I just recently found a very interesting paper from J.P. Morgan from 2020, which tested whether it is worth it investing at all time highs. This is particularly helpful as US Markets just hit an all-time-high.

The researchers looked at the returns of the US Stock Market Index S&P 500 over a one, three and five year periods on any random day versus on a day that the index hit an all time high. The data in the sample covered the 1988 - 2020 time period. I believe that the results of the study could be relevant today, particularly for investors who may be afraid of the market because "it is too high".

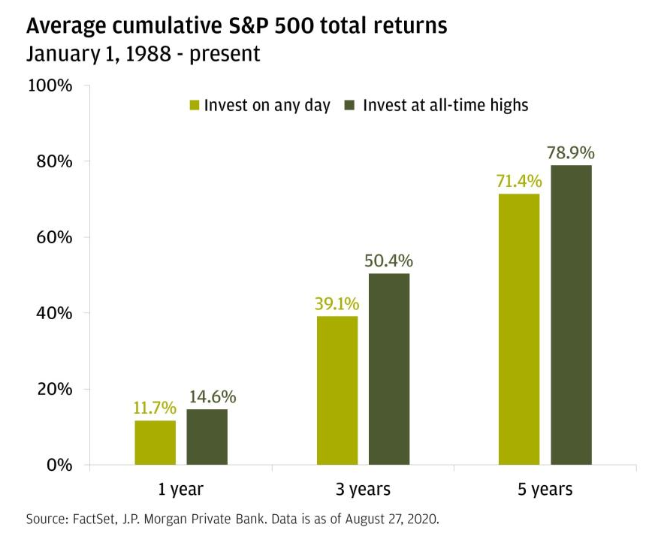

If you invested in the S&P 500 on any random day since the start of 1988 and reinvested all dividends, your investment made money over the course of the next year 83% of the time. On average, your one year total return was +11.7%.

Now, what do those figures look like if we only consider investments on days when the S&P 500 closed at an all-time high? They’re actually better! Your investment made money over the course of the next year 88% of the time, and your average total return was +14.6%.

And if we look at cumulative total returns three or five years after the original investment, the takeaway is the same.

Markets can have bad weeks, months, and years, but the value of investments in the S&P 500 has risen over time. Getting invested and staying invested is a simple step an individual can take towards growing their capital and income over time.