2025.

The stock sells for 25.63 times forward earnings and yields 0.37%.

HNI Corporation (HNI) engages in the manufacture, sale, and marketing of workplace furnishings and residential building products primarily in the United States and Canada. The company operates through two segments, Workplace Furnishings and Residential Building Products.

The company raised quarterly dividends by 3.10% to $0.33/share. This is the 14th year of consecutive annual dividend increases for this dividend achiever. Over the past decade, the company has managed to boost dividends at an annualized rate of 2.90%.

Earnings went from $1.37/share in 2015 to $1.11/share in 2023.

The company is expected to earn $3.05/share in 2024.

The stock sells for 15.10 times forward earnings and yields 2.87%.

Relevant Articles:

- Eight Dividend Growth Stocks Rewarding Shareholders With a Raise

- Fourteen Dividend Growth Stocks Raising Dividends Last Week